July — Fireworks; August — Policy Works — Week of August 1, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 4.28 | -12.59 | -5.17 | 12.93 | 12.78 | 4,130.29 |

| Dow Jones Industrial Average | 2.97 | -8.60 | -4.54 | 8.77 | 10.91 | 32,845.13 |

| Russell 2000 Small Cap | 4.35 | -15.45 | -14.86 | 7.23 | 7.02 | 1,885.23 |

| NASDAQ Composite | 4.72 | -20.45 | -15.52 | 15.41 | 15.30 | 12,390.69 |

| MSCI Europe, Australasia & Far East | 0.96 | -16.14 | -15.51 | 3.29 | 3.02 | 1,915.34 |

| MSCI Emerging Markets | 0.79 | -17.38 | -20.61 | 1.14 | 1.42 | 997.61 |

| Barclays U.S. Aggregate Bond Index | 0.56 | -8.23 | -9.05 | -0.19 | 1.26 | 2,161.23 |

| Merrill Lynch Intermediate Municipal | 0.69 | -5.51 | -5.97 | 0.39 | 1.74 | 302.49 |

As of market close July 29, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Best so far

July is in the books, and we enjoyed the fireworks. The S&P 500’s 9.1% gain was its best since November of 2020. The NASDAQ Composite, heavily weighted toward tech, jumped 12.3%, its best month since April 2020. How about a repeat in August? 2022’s first half says, “no way.” But we remind ourselves that this is a midterm election year and that markets took the Fed rate increase in stride. Markets climb a wall of worry. The start of August finds us staring up at more bricks than ever. Let’s put that aside briefly and review July.

Most of July’s negative price action was confined to the second week. The S&P 500 and Dow Industrials declined more than 3% as fears of a 1% Fed rate rise were in force. That week’s lowest price was well above the low of June 16. Higher lows are an encouraging sign. In the eleven trading days that followed, only two had negative returns. That was the best run since an 11% rebound in late March.

Grades

Second quarter earnings get a lot of the credit. Last week was Big Tech’s turn. Apple CEO Tim Cook said that the only negative in iPhone sales was the strong dollar. Microsoft’s chief Satya Nadella was bullish on future sales, saying, “as a percentage of GDP, IT spend is going to increase because every business is trying to fortify itself with digital tech.” Amazon posted better than expected operating income and raised guidance. So, the big three got bigger.

On the raw material end of tech, Exxon and Chevron both beat estimates with some of their strongest ever free cashflow numbers. No one should be surprised when crude prices jump 49% year-over-year. Exxon caught our attention because they guided capex spending at a $22.5 billion midpoint, well above Wall Street expectations. Most energy companies have lowered capital spending due to regulatory concerns.

Over half the S&P 500 (279) has reported as of this morning. To date, 73% have beat earnings and 66% have beat revenue estimates. Earnings growth over last year’s second quarter is running at 6%. If 6% holds through the next couple of weeks, 2022’s second quarter will have the lowest earnings growth since 2020’s fourth quarter, according to FactSet. Despite the 9% rally last month, earnings growth has kept the forward P/E for the S&P at a very reasonable 17.1 times. Strip out the eight largest companies and the remaining members price out at 15 times.

About those bricks

The Ukraine war continues to drag on. We are not sure it is possible to calculate the human toll. We are confident that between the war and depressed natural gas supplies, fertilizer production will be lower in the next several years. This will depress crop yields worldwide, pressuring food prices higher.

The Fed is not finished raising rates. Despite Chairman Powell’s bullish assertion that rates are near neutral, expectations are for rates to rise at least another 1% this year. The Fed’s favorite inflation gauge, the Personal Consumption Expenditures index, is running at 6.8%. We think we understand algebra; and 6.8% – 2.25% Fed Funds rate sure looks a long way from zero neutral. This is the fastest set of rate increases since 1994 and its effects have yet to fully ripple through the economy. Over the last several weeks, five-year inflation indicators moved higher, suggesting that traders fear the Fed stopping too soon — and not tamping down inflation.

Earnings from the second quarter are coming in above expectations. June early data suggests the slowdown continues and third and fourth quarters will need to be marked down. Walmart just issued its second profit warning in 10 weeks. Amazon cut its earnings guidance for the rest of the year.

Any lights?

What is that light in the tunnel? Bulls will say it’s the sunshine on the other side of a mild slowdown. Supporting their case are peaking Fed Funds futures, commodity prices, valuations, technicals and, of course, sentiment.

Fed Funds futures, while peaking at 3.5% near the end of this year, show increasing odds of the Fed cutting rates next spring. Futures are telling the Fed, “Hey, you may be going too far and inflation is not that big of a problem.” Certainly, that is a message one could infer from commodity prices. Iron ore, steel, copper and even crude oil buyers have responded to high prices by lowering demand. China’s struggles with their real estate industry are also cutting into demand.

Stock valuations are not cheap, but well below the nosebleed levels of the last two years. Call them reasonable, and more so if rates continue to slide. Technicals are slowly rebuilding — most of the U.S. indices are well above short-term moving averages. The advance-decline line has turned higher and the percentage of stocks above their 20- and 50-day moving averages continues to climb higher. Expected volatility over the next month as measured by the VIX index continues to fall. Sentiment remains near the bottom of the Gulf of Mexico, which is a bullish signal.

Wrap-up

Is a repeat of July in store this month? Doubtful. July was a Bull rally in a Bear cycle. August in mid-term years is usually flat for stocks and ranks eighth out of the 12 months of the year in performance. Markets are going to have to work hard to scale the big bricks in the Worry Wall. Our indicators urge caution and are keeping us neutral.

