Where’s the Bull? — Week of May 15, 2023

Index

WTD

YTD

1-year

3-year

5-year

Index Level

S&P 500 Index

-0.24

8.05

6.73

14.63

10.51

4,124.08

Dow Jones Industrial Average

-1.04

1.19

7.22

14.19

8.35

33,300.62

Russell 2000 Small Cap

-1.04

-0.66

1.61

12.29

2.94

1,740.85

NASDAQ Composite

0.44

17.75

9.04

11.82

11.69

12,284.74

MSCI Europe, Australasia & Far East

-0.50

11.50

15.47

12.36

3.94

2,130.19

MSCI Emerging Markets

-0.37

3.00

2.36

5.31

-0.69

977.82

Barclays U.S. Aggregate Bond Index

0.24

3.78

-0.40

-2.93

1.23

2,126.22

Merrill Lynch Intermediate Municipal

-0.03

2.50

5.02

0.62

2.10

306.27

As of market close May 12, 2023. Returns in percent.

Strategy & Positioning

— Steve Orr

Where’s the Bull?

Bear cycles, no matter how short in time, make it tough to remember the long-term trend. Secular Bulls can last longer than fifteen years, while secular Bears mercifully usually about four. Both have several cycles, up and down. The current secular Bull that started in 2009 has years left to run. The S&P 500 fell 25% from its all-time high at the end of 2021 to last October’s low. Since October 12, it has rallied 15%, on track for a typical Bull recovery.

Global stocks, as measured by the MSCI All-Country World Index, have performed similarly. Last fall we were concerned about recession in Europe and China’s reopening. Europe appears to have dodged an economic bullet. The overhang of the Ukraine war is muted by talk on the Continent of peace talks in the fall. Last winter’s natural gas shortage was mitigated by a mild winter and lower prices this year are aiding the refilling of storage. Both indices have encountered resistance at year-ago levels (pink bar below).

Source: Bloomberg, LP

As Bears go, it could be worse. We are, after all, sitting 15% above the worst levels of last fall. The uptrend line from the October lows forms an ascending triangle formation with the pink overhead resistance around 4,175.

Source: Bloomberg, LP

At best we can say there will be a breakout in one direction or the other. The 2011 version has Congress arguing with the Administration through the summer, taking stocks lower and rebounding in the fall. Other pre-election years suggest a rally through the summer.

For a rally to develop and punch higher through the 4,175 area, traders would have to be convinced that earnings are going to hold or improve despite the economic warning signs. More on those in a moment.

Dumb

The debt ceiling debate is, for the moment, not a debate. In fact, it is nothing. Staff negotiation meetings continued through the weekend, but the principals will not meet until Tuesday at the earliest. There are just a few days left for Biden and Congress to be in town at the same time. The outlines of a deal as we know it are a short-term debt ceiling lift until this fall, some spending caps and possibly cutting benefits to recipients who are not looking for work. The latest Treasury cash balance is roughly $154 billion today. Social Security payments this week should take $115 billion, leaving less than $40 billion. Treasury would then have to pick and choose who to pay through mid-June, when quarterly tax receipts come in.

There is rising chatter about the Treasury defaulting on Treasury bonds. That is a nonstarter. There does exist a small, non-zero possibility that the Treasury could default on a Treasury Bill maturity. We would think the Treasury would prioritize payments and use drawing rights to fund the debt payments first. Default would only rise in probability (and news chatter) if in the coming weeks an extension of the debt ceiling is not agreed to by the Administration and Congress.

Remember there was one technical default, back in 1979. A T-Bill payment was missed by a day thanks to a “computer error.” Back then that was an understandable reason. Today the argument is whether or not to continue government spending at the fastest pace since World War II.

Redux

As if the debt ceiling negotiations in Congress were not enough drama for mid-June, the FOMC’s next policy meeting is set for June 13 –14. Fed speakers are back on the lecture circuit, and they are still focused on inflation and downplaying bank stress. What else could happen this summer? How about a return to the recession discussion?

Bulls are focused on yesterday and today, the Bears (count us in) are focused on July. The Bear argument today is that unemployment is running at its lowest level since 1969. The Federal government is helping, too. Congress is spending at a rate 13% higher than last year’s first seven fiscal months. We wonder if Congress dialed back just a bit, would negotiations be easier? Just a thought.

The Bear case, and we think closer to reality, is this: A 3.4% unemployment rate is a wonderful achievement. Consumer spending and corporate earnings run best at full employment. Thanks to those employment stats, the Atlanta Fed GDP model projects second quarter GDP growth at 2.7%. As an aside, it is early in the quarter, and we think that will get revised down.

Every time unemployment dips down to the 3% neighborhood, it does not hang around long.

Source: U.S. Bureau of Labor Statistics

In the above chart, the gray vertical bars are recession periods. And what, you ask, preceded each of the last eight rising unemployment / recession periods? Why, the Fed raising interest rates, of course.

Short-term interest rates remain more than a percent and a half above 10-year Treasuries. Inverted yield curves, where short-term rates are above long, usually forecast a recession about a year out, or this July.

The unemployment rate of course still sits at 40-year lows. Jobless claims feed the unemployment rate, and every time they rise more than 20%, a recession follows within three months or so. Claims have risen 25% since January, so they are saying recession any minute.

The Conference Board’s Leading Economic Index, which includes a yield curve measure and stocks, peaked in April 2021 and is well into recession territory.

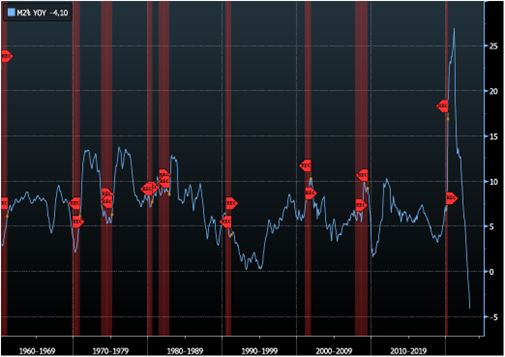

Money supply growth usually runs at about the rate of GDP growth. On a three-month rolling average basis, money growth is contracting for the first time since a very brief period in 2018. Negative money supply growth on a year-over-year basis is also negative, contracting at a 4% rate. This is something new in the modern era. Money supply growth nearly went negative in 1993 and 1995. The red bars in the graph below are recession periods.

Source: Bloomberg, LP

The most recent Federal Reserve survey of bank lending officers shows loan creation slowing. Less liquidity and credit mean slower growth now and continuing until money growth turns positive.

Wrap-up

The warning signs for the Most Anticipated Recession Ever keep piling up. We wonder when the (economic) dam will break. If it’s a recession, then let’s get it over with.

We position our portfolios for the intermediate and long-term trends in market cycles. Short-term, there is no trend in rates or stocks. Our stock positions have held the line — working higher with the intermediate trend. Bonds may soon become attractive with clarity on the Fed’s rate direction. Cash is the only asset paying close to inflation levels. For now, we remain market weight stocks and overweight cash.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.