Which market has it right? — Week of January 23, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -0.65 | 3.55 | -9.92 | 7.88 | 9.05 | 3,972.61 |

| Dow Jones Industrial Average | -2.66 | 0.78 | -1.83 | 6.76 | 7.37 | 33,375.49 |

| Russell 2000 Small Cap | -1.04 | 6.06 | -6.44 | 4.74 | 4.49 | 1,867.34 |

| NASDAQ Composite | 0.55 | 6.47 | -20.59 | 6.83 | 9.74 | 11,140.43 |

| MSCI Europe, Australasia & Far East | -0.49 | 6.53 | -7.64 | 3.35 | 2.43 | 2,070.00 |

| MSCI Emerging Markets | -0.17 | 7.52 | -15.57 | -0.41 | -0.89 | 1,027.91 |

| Barclays U.S. Aggregate Bond Index | 0.61 | 3.37 | -8.17 | -1.91 | 0.88 | 2,1117.80 |

| Merrill Lynch Intermediate Municipal | 0.62 | 2.56 | -3.04 | 0.10 | 1.99 | 306.46 |

As of market close January 20, 2023. Returns in percent.

Strategy & Positioning

— Steve Orr

Get real

Nice rally while it lasted. Week 3 ended slightly down for most U.S. indices. Surprising strength in U.S. tech pushed the NASDAQ into positive territory. We wrote recently about how stocks seemed to be getting ahead of themselves. The recent rally certainly does not jibe with the deteriorating fundamentals out there “in the real world.”

Bonds have also risen in price since the start of the year. Falling interest rates in the face of Fed rate increases and inflation should be a signal of slowdown. Which market is the real deal, stocks or bonds? We think the bond market usually gets it right over a cycle. On a relative value basis, stocks have run too far ahead of earnings and bonds have run up a bit too far in advance of recession. We think both should take a pause in the coming weeks.

On the...

What if, on the other hand, they threw a Recession, and nobody came? Europe is slowly gaining steam and its stock markets are breaking out of their downtrends. U.S. jobless claims fell below 200,000 last week. That is a level so low we wondered if a couple of states forgot to mail their results to D.C. Employment and job openings remain strong, and the services sector of the economy is doing relatively well.

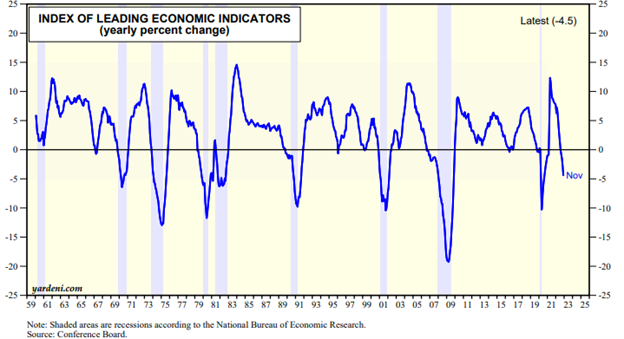

The Leading Economic Index has fallen 11 of the last 12 months. The index is comprised of 10 economic indicators that the Conference Board believes anticipate turning points in the economy by about six to seven months. Generally, the LEI peaks around 12 months ahead of a peak in the business cycle. Its most recent peak was around April 2021. The LEI fell into recessionary territory in October:

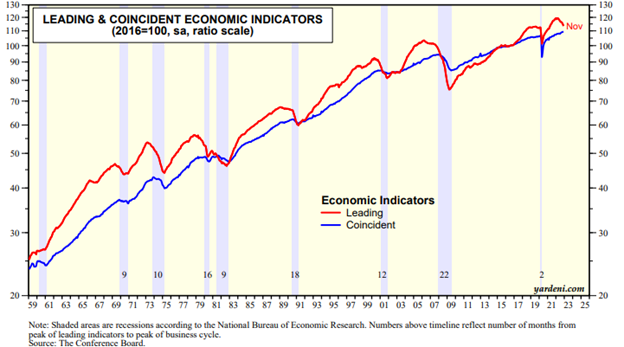

There are two companion indices to the LEI: Coincident and Lagging. The Coincident index consists of four indicators: non-farm payrolls, personal income, industrial production and manufacturing sales. Employment remains strong and production is off-peak but above recession levels. The Lagging index focuses on credit, unemployment, inflation and labor costs. December’s Coincident index increased only one-tenth of a point and remains at an all-time high.

Most recessions involve a credit crunch: High interest rates and banks not making loans are two possible causes. Interest rates are higher over the last year. Loan demand has moderated, but consumer and corporate spending are holding above recession levels. We are watching consumer credit, as those metrics have moved higher, suggesting that the stimulus monies have run their course over the last several months. Coincident (what’s happening now) at all-time highs, the Leading rolling over and dropping for 10 months straight. Our conclusion: recession still just over the horizon. 2024 perhaps?

Nope

It’s still early in the fourth quarter earnings reporting season, and any positive hopes for higher earnings are circling the drain. Year-over-year fourth quarter estimates are sticking to the -4% level, the first earnings drop since the 2020 shutdowns. Big banks were last week. This week is a mix of energy, industrial and “old” tech. Baker Hughes, Raytheon, Texas Instruments and Lockheed Martin are headliners today and tomorrow. Wednesday, we hear from Abbott Labs, Boeing, AT&T (same deal for new shareholders as old) and Tesla (more rebates!).

Thursday, Southwest Airlines and Sherwin-Williams announce before markets open. We will be paying close attention to how Southwest plans to overhaul their scheduling software. American also reports that day. Chevron reports on Friday. Competitor Exxon used to report the same Friday but has pushed back this quarter to announce on Tuesday the 31st.

Wrap-up

Enough with the mixed signals from markets. We think gold and bonds have the economy right: continued weakening as the effects of higher interest rates take hold this year. Perhaps a recession may be mild and be pushed into next year. Regardless of when, the data suggests further slowing ahead. Earnings would adjust lower, followed by P/E multiples, pulling down prices. If that scenario plays out, our indicators would flash lower risk exposure. If we muddle along and fundamental data stabilizes, then our current positioning should produce reasonable returns. Again, in this downturn we find ourselves having to be patient.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.