50 is the new 25 — Week of September 23, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.39 | 20.28 | 33.62 | 11.11 | 15.58 | 5,702.55 |

| Dow Jones Industrial Average | 1.67 | 13.21 | 25.92 | 9.65 | 11.61 | 42,063.36 |

| Russell 2000 Small Cap | 2.10 | 10.98 | 26.86 | 2.05 | 8.81 | 2,227.89 |

| NASDAQ Composite | 1.51 | 20.22 | 36.82 | 7.66 | 18.18 | 17,948.32 |

| MSCI Europe, Australasia & Far East | 0.43 | 11.12 | 20.70 | 4.73 | 8.13 | 2,410.93 |

| MSCI Emerging Markets | 2.26 | 10.66 | 19.08 | -1.31 | 4.49 | 1,106.44 |

| Barclays U.S. Aggregate Bond Index | -0.22 | 4.70 | 11.17 | -1.65 | 0.47 | 2,263.69 |

| Merrill Lynch Intermediate Municipal | 0.12 | 1.95 | 7.26 | 0.00 | 1.42 | 321.02 |

As of market close . Returns in percent.

Investment Insights

— Steve Orr

5

Since the early August downdraft, stocks and rates have posted higher readings in five of the six weeks. Normally that is the sign of a healthy Bull, especially in stock indices. This being sloppy September, a Bull breakout carries extra weight. In “normal” years, we would be stuck in neutral, wading through a minor 4% or 5% correction. Not this year. The nonstop borrowing by the drunken-sailor spending Congress is pushing toward another $2 trillion deficit this year. The enormous amounts of liquidity floating between banking excess reserves, the Fed and Treasury General Account help put a psychological, if not actual floor, under prices.

Markets finally got the 50-basis point (half-percent to you and me) rate cut they demanded last Wednesday. Stocks rallied on the news, then as usual, dumped after Powell’s presser. Thursday’s massive rally looked good on the cable news channels. The S&P 500’s +1.7% gain set its 39th all-time high for the year. It also broke 5,700 for the first time. The Dow Industrials broke 42,000 for the first time and crossed a 1,000 number for the 5th time this year. All interesting milestones, but is this the resumption of the 2024 AI meme rally?

10

Give us about 10 market days to see if the rally sticks. Last Thursday marked the last trade day before options expiration on Friday’s close. A good portion of the rally was due to setting marks relative to expiration strikes. Volume that day was 20% above the 10 average: a healthy sign. Advancers over decliners were around 3 to 1. Nice but not the 9:1 breadth thrust. Thursday and Friday are the small candles at the far right. Note they are above the prior highs. Generally, you would expect a throwback, where the S&P 500 sinks back below the highs before climbing and staying above the all-time high.

Breadth, or winners versus losing stocks, is in good shape. Longer-term trends are also positive: The percent of stocks above their 200-day moving average remains near three-year highs. Markets thrive on easy liquidity, regardless of the season or cycle. We discuss the Fed’s rate cut below, but please remember that the administration’s free spending ways are creating a $1.9 trillion deficit this fiscal year.

50

In its first rate cut since the 2020 shutdowns, the Fed jumped over market expectations and cut rates one half of a percent. The vote to cut had one dissent, by Fed Governor Michelle Bowman. It was the first dissent by a Governor since 2005. She was in favor of a 25-basis point cut. The last dissent was by Kansas City Fed President Ester George in 2022. Like Bowman, she favored a smaller move.

In his Jackson Hole speech back in August, Chairman Powell pivoted from inflation to jobs. In Wednesday’s press conference, responding to a question by CNBC’s Steve Leisman, he seemed to indicate that job numbers could get revised lower. This was a no-news statement, as almost every jobs number in the past 12 months has been revised lower. Setting aside whether the administration’s job models are reliable, other job stats suggest little or no cuts were needed. Jobless claims remain very low versus history. Recent WARN notices are largely confined to the tech sector. In the monthly payroll data, aggregate hours worked, and private civilian labor force data is at worst stable, if not growing. What then is the motivation for “going big?” Chair Powell stated that the Fed wanted to “get ahead of the curve.” This is good news for a Fed that is chronically late starting, ending, raising and lowering rates. We wonder if there is some special medical treatment for new FOMC members that makes them late. Apparently, Powell is trying to fight off the effects.

Almost 50

More than 40 countries around the world have their currencies and/or interest rates tied to the U.S. As our rates rise, they feel the pain too. For example, many of those countries have home mortgages tied to their overnight interest rate plus a credit spread. So, it is no surprise that consumer spending in many countries slipped over the past two years. Imagine your mortgage interest rising from 4% to 9%. Seniors and savers get the opposite treatment. If money market funds hold about $5.5 to $6 trillion, then a half point cut likely cut $40 billion out of future money market fund earnings. In the very short term, there will be some lift in mortgage refinancings, but rate reductions take months to have effects across the economy.

