Fed in another pickle — Week of March 20, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.47 | 2.40 | -9.72 | 17.55 | 9.19 | 3,916.64 |

| Dow Jones Industrial Average | -0.11 | -3.35 | -5.60 | 16.86 | 7.32 | 31,861.98 |

| Russell 2000 Small Cap | -2.58 | -1.71 | -15.19 | 17.40 | 3.02 | 1,725.90 |

| NASDAQ Composite | 4.44 | 11.36 | -13.78 | 17.57 | 10.25 | 11,630.51 |

| MSCI Europe, Australasia & Far East | -3.04 | 2.83 | -4.34 | 14.83 | 2.67 | 1,988.12 |

| MSCI Emerging Markets | -1.33 | -1.30 | -13.24 | 7.31 | -2.27 | 941.35 |

| Barclays U.S. Aggregate Bond Index | 0.59 | 2.05 | -6.12 | -2.62 | 0.84 | 2,090.71 |

| Merrill Lynch Intermediate Municipal | 0.60 | 1.54 | -0.44 | 0.82 | 2.01 | 303.40 |

As of market close March 17, 2023. Returns in percent.

Investment Insights

— Steve Orr

Looks aren’t everything

At least that is what I tell myself. More important, is the look of the stock market versus the statement. Since the recent highs of early February, the S&P 500 and its peer indices have posted impressive intraday volatility numbers. Swings back and forth before the European close are followed by pops higher at lunchtime or afternoon collapses. Rarely is the last hour of trading consistent with the day’s trend.

Only Friday’s trading action was a semblance of “normalcy.” And unfun normal at that — open down, drift lower, noon balloon for ten minutes, drift lower into the close. That is an August “on vacation” pattern, not a quarter-end option expiration day. It is easy to get lost in the daily noise and forget that the Bear cycle low was last October. Despite the banking turmoil of the last ten days, stocks have held in a range between 3,800 and 4,200 (white dotted lines). It took the failure of the three tech-based banks to force the S&P 500 below its uptrend from the October lows (green line). Over the last week the big index bottomed and actually finished higher on the week.

Source: Bloomberg, L.P.

Does last week’s rebound mean the worst is over for stocks? We do not believe we are “out of the Bear woods.” Even in last October’s lows, very few of our bottoming signals were triggered. Our breadth and sentiment indicators are increasingly negative, suggesting that near-term action will be sideways to lower.

If earnings estimates, trend and sentiment weaken together, that may trigger a reduction in equity exposure for our portfolios. This Bear cycle was triggered by a too-late Fed raising rates too quickly. Higher rates compress earnings for companies, consumers and, yes, governments by raising borrowing costs.

Pickle

A constant in our careers is that the Fed is “walking a tightrope” or on a “knife edge” because any wrong step would send the economy or stocks or (take your pick) reeling. Once again, this week’s Fed meeting finds the Fed in a pickle — of its own making.

“Raise till something breaks” is the old saw for Fed rate increase cycles. We submit that the breaking started last summer with crypto currencies, then housing, U.K. pension funds, then tech and now tech banks. Higher interest rates pushed by the Fed raising overnight rates has also pulled deposits out of banks into money market funds and Treasury Bills. Between higher rates and worries over uninsured deposits, the Fed may stumble into its goal of lowering inflation in the coming years.

Think of it this way: Our economy runs on credit. Short-term loans for working capital, accounts receivable, etc. When the supply of cash from deposits declines, banks cannot extend credit to businesses. In turn, businesses cut orders and lay off staff, which drops pressure on wages. The Fed staff economists believe that at that point wage disinflation will lower inflation. That sounds good in theory.

Today we have a labor shortage and reshoring of supply chains that will exist for years, aging boomers who type investment letters, and rising healthcare costs for the elderly. We are struggling to find any disinflationary forces that will abide by the Fed’s soft-landing drift toward 2% inflation anytime soon.

This Wednesday’s short-term pickle for the Fed is whether to raise rates a quarter point or stand pat. If they raise, they can say they are continuing to fight inflation and taking steps to ensure bank liquidity. All is fine. Move along here. If they pause, they will need strong language to steady traders’ nerves that all is okay. We think a cut in rates would send a wrong message. There may be an initial relief rally that “happy days of cheap money” are back. We think that rally would be measured in minutes. The Bear Fear would hit just before market close: “What does the Fed know that we don’t that is so bad it must cut rates?”

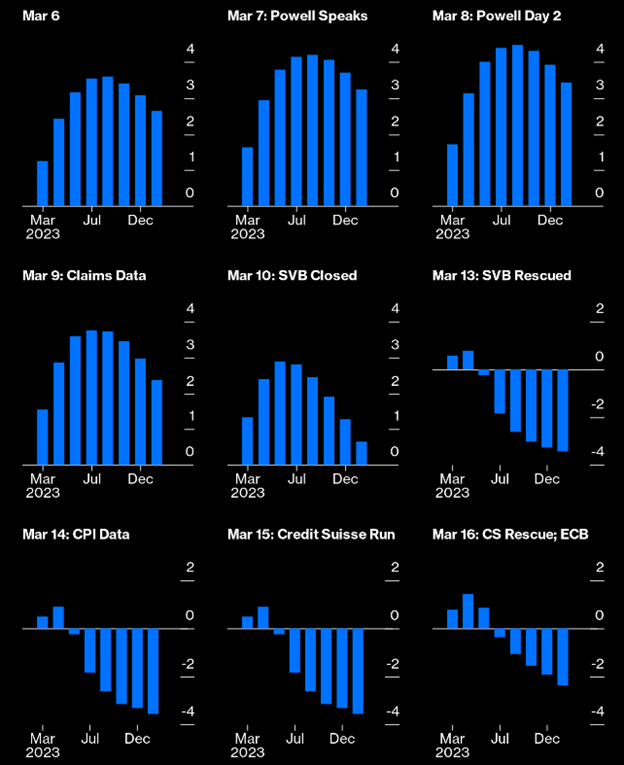

Fed Futures have quickly repriced from 5% to 5.25% later in the year, to the Fed’s plan to cut rates several times later this year. John Authers and Isabelle Lee at Bloomberg pulled together futures pricing over the last two weeks. March 6, in the upper left, shows the Fed raising rates several more times before starting cuts in the fall. By last week in the bottom row all but one increase is washed out of futures and markets are hedging that the Fed will turn tail on the inflation fight (hat tip to Jerry Levy).

For the last two decades central banks have kept rates low and readily supplied liquidity in times of stress. Prior to the “Age of the Central Banker,” the rule was “Sell at the last hike.” If futures are correct, then a recession and the last rate increase are closer in the mirror than they appear.

Leading indicators are down eleven straight months. Consumer confidence is above recession levels but falling. Their inflation expectations are rising. The University of Michigan’s survey expects 4% inflation over the next year. That looks low to reasonable to us. This week, home sales, durable goods orders and purchasing manager indices will all show lower activity in February.

Wrap-up

The Fed is in another pickle of its own making. Its rush to higher rates to combat government spending is a recession wrecking ball rolling through the economy. The chances of avoiding a recession are almost nil. Odds of a soft landing were 25% at the beginning of the year. It is lower now. A recession of some level will be hard to avoid. At that point stocks may break their recent lows and head toward October’s levels.

We are confident that the U.S. banking system is sound. Traders’ fears are another matter. If the volatility volume is turned down over the coming weeks, we remind readers that these weeks are historically very bumpy. If the worst of the bumps are past, there may be a short relief rally that surprises.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.