Impressive October Rally, mind the headwinds — Week of October 31, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 3.97 | -17.10 | -13.82 | 10.48 | 10.53 | 3,901.04 |

| Dow Jones Industrial Average | 5.72 | -8.06 | -6.14 | 8.93 | 9.35 | 32,861.80 |

| Russell 2000 Small Cap | 6.02 | -16.87 | -18.59 | 6.69 | 5.45 | 1,846.92 |

| NASDAQ Composite | 2.25 | -28.57 | -27.55 | 11.23 | 11.67 | 11,102.45 |

| MSCI Europe, Australasia & Far East | 4.90 | -22.25 | -22.66 | -0.45 | 0.73 | 1,761.76 |

| MSCI Emerging Markets | -0.63 | -28.28 | -30.47 | -3.73 | -2.35 | 859.46 |

| Barclays U.S. Aggregate Bond Index | 1.90 | -15.16 | -15.09 | -3.33 | -0.35 | 1,998.11 |

| Merrill Lynch Intermediate Municipal | -0.43 | -10.58 | -9.96 | -1.50 | 0.55 | 286.24 |

As of market close October 28, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Another week

Another Fed narrative. Here goes: “After the European Central Bank, Bank of Canada and weaker GDP numbers, surely the Fed will slow down its rate increases.” A lot of last week’s action was based on this (hope) narrative, along with short covering in European bonds, the euro and British pound. Both central banks raised their interest rates but lowered their economic forecasts. The Bank of Canada surprised traders by only raising rates one-half of a percent instead of the expected three-quarters.

The Fed meets again this Tuesday and Wednesday. Traders expect the Fed will announce a three-quarters of a percent increase in overnight rates. Bets are evenly split between a half and three-quarters of a percent at the December 14 meeting. The excitement for markets has moved to the February 1st meeting. The latest “Bullish” Fed narrative has the Fed stopping its rate increases at the December meeting or just making small quarter-point increases starting in February.

In front of the Most Anticipated Recession Ever, the latter scenario would be the best of outcomes. Small rate increases would show the Fed is still “on the job” to fight inflation but would let the members see the impact of three straight 75 basis point increases. Housing has already entered a recession. Shortages of diesel fuel and fuel additives may start to crimp deliveries and transportation, keeping inflation elevated. FedEx warned about slowing delivery activity back in September. Amazon took the stage last week with a dim holiday outlook.

People close to the Fed tell us members of the Open Market Committee are determined to bring down inflation. They are embarrassed that they are so far behind in this inflation cycle. Every rate increase cycle has ended only when nominal overnight interest rates are greater than inflation. The Fed’s favorite inflation gauge, Personal Consumption Expenditures, is running at a 6.2% pace. Overnight Fed Funds range from 3% to 3.25%. The Fed is halfway home. We think they meet around 5% in late spring. Then the Fed may think about a pause.

Below one

Last Thursday’s release of third quarter real GDP registered +2.6%. No recession, correct? Well by some measures, yes, no recession. The first two quarters of the year were funny GDP accounting and showed negative real (inflation-adjusted) growth. To get that +2.6% annualized growth, the BEA had to use an inflation rate of 4.1%. Remember that the consumer price index is running at 8.2%.

At the risk of raining on the Rally Parade, in the third quarter net exports grew 2.7%, or greater than the headline number. A big chunk of that export growth was oil shipments from our Strategic Reserve and shipments of weapons to Ukraine. Not exactly economy-building activity. In nominal dollar terms, the U.S. economy has grown less than 1% in 2022. The economy continues to grow but has downshifted to first gear. A first gear economy means flat earnings, fewer job openings and lower wage growth in coming quarters.

Treats

Today may have a few tricks, but October’s stock performance is all treats. Last week’s moves are not only greater than a “good” full month of October, but they also approach the average gain for the full fourth quarter. For the month, the Dow Jones Industrials surged over 14%; the S&P 500, 8%; and the tech-heavy NASDAQ, a measly 3.75%. Tech has pulled the performance cart for at least the last five years, but higher interest rates are taking their toll on valuations. On the hardware side, the recent export ban to China of some sensitive chips will hurt earnings. In social media, Meta (“Facebook” for the grandparents) lost a quarter of its value last week after reporting slower ad growth.

