Fade the Pivot – Fed not stopping — Week of October 10, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.56 | -22.70 | -16.01 | 9.73 | 9.28 | 3,639.66 |

| Dow Jones Industrial Average | 2.03 | -18.08 | -13.99 | 6.04 | 7.48 | 29,296.79 |

| Russell 2000 Small Cap | 2.27 | -23.41 | -23.39 | 6.23 | 3.72 | 1,702.15 |

| NASDAQ Composite | 0.75 | -31.48 | -26.73 | 11.78 | 11.12 | 10,652.40 |

| MSCI Europe, Australasia & Far East | 3.43 | -24.20 | -21.64 | 0.50 | 0.41 | 1,718.36 |

| MSCI Emerging Markets | 3.98 | -24.08 | -25.01 | -0.25 | -1.10 | 910.57 |

| Barclays U.S. Aggregate Bond Index | 0.19 | -14.45 | -14.20 | -3.40 | -0.20 | 2,014.93 |

| Merrill Lynch Intermediate Municipal | 0.74 | -9.49 | -9.06 | -1.40 | 0.79 | 289.73 |

As of market close October 7, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Spin cycle

Another week, another pivot scenario spun and done. Last week started with a two-day 5% pop that looked good on TV screens but did little to help stocks. By Wednesday, the Bulls had run out of spin energy and stocks ended the week largely where they started. Bond prices, too, did a round trip. Yields briefly dipped nearly a quarter of a percent but finished the week close to where they started. The 10-year Treasury closed at 3.88%, and 2-year went out at 4.30%, just below its recent high of 4.34%. For context, those are the highest rates since 2008.

The spin, or “pivot” story this time came from September surveys showing the economy is slowing down. “Bad” news is now good, goes the thinking, because bad news will tell the Fed to slow down or stop raising rates. Monday’s manufacturing survey and Tuesday’s job openings data both registered declines, encouraging a spin narrative that the end of rising interest rates was near. For months Fed members, Chairman Powell in particular, said that cutting employment and job openings were key to lowering inflation expectations.

Not so fast, or Reality Bites. Whatever your label, Fed speakers took to the microphones to remind markets that the Fed will not back down after a couple of weaker reports. Speeches given Thursday and Friday sang the same tune with different words. “We will not stop raising rates until inflation is under control” was the message. Note: no mention of job losses in the speech quotes. We find the change in direction intriguing. Clearly the Fed is worried about its credibility — that is an ongoing problem. But as payroll gains flatten out and job openings fall, one would expect the Fed to moderate its message and slow the amount of rate increases. Not this time — at least that is what they are saying. Stay tuned. Powell has pivoted enough over the last several years that the Fed has installed a revolving door at its entrance.

No change

This year may be remembered as the head fake or pivot year. Most Bear cycles have a few big rally days, but they are usually followed by a short uptrend that raises hopes. This year we have Fed speakers stepping forward on any good day to remind traders that there is little fun in store for markets.

The primary trend for stock and bond prices remains lower for now. The only area where we see possible near-term trend changes higher is grains and some commodities. After the Crimea bridge attack, Putin could change course on allowing grain shipments through the Black Sea. This action would increase pressure on grain prices. The strong U.S. dollar is not helping matters. 85% of all international trade is denominated in dollars. Countries already hurting from higher fuel import costs may next experience another round of higher food input costs.

The S&P energy sector remains the star this year, up 44%. Until tech and the consumer discretionary sectors turn higher versus energy, it will be tough to call a bottom. The easy signals from tech to follow would be Apple, Amazon and Google turning higher.

Europe’s natural gas supplies have some margin for hope this winter. Imports of liquified natural gas have helped shore up storage. It will still be touch and go, however. German retail sales are down 5% from the start of the Ukraine war. Most years their retail sales grow around 3%. We stand by our call that the continent is close to or may already be in recession.

Higher, not better

Third quarter earnings season starts this week. Usually our favorite six weeks of the quarter, this season projects to be a downer. Depending on the sector, S&P 500 companies usually earn between 30% and 45% of their revenues overseas. For certain tech sectors, it can range up to 70% of their revenues. The higher the dollar versus other currencies, the lower the revenue for our companies. Take John Deere, for example. If say, a mid-size tractor from Deere is paired against a Mahindra from India in a Czech showroom. All else being the same, the Mahindra is 7% to 10% cheaper than a year ago. That currency “discount” may tip the sale to the Indian company.

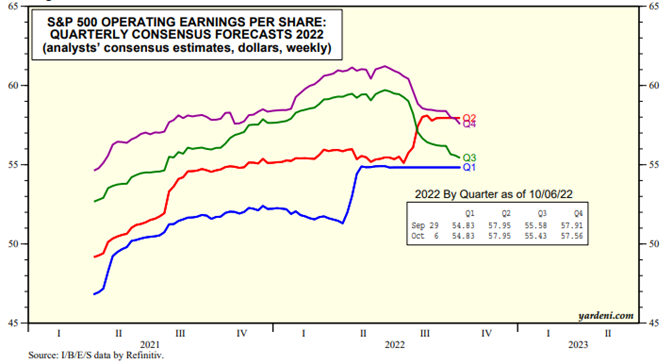

Earnings reports will also be under pressure from inflation, in the form of lower margins and higher wages. Analysts finally got the hint over the last month and started reducing their estimates. Yardeni Research helpfully put this in chart form:

Note the green (third quarter) and purple (fourth quarter) estimate lines have turned lower and are now trending down. They may overshoot too far, and earnings may come in above their estimates. That would be a welcome reprieve for this Bear cycle, but we are not optimistic.

A few names trickle out in the middle of this week. Pepsi, Fastenal and Walgreens lead that group. The “unofficial” start to the third quarter season is on Friday, when the big banks start reporting. J.P. Morgan, Citi, Wells Fargo and PNC all report Friday. Half of the S&P 500 members report by November 4th, so we should have a good read on the third quarter by then. More important are comments from managements about the fourth (holiday sales) and recession worries in the coming year.

Flow and fear

Decent earnings and a “not-so-bad” outlook from corporate executives could presage a “rolling recession” in the coming quarters. Our friends in the mortgage world tell us a recession in their markets is well underway. Could we endure pockets of weakness moving from sector to sector in the coming months? It is entirely possible and certainly has happened in the past.

If a rolling recession developed, it could slide another few percents before slowly forming a bottom over a number of months. Positioning by funds and institutional managers could support such a scenario.

Recently, volatility control and risk parity programs have been big sellers. Pension funds have also cut risk exposure. Any good news would cause them to open their cash drawer and buy stocks. With earnings season right around the corner, corporations are “blacked out” from buying their stock. Average estimates for rest of the year buying of their own stock by issuers are on the order of $5 billion per day for the last two months of the year. Investors remain fearful so sentiment gauges remain near the bottom of the ocean — so bad that it can mean good returns over the coming year. Valuations are almost reasonable: the headline S&P 500 number of 16x Price / Earnings is still above the 15x long-term average. But removing the “Big 8” mega tech names pushes the S&P 500’s remaining 497 members (yes, 505 in the index) to an interesting 14x area.

Wrap-up

Week over week we see small indications of bottoming behavior. Valuations and sentiment are at or near decade or twenty-year bottoms, depending on how you measure. In the fundamental picture, economies continue to struggle with determined central banks. The uncertain path of interest rates and recession makes earnings forecasting very difficult. Our indicators continue to flash neutral to caution; as such we are on the sidelines.

Essential Economics

— Mark Frears

You do what?

The craziest job I ever had was either working quality control in a salmon cannery on Kodiak Island or being a U.S. observer on a Japanese bottom trawler in the Bering Sea. We tend to migrate towards an identity that is tied to our occupation. Not sure what those jobs said about mine, but the markets are continuously trying to find out the identity of the labor market.

JOLTS

The Job Openings and Labor Turnover Survey (JOLTS) gives us a picture of the job openings in the market. The release for August showed one million fewer openings than the previous month, but at over ten million, it still reflects a market that is actively seeking workers. If workers see this, they are more comfortable in seeking higher wages and/or looking for alternative employment. Both cause labor costs to trend higher.