Essential Economics

— Mark Frears

Civics

I have owned several Honda Civics, great basic transportation. My two boys both learned to drive in a “seasoned” model. Taught my wife to drive a stick in one. The study of civics deals with the rights and duties of a citizen. What do you consider your rights and duties as a citizen? The markets think they have rights as well, and they chose to exercise them this past week given a wide mix of inputs.

Mindset

We had two measures of how the consumer was thinking out this week. The Conference Board’s Consumer Confidence usually leans more toward the job market. It came in lower than expectations and three points lower than last month, still above COVID-19 lows but on a downward trend through 2022. The UofM Consumer Sentiment rose above early July readings and the five to 10-year inflation component stayed below 3%. This measure is more sensitive to inflation expectations.

Buying

What goods and services are purchased is part of the economic picture. Is money spent on more durable goods, or on day-to-day needs? The Durable Goods Orders release showed a monthly improvement of 1.9%, in line with expectations. Capital Goods Orders Non-defense ex-Aircraft is considered a good proxy for business spending plans. For June, the 0.5% increase was above expectations and in line with last month. In fact, it is on almost the highest growth rate ever.

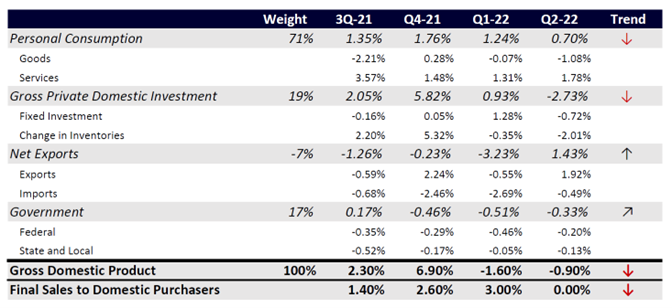

Muscles

The Gross Domestic Product (GDP) measures the strength of the U.S. economy. There was considerable focus on this release for the second quarter. First quarter’s measurement showed a contraction of 1.6%, and the fear was that this quarter would be negative also, as two consecutive quarters of negative growth defines a recession. GDP did fall 0.9% in the second quarter. Real final sales to private domestic purchasers were unchanged in the second quarter after advancing at an annualized rate of 3.0% in the first quarter, confirming the “technical” economic slowdown.

This is a great table, showing many interesting trends. First, consumer spending was still positive last quarter, yet fixed investment and change in inventories weighed negatively. Second, exports were surprisingly strong given the strength of the U.S. Dollar. Third, spending on services over goods continues.

The question of whether we are truly in a recession is hotly debated in the media. Given the strength of the job market and income gains, we are not there yet.

Prices

While the Federal Open Market Committee (FOMC) watches all sorts of inflation indicators, the only one they watch in their Summary of Economic Projections is the Personal Consumption Expenditures Price Index (PCE). Both the PCE Deflator and the Core Deflator, on a year-over-year basis, increased to close to and to new highs in June, respectively. The Core Deflator is currently at 4.8% with the FOMC calling for this to be around 4.3% by year end and average 2.7% in 2023. While we have seen gas prices drop from their highs, we are still experiencing higher costs in most areas of our lives.

FOMC

While the June FOMC meeting was a much-watched event, it came and went with less fanfare than usual. Fed Funds futures had a 75bp (basis point) rate hike baked in and they came through with the same. When markets get what they are expecting, they start to look for other inputs.

The press release and Chair Jay Powell’s press conference seemed to lean a bit toward the dovish side. That is, possibly slowing down future rate hikes in order to evaluate the impact on the demand side of inflation, as well as be cognizant of possible recessionary trends. They have committed to fight inflation to the best of their ability, so there is still another 100bp of rate hikes before year-end built into the futures market.

Wrap-up

Wishing the citizens of Canada a great Civic Holiday! We will continue to watch War, Inflation, Fed and Earnings for glimpses into what is coming next.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 1-Aug | Empire Manufacturing | Jul | 52.3 | 52.3 |

| 1-Aug | Construction Spending MoM | Jun | 0.2% | -0.1% |

| 1-Aug | ISM Manufacturing | Jul | 52.0 | 53.0 |

| 1-Aug | ISM Prices Paid | Jul | 73.5 | 78.5 |

| 1-Aug | ISM New Orders | Jul | 49.0 | 49.2 |

| 1-Aug | ISM Employment | Jul | 48.2 | 47.3 |

| 2-Aug | JOLTS Job Openings | Jun | 11,000,000 | 11,254,000 |

| 2-Aug | Wards Total Vehicle Sales | Jul | 13,500,000 | 13,000,000 |

| 3-Aug | S&P Global US Services PMI | Jul | 47.0 | 47.0 |

| 3-Aug | S&P Global US Composite PMI | Jul | N/A | 47.5 |

| 3-Aug | ISM Services Index | Jul | 53.8 | 55.3 |

| 4-Aug | Challenger Job Cuts YoY | Jul | N/A | 58.8% |

| 4-Aug | Trade Balance | Jun | $80.1B | -$85.5B |

| 4-Aug | Initial Jobless Claims | 30-Jul | 260,000 | 256,000 |

| 4-Aug | Continuing Claims | 23-Jul | 1,338,000 | 1,359,000 |

| 5-Aug | Change in Nonfarm Payrolls | Jul | 250,000 | 372,000 |

| 5-Aug | Change in Private Payrolls | Jul | 230,000 | 381,000 |

| 5-Aug | Unemployment Rate | Jul | 3.6% | 3.6% |

| 5-Aug | Average Hourly Earnings YoY | Jul | 4.9% | 5.1% |

| 5-Aug | Labor Force Participation Rate | Jul | 62.2% | 62.2% |

| 5-Aug | Underemployment Rate | Jul | N/A | 6.7% |

| 5-Aug | Consumer Credit | Jul | $27.000B | $22.347B |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.