Bear in mind that Bear cycles always have the sharpest rallies. On average a 10% up move in a Bear cycle lasts around 59 days versus Bulls around 100 days. A Bloomberg analyst pointed out that the S&P 500 has rallied over 1% three days in a row just 75 times since 1928. Streaks of four days are even more rare and tend to come in recessions. The Dow’s double digit move in 13 trading days certainly makes us scratch our heads. Interest rates have had a similar sharp rally, with the 10-year Treasury falling from an intraday high of 4.33% on the 21st, to 4.04% this morning. The two-year Treasury also round tripped from 4.63% the same day to 4.48% this morning.

We like rallies as much as anyone but are mindful that the fundamental picture continues to deteriorate. Most of the earnings calls we reviewed paint a flat to dour picture for the next two quarters. Companies are clearly pulling in their horns and minding their cash balances. If we are at the edge of a rolling recession, where various parts of the economy slow down but overall growth plods along, then a bottoming process and fall rally for stocks make sense. If as fundamental indicators like the Leading Economic Index and Purchasing Managers Surveys suggest, the MARE is coming in the spring, then October is the start of just another countertrend rally that will turn lower in the coming months.

Stop cutting

Back at the beginning of the third quarter earnings season, more firms were raising guidance than cutting. FactSet now reports that more firms are cutting guidance. Revenue and earnings growth are running barely 2% over the year-ago third quarter. Most of the positive results come from the energy sector’s 134% increase in earnings from last year. Without energy, the rest of the S&P 500 is on track for a 5% decline in earnings. We would like companies to stop lowering guidance and analysts their estimates. Considering the first gear economy, we may have to wait a couple more quarters. This is the biggest week for S&P 500 reporting with 163 companies presenting results. Ecolab, Pfizer, Lilly and Phillips 66 are some of the names we are waiting on.

Wrap-up

October will go in the books as an impressive Bear rally month. November in mid-term election years ranks #2 in performance, with positive returns in every cycle. Seasonal performance gaming from mutual funds and year-end pension contributions can play a role in raising returns. Since World War II we have not started a November with fuel, labor and war shortages, and rising interest rates. These headwinds are keeping our indicators in neutral and alert for trend changes.

Essential Economics

— Mark Frears

Behavior change?

What gets our attention, enough to get us to take notice? When I was growing up, my mother was the counselor in our middle school. Her office was very near the principal’s. Not good for Mark and the crew he was running around with at that time. Needless to say, she got my attention and my behavior changed! Has the consumer’s behavior changed in the current economic environment?

Shopping, saving

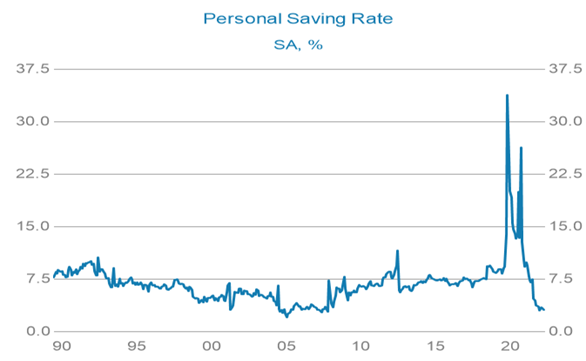

Last week we had Consumer Spending for September come in above expectations; we are spending more, and maybe more on needs versus wants, as costs remain elevated. We also saw slower overall Income Growth, causing the Savings Rate to drop to a 17-year low of 3.1%.

Source: Bureau of Economic Analysis / Haver

In addition, total outstanding U.S. credit card debt is back to December 2019, pre-pandemic levels. So, we have seen some behaviors change as to the source of the money for spending, but the outflow of cash is continuing with a higher portion going to housing, utilities and transportation.

If this trend continues, the Fed will get their desired slowdown, with less demand forcing prices to fall.

