Nice run into earnings season— Week of January 16, 2023

Strategy and Positioning written by Steve Orr, Chief Investment Officer.

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 2.71 | 4.22 | -12.75 | 8.53 | 9.39 | 3,999.09 |

| Dow Jones Industrial Average | 2.01 | 3.54 | -3.01 | 8.05 | 8.18 | 34,302.61 |

| Russell 2000 Small Cap | 5.27 | 7.17 | -11.38 | 5.32 | 4.78 | 1,887.03 |

| NASDAQ Composite | 4.83 | 5.88 | -24.51 | 7.09 | 9.84 | 11,079.16 |

| MSCI Europe, Australasia & Far East | 3.34 | 6.12 | -9.59 | 3.33 | 2.60 | 2,062.07 |

| MSCI Emerging Markets | 3.01 | 6.50 | -16.86 | -1.22 | -0.69 | 1,018.31 |

| Barclays U.S. Aggregate Bond Index | 1.22 | 3.09 | -9.13 | -1.89 | 0.73 | 2,112.05 |

| Merrill Lynch Intermediate Municipal | 0.79 | 1.73 | -4.22 | -0.06 | 1.83 | 303.98 |

As of market close January 13, 2023. Returns in percent.

Strategy & Positioning

— Steve Orr

Interesting

An enjoyable start to the year for all risk markets, but we admit to being a bit perplexed. January’s first few days always see good money flows, thanks to annual and quarterly contributions from pension plans and other rebalancers. Those flows are contributing to higher prices. The prices for bonds, stocks, most commodities and crypto have all rallied to start the year. The good mood around all risk assets and gold does not fit the economic data, or most forecasts.

From a technical perspective, the rally has some legs. Composite tape and breadth indicators are positive and rising. One year ago was the last time 65% or more of the S&P 500 members were above their 200-day moving average. The index was around 4,650 then, or 16% above today’s levels.

For history buffs, the S&P 500 did post a mild Santa rally. The first five days indicator was also positive at 1.42%. Since the middle of the last century in the 18 times both have had positive returns, then the full year was positive 14 times. If the full month of January is positive, then history gives good odds that the index may finish the year in positive territory. Our Stock Trader’s Almanac records 31 years when all three January indicators had positive returns. In 28 of those years the full year had positive returns for a 90% win rate.

While that is interesting, we would caution ourselves and our readers on two points: 1) those are Not 100% odds and the road to new highs will be bumpy and 2) the fundamental backdrop has been deteriorating for over a year.

Which way

China is the world’s second largest economy. It is the largest goods trading partner for Europe and many countries in Asia. The economic and social strains of seemingly permanent lockdowns of the last two years finally forced the Communist Party’s hand last month. They were forced to reverse lockdown orders and allow foreign travel. These policy changes should eventually have mostly beneficial effects for the global economy.

The Bear case for China says that estimates of up to 250 million COVID-19 cases over the next month will continue to overwhelm their medical system. The real estate sector remains mired in bad-performing loans, unfinished apartments and teetering companies. China’s economic growth would be challenged most of the year. Oxford Economics estimates 2022’s GDP growth slid to only 2.7%. The government’s fixation with Taiwan adds to global tensions.

The Bull case sees growth returning in the coming months thanks to multiple rounds of stimulus and regulatory changes for the real estate industry. That sector accounts for some 30% of China’s GDP. The current slowdown has helped depress energy prices and helped build inventories. Recovery from COVID-19 is at best wait and see, but we do know that travel bookings for the upcoming Lunar holiday jumped to near pre-shutdown levels since the Party’s announcement. Same for overseas travel.

Growth

Markets are not waiting to find out. Both European and Asian indices have handily outperformed the U.S. to start the year. Through Friday China is up 13.4%, MSCI Europe index +6.6%, and the S&P 500 4.2%. Some of the turnaround can be attributed to the value of the U.S. dollar turning lower. Another aspect to the return differences is relative performance of U.S. mega-tech firms versus foreign stocks. Over the last three months economic releases in Europe have beat expectations more often than their U.S. counterparts. Last week Goldman Sachs changed their view on the Euro area, stating that they no longer expect a recession and peg growth at a positive 0.6% for all of 2023.

Good drop

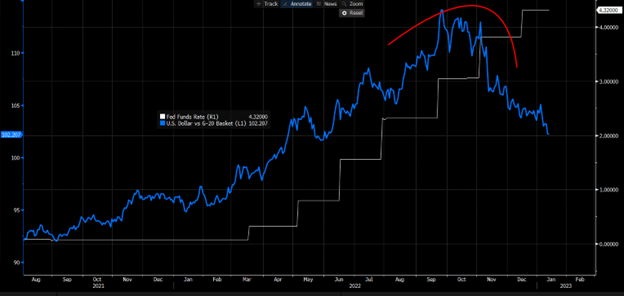

One aspect of the Fed leading other central banks in raising rates was the rally in the dollar. Currency traders got ahead of the Fed, pushing the greenback’s higher relative to the G-20 basket before the Fed’s first rate increase. Now that inflation has peaked and interest rates have risen in the G-20, the dollar has come off its peak. This helps exporters to the U.S. and the trade math in our GDP calculations. Look for the dollar to drift lower through the spring (blue line below).

And we are off

Stumbling a bit out of the blocks, that is, for the fourth-quarter earnings season. The big four banks reported before the open on Friday. Wells Fargo and Citi missed earnings per share expectations. Wells on higher operating losses and Citi on lower trading revenues. Old-fashioned banking, in the form of solid loan growth, was ignored by the Street. JP Morgan and Bank of America beat both earnings and revenue projections. Last year Jamie Dimon, CEO of JP Morgan, warned of a coming economic hurricane this year. Last week he walked that comment back a bit, stating that the U.S. economy remains “strong” for now, but that the bank remains “vigilant” and “prepared for whatever happens.” We will take that as an improvement.

Banks and financial services continue the parade this week: Schwab, Morgan Stanley, PNC and Goldman report Tuesday and Wednesday. Netflix on Thursday will garner some interest because it will no longer report subscriber gains/losses, just boring financial numbers.

Only 29 S&P 500 members have reported, so projections have not changed. For the fourth quarter, FactSet estimates that earnings for the entire index slid -4% year-over-year. If that estimate holds, it will be the first earnings drop since the 2020 shutdowns. Estimates have also come down for this quarter and next. Current earnings per share declines for the first quarter of 2023 are -0.6% and second quarter -0.7%. This week, 26 members report, 96 the week of the 23rd and 104 to start February.

Wrap-up

Dow transports, S&P 500, Mid Cap and Small Cap are all taking a fourth shot at their 200-day moving averages. Whether they can break through and continue to rally depends on earnings and managements’ views of 2023 business. Areas of the global economy are stabilizing, and China will come back online in the coming months. Progress on these fronts will show up in our indicators and recession probabilities. Until then, we think it prudent to be a spectator.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.