FOMC Rate Hike — Week of June 20, 2022

Essential Economics

— Mark Frears

You and me

OK, the FOMC hiked rates by 75 basis points (bp) and are focused on bringing inflation back down to 2% levels from current 5% indications (Personal Consumption Expenditures core). What does this mean for the consumer? It does not directly impact me if the rate banks trade with each other goes up, but the message sent by the FOMC is the important idea. They will raise rates until the demand for goods and services slows down, significantly. This is the only way they can fight inflation. How does it impact us?

Gas

Rising rates do not impact gas prices as much as supply and demand disequilibrium. Right now we have a strong economy where individuals and companies are buying gas, but the supply is lacking. That causes prices to rise. As supply increases generally take a longer time to work their way to the pump, declining demand is the path to lower gas and diesel prices. You will hear about getting more oil from the Mideast or Venezuela, but they too are not in the position to quickly increase production, even without prickly political situations.

Rising rates in other areas of the economy will have a slowing impact in general and that will trickle down to the local service station, eventually. So far, behaviors are not changing materially and this will have to happen to have an impact.

Food

While we may choose to not go on a car trip, we do have to eat. During the pandemic, we ate at home more and our food costs came down; we may have to do more of that, even though grocery store costs are up significantly.

People have been choosing to eat out more, some of it is reversion to normal behavior and some is built-up demand from not being able to go out during the pandemic. On the restaurant/bar front, they are still actively looking for workers. Labor costs, along with food supply constraints and increased cost of transportation (see above), are all impacting restaurants and grocery stores.

One of the top items you are hearing about in rising food costs is the war in Ukraine. The impact on eastern Europe and Africa will be more drastic than in the U.S. It will still have an impact on you and me, though, especially in the trickle down of things like much-higher-cost fertilizer.

Where you live

If you are in a home that you like and have a nice low mortgage rate locked in, you are in great shape. Many around the country have been able to achieve this over the past two years. You are not hearing about that in the media though; all you are hearing is rising costs!

It is true that mortgage rates are rising and that will slow down buyers. Rising costs of building materials, transportation and labor are impacting this market. This impact will help move the needle in slowing down the economy. The very liquid housing market that we have been accustomed to lately is drying up.

Renters are seeing the impact of less supply with still strong demand. As houses are less attractive, this trend will continue. One way around this is to choose your location better. My one son and his wife live in Fayetteville, Arkansas, in a very nice two-bedroom apartment for $750 per month!

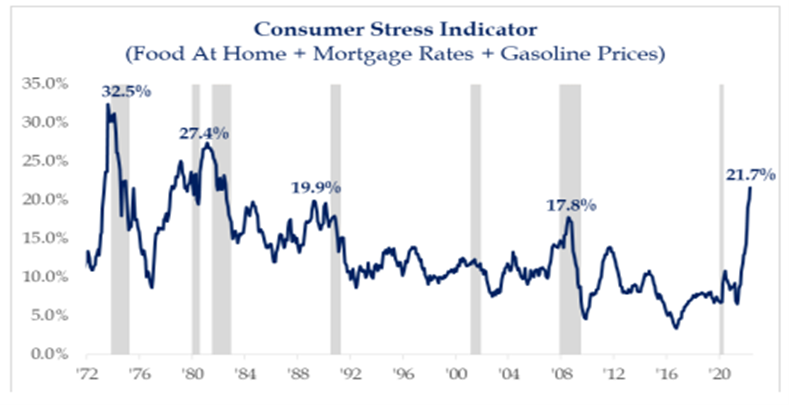

The chart below shows the Consumer Stress Indicator as published by Strategas. You can see the impact of the three areas we have discussed. The question is not whether the economy will slow down, but by how much.

Source: Strategas Securities, LLC

Off to work I go

The monthly nonfarm Payroll number has been showing a viable job market, but we are starting to see some cracks in the employment situation in rising Unemployment Claims. In general, people are in jobs where they are earning more than they were in the last couple of years. The lowest income workers are seeing the fastest increase in wages, but it still does not keep up with current inflation.

Companies are having to make hard decisions now on planning, how to manage current inventory, and how much they can pass along increased costs to their customers. We are starting to see a slowing of capital expenditures, hiring, travel and advertising.

Wrap-Up

The FOMC is front and center. Will they have to raise short-term rates to the projected 3.8% by next year, or will the economy start to moderate sooner? That is a huge question.

There is still a very strong case to be made for a “soft landing.” The consumer and companies are both in great financial shape, not like heading into 1990 or 2008 recessions. The banking industry is also in a position of strength to manage through the slowdown and still be there to provide credit and liquidity where needed.

Yes, we are facing headwinds right now, but we still live in the greatest country in the world, and we will bounce back.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 21-Jun | Chicago Fed Nat'l Activity Index | May | 0.47 | 0.47 |

| 21-Jun | Existing Home Sales | May | 5,400,000 | 5,610,000 |

| 21-Jun | Existing Home Sales MoM | May | -3.7% | -2.4% |

| 23-Jun | Initial Jobless Claims | 18-Jun | 232,000 | 229,000 |

| 23-Jun | Continuing Claims | 11-Jun | 1,338,000 | 1,312,000 |

| 23-Jun | S&P Global US Manufacturing PMI | Jun | 56.0 | 57.0 |

| 23-Jun | S&P Global US Services PMI | Jun | 53.7 | 53.4 |

| 23-Jun | S&P Global US Composite PMI | Jun | N/A | 53.6 |

| 23-Jun | KC Fed Manufacturing Activity | Jun | 15 | 23 |

| 24-Jun | UM (Go MSU) Consumer Sentiment | Jun | 50.2 | 50.2 |

| 24-Jun | UM (Go MSU) Current Conditions | Jun | N/A | 55.4 |

| 24-Jun | UM (Go MSU) Expectations | Jun | N/A | 46.8 |

| 24-Jun | UM (Go MSU) 1-year inflation | Jun | N/A | 5.4% |

| 24-Jun | UM (Go MSU) 5 to 10-year inflation | Jun | N/A | 3.3% |

| 24-Jun | New Home Sales | May | 590,000 | 591,000 |

| 24-Jun | New Home Sales MoM | May | -0.2% | -16.6% |

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.