Most of the economist community and traders expected a quarter-point cut. The Fed Futures market has a good track record this century of guiding the Fed about 10 days out. Once futures contracts project 90% or greater odds within 10 days of the next Fed meeting, the Fed usually follows what those odds project. This time futures were 100% for a 25-basis point cut. OK, but odds for a 50% cut were only 60%. So this was an unusual move with odds so low.

This was also the first time in the modern era we could find where the Fed changed policy going from up to down or visa versa, within 11 months of an election. Also unusual.

50 more

The next Fed meeting is scheduled for the two days following the election. The Fed members rate projections, nicknamed the “dot plot,” shows the most likely path for rates to be a quarter point cut at that November meeting and one in December. Fed Funds overnight rates would finish 2024 between 4% and 4.25%. In 2025, they project four quarter point reductions. Sticking to that game plan means a year from now rates would be averaging 3.25% on their way to 3%.

Powell did stress that the Fed remains data dependent. There is one inflation report and two payroll reports between now and the November 7 meeting. We expect the Fed to stick to quarter point moves and the data to come in consistent with a slow but second-gear economy. The highest risks that may change Fed thinking are supply chain inflation from looming port strikes and further escalation in the Middle East.

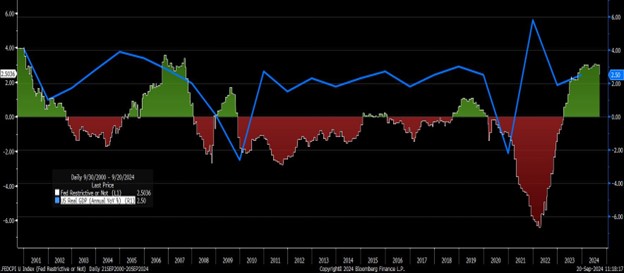

Despite borrowing spreads and global liquidity at very attractive levels, the Fed’s rate focus centers only on the level of Fed Funds versus inflation. We can dive into inflation another time, but for now consider the following: If inflation has bottomed around 2.5% to 3% and Fed Funds are sitting (today) at 4.5% to 4.75%, the difference is near 2%. That is historically high (“tight” in Wall Street lingo) for the current central bank thinking. Take note of the green patch at the far-right-hand side of the graph. Even after the cut, the gross difference between effective Fed Funds and CPI is in excess of 2%. Cutting rates slowly by 2% would get the gap back near 0 or neutral. Most of the post-GFC decade, money was so “easy” that the rate was below inflation (red areas). Oh, and the blue line? That’s year-over-year GDP. The Fed worries that if they stay restrictive (FF > CPI) too long, it will restrain growth. The blue line of GDP growth seems to agree.

50-50

After Wednesday’s 50 basis point cut, Wall Street needed a diversion. Thursday night provided a welcome respite as Shohei Ohtani hit the unthinkable feat of 50 home runs and 50 stolen bases, in one season. Facing the Miami Marlins, Ohtani went 6 for 6, hitting three homers and stealing two bags. He became only the third player in history to record at least six hits, three homers and 10 RBIs in one game. He is also the fastest player to reach 40 stolen bases and 40 homers, needing just 126 games. Our opinion: He does not need to return to pitching.

9/30

Ahh, the government fiscal year is fast upon us. No budget deal yet from Congress. A longshoremen’s strike looming on October 1st that is sure to stifle delivery of our Christmas presents. And for Christmas, the debt ceiling will be reached at the end of this year. So much to look forward to, and yet October is just ahead.

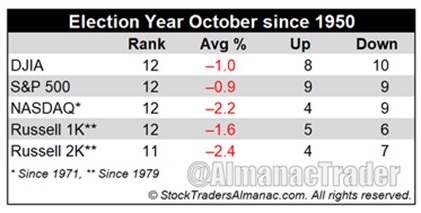

September performance for stocks and interest rates to date have topped historical ranges. These two months still have the deserved reputation for downdrafts, corrections and (1987) crashes. Election year Octobers are in last place in the stock market performance derby. Our trusty Stock Traders Almanac has the tale of the tape:

Source: StockTradersAlmanac.com

If the recent earnings results from Lennar and FedEx are an indication of what third quarter results await us in late October, then our belief in this fall’s bumpy ride remains. Rates markets are priced for extended slowdown in 2025. Stocks are priced for 14% earnings growth in 2025 and paying a 21x multiple to achieve that growth. One or both markets have overshot in opposite directions. Certainly, homebuilders and transport stocks will not be contributing this quarter.

Wrap-Up

Rates and stock markets got the rate cut they wanted from the Fed. Recent economic data continues to paint a steady, but mixed, picture. Our indicators are keeping us fully invested, but we are mindful of a bumpy path to the election.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI