No Free Lunch with rate hikes — Week of March 27, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.41 | 3.85 | -10.66 | 19.39 | 10.84 | 3,970.99 |

| Dow Jones Industrial Average | 1.18 | -2.21 | -5.11 | 18.31 | 8.83 | 32,237.53 |

| Russell 2000 Small Cap | 0.53 | -1.19 | -15.18 | 17.96 | 4.14 | 1,734.92 |

| NASDAQ Composite | 1.68 | 13.23 | -15.91 | 17.77 | 12.11 | 11,823.96 |

| MSCI Europe, Australasia & Far East | 3.33 | 6.19 | -1.85 | 15.68 | 3.87 | 2,052.04 |

| MSCI Emerging Markets | 2.79 | 2.56 | -11.15 | 9.78 | -0.85 | 977.78 |

| Barclays U.S. Aggregate Bond Index | 0.46 | 3.38 | -4.15 | -2.07 | 1.09 | 2,117.94 |

| Merrill Lynch Intermediate Municipal | 0.14 | 1.85 | 0.71 | 2.47 | 2.07 | 304.35 |

As of market close March 24, 2023. Returns in percent.

Investment Insights

— Steve Orr

New base?

Last week’s quarter-point rate increase by the Fed’s Open Market Committee was not a surprise. What did catch our attention was the change in tone. For the last five meetings, the FOMC was confident that “a soft landing is our base case.” Last Wednesday suddenly it was “too early to say.” Markets interpreted that change as the Fed worrying that odds of a soft landing in the coming quarters are dwindling to nothing. We are left wondering if the Fed’s new base case is mild, moderate, regular or severe recession.

The 15-year global central bank experiment with ultra-low rates was cut short by excessive government spending, which greatly expanded the money supply. The multiple rounds of money-printing stimulus from Congress went straight into the economy. Too many dollars chasing goods means prices rise. In summary, inflation resulting from Congressional largess got this rate increase cycle going. The Fed was too late to act and has, like many times before, gone too far in raising rates.

What level?

Humans have an inherent need to make sense of the world around them. Market beginners often get lost in trying to make sense or order out of the noise coming at them from financial media, data feeds, etc. News flash: Markets do not always make sense. We have learned the hard way that in times like these, it is best to stand aside, watch and wait. Even some technical analysis tools do not work when the two-year Treasury note swings from 5% to 3.85% in ten trading days. Interest rates and credit spreads are moving around too fast for most tracking methods to keep up. The key points to remember in these situations:

- NFL: There is No Free Lunch — the Fed cannot raise rates from zero to 4.75% in 12 months and not expect to break something. Broken running total to-date is four: crypto, housing, industrial new orders, bank deposits.

- Bank solvency is sound — Chairman Powell was right about that. Liquidity is the issue. Waves of deposits left the banking system each time a new “home” was available. When the Fed raised rates in the 1970s, funds left for the new money market mutual funds. When Congress raised deposit insurance for Savings & Loans in the 1980s, same thing. Impress your friends with the term for these deposit moves: disintermediation.

- This too will pass. Longer term interest rates have fallen this quarter, suggesting lower growth ahead. Short-term rates are marginally higher, suggesting the Fed is not quite done raising rates.

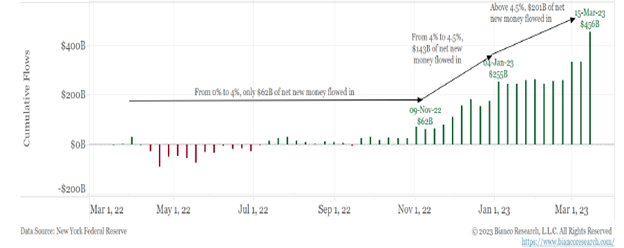

Last week’s quarter-point increase by the FOMC will likely be followed by one more at either the May or June meeting. We believe it would be prudent for the Fed to pause at that point. When should the Fed have stopped? Bianco Research put out an interesting chart recently. Using Federal Reserve data, they graphed the flows into money market funds as the Fed raised short-term rates. Presumably most of the funds moving to money markets came from lower-paying bank deposits. As rates hit 1% in May then 3% last September, the green bars show small moves to the higher-yielding money funds. One inference you can draw is that depositors were either insensitive or lazy until rates reached 4%. At that point funds started moving. After years of zero to one quarter of a percent, we were surprised flows did not start earlier last year. The Fed had this data at the 4% level yet kept going.

Despite rates markets forecasting rate cuts before the end of this year, we think the Fed will follow their recent pattern of pausing for around six months. So, expect rates to stay near these levels for most of 2023.

Price vs reality

This week marks the end of the first quarter. The economic data calendar is light. Consumer confidence and the final reading for fourth quarter’s GDP are the only big items. Traders will be watching the tape for the next shoe to drop. We are watching pricing on contracts and spreads for insurance companies and commercial real estate loans. Despite the headlines, stock markets have held up pretty well this quarter. If the tape stays quiet, most of the major indices should finish positive. The NASDAQ, S&P 500 and Dow are all in positive territory. Emerging markets are basically flat, and U.S. small cap is down about 2%.

Big tech — think Apple, Meta, Amazon and the other eight largest companies in the S&P 500 — is all up double digits since the start of the year. All produce free cash flow and are seen as safe havens if a recession is declared. The one and a half percent drop in the S&P 500 after last Wednesday’s Fed meeting was driven more by Treasury Secretary Yellen and Fed Chair Powell having differing messages than new problems on the tape.

Stocks remain largely range bound. If volatility stays at moderate levels, then we expect that to continue into the first quarter earnings season. April stock market performance in pre-Presidential election years is number one among all months. The average April sees gains of over 3% in those years. The Fed and interest rates occupy center stage for now. The (big) daily moves in rates will not settle down until the Fed does.

The procession to recession progression (say fast three times) continues. The dramatic fall in two-year Treasury notes rates pushed its yield below its 200-day moving average for the first time in a year and a half. Every time that has happened, rates were lower a year later. In other words, slower growth is coming — the same signal from the long end of the yield curve.

Another signpost is bank lending standards. When loan officers raise lending standards, lower hiring and capital spending follow in subsequent quarters. Look for layoffs to rise in coming months.

Wrap-up

There is No Free Lunch when the Fed goes too far, too fast in raising rates. The FOMC should have stopped at 4%, if not earlier. Inflation will stay higher than the Fed wants. CPI may fall into the 4% range by the end of the year, but the Fed’s goal of 2% will remain elusive. Commodities prices are at 52-week lows, suggesting more slowdown ahead.

We remain cautious and expect our indicators will suggest more risk reduction in the coming weeks.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.