The Employment Cost Index (ECI) for the third quarter did slow to 1.2%, versus 1.3% last quarter. The Fed has cited this metric as one they are watching for slowing wage growth. So, possibly some impact is being felt from their rate hikes.

Bigger picture

Gross Domestic Product (GDP) for the third quarter came out last week at 2.6%, versus an estimate of 2.3%; and the two previous quarters had been negative. As the consumer makes up two-thirds of GDP, you and I are important contributors. Although, when you dig deeper into this release, the Consumer Spending portion actually dropped from last quarter, as inventories, government spending and fixed investments took up the slack. This lower consumer spending does indicate an economic slowdown.

The Purchasing Managers Indices (PMI) for October came out last week and we saw decreases in Manufacturing and Services. These came in well below consensus and are below a reading of “50,” indicating contraction. More evidence of a slowing economy.

The term “peak inflation” is coming up more often, as people are looking for signs that inflation is slowing. We agree that prices are still elevated, but markets want to see progress by the Fed in slowing the monster that is eating away our pricing power. The favorite measure of the Fed is the Personal Consumption Expenditure (PCE) Core measurement. As you can see below, while we had a slight uptick last month, we are below the high in February 2022.

Source: Bloomberg

Economists expect to see a slowing of inflation pressures over the next quarter in important areas such as housing, giving ammunition to the talk of a peak in Fed rate hikes coming in first quarter 2023.

As mentioned above, wages and the broader labor market are a concern for the Fed. This week we have the monthly Payroll release and are expecting a monthly addition of workers of 190,000 and unemployment rate ticking up slightly to 3.6%. If payrolls are lower or the unemployment rate higher than these estimates, there will be more talk of the Fed being closer to being done, or a Fed Pivot.

FOMC

This week we also have the closely watched Federal Open Market Committee (FOMC) meeting and the expected rate increase of 75 basis points (0.75%) announcement on Wednesday. The talking heads will not be focused on this meeting but will be looking for clues as to the end of the rate-hiking cycle. We will delve closely into the press release and the press conference will be “must-see-TV.”

Wrap-up

While we are seeing some slowing in the economy, the consumer does not seem to have fully embraced the concept yet. Therefore, the Fed will continue to raise rates until behaviors change. Maybe they need to send the message through the principal’s office and then they would see some change!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 31-Oct | Dallas Fed Manufacturing Activity | Oct | (18.5) | (17.2) |

| 1-Nov | JOLTS Job Openings | Sep | 9,625,000 | 10,053,000 |

| 1-Nov | Ward's Total Vehicle Sales — U.S. | Oct | 14,300,000 | 13,490,000 |

| 2-Nov | ADP Employment Change | Oct | 180,000 | 208,000 |

| 2-Nov | FOMC Rate Decision (lower bound) | 3.75% | 3.00% | |

| 2-Nov | FOMC Rate Decision (upper bound) | 4.00% | 3.25% | |

| 3-Nov | Trade Balance | Sep | -$72.0B | -$67.4B |

| 3-Nov | Nonfarm Productivity | Q3 | 0.5% | -4.1% |

| 3-Nov | Unit Labor Costs | Q3 | 4.0% | 10.2% |

| 3-Nov | Initial Jobless Claims | 29-Oct | 220,000 | 217,000 |

| 3-Nov | Continuing Claims | 22-Oct | 1,450,000 | 1,438,000 |

| 3-Nov | Factory Orders | Sep | 0.3% | 0.0% |

| 4-Nov | Change in Nonfarm Payrolls | Oct | 190,000 | 263,000 |

| 4-Nov | Change in Private Payrolls | Oct | 195,000 | 288,000 |

| 4-Nov | Unemployment Rate | Oct | 3.6% | 3.5% |

| 4-Nov | Average Hourly Earnings MoM | Oct | 0.3% | 0.3% |

| 4-Nov | Average Hourly Earnings YoY | Oct | 4.7% | 5.0% |

| 4-Nov | Labor Force Participation Rate | Oct | 62.4% | 62.3% |

| 4-Nov | Underemployment Rate | Oct | N/A | 6.7% |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.