Nonfarm payroll

The headline number was close to consensus, but the market wanted a below-consensus release to show a Fed pivot was closer. Depending on the news source you watch, this number was a start to a weaker labor market, or confirmation that the Fed’s job of fighting inflation was not done.

This was the smallest gain since April 2021, and the 263,000 jobs added were below the 382,000 pace of the previous three months. While it is moving in the right direction, the data-driven Fed will need to see more evidence on multiple fronts before they slow the pace of tightening financial conditions.

An interesting side note is that if the “seasonal adjustment” for September was left the same as last year, the Nonfarm Payroll number would have been -10,000. Who stands to gain from a better number?

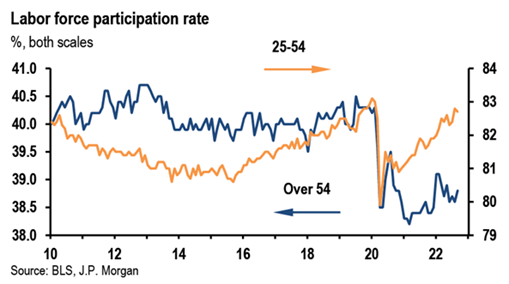

Unemployment rate

Another item that keeps the Fed full steam ahead was the declining unemployment rate going from 3.7% to 3.5%. This number comes from a separate survey, and while the number of employed considered was lower, the participation rate also fell. There continues to be a concern that due to Baby Boomer retirements, lower legal immigration and lingering pandemic concerns, people are not returning to the workforce.

Jobless claims continue to stay at very manageable levels. The 219,000 number from last week is well below a 400,000 number that would indicate stress in the labor market (see below).

Source: Bloomberg

Challenger-Gray layoff announcements are just starting to move a bit higher. They are not showing signs of accelerating job reductions. So far, we are seeing job opening reductions and not job reductions.

Impact

While some see the current labor market’s identity as not-too-hot, not-too-cold, it is still running too hot for the Fed. The futures market shows they will hike 75 basis points (bp) at the November second meeting and another 50bp at the December 14 meeting.

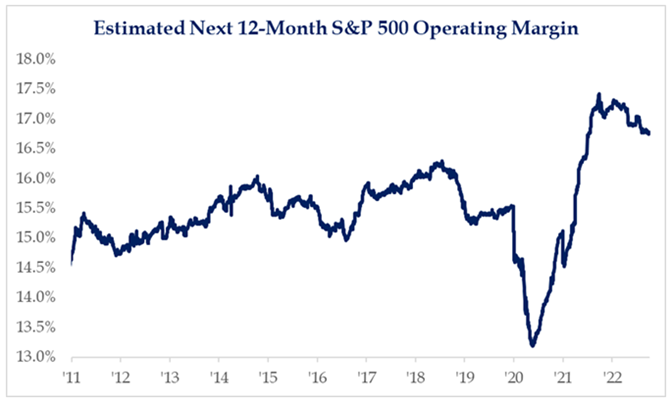

This will raise the cost of short-term borrowing for corporations as variable rates move up with the Fed moves. It will also increase the Prime Rate. Along with continued elevated labor costs, companies’ earnings will start to get squeezed.

Source: Strategas

The biggest unknown on the Fed moves is the lag effect. Current numbers show their moves are not impacting the labor market, but housing is slowing dramatically, and consumer prices are off their peak. At some point they need to pause and wait, but futures markets don’t see that happening until first quarter of 2023.

Wrap-up

The Fed takes their identity from their two-purpose mandate: full employment and price stability. They still have some work to do to establish the second part of that mission, so buckle up for a while longer.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 11-Oct | NFIB Small Business Optimism | Sep | 91.2 | 91.8 |

| 12-Oct | Producer Price Index MoM | Sep | 0.2% | -0.1% |

| 12-Oct | PPI ex Food & Energy MoM | Sep | 0.3% | 0.4% |

| 12-Oct | Producer Price Index YoY | Sep | 8.4% | 8.7% |

| 12-Oct | PPI ex Food & Energy YoY | Sep | 7.3% | 7.3% |

| 12-Oct | FOMC Minutes released from Sep 21 meeting | |||

| 13-Oct | Consumer Price Index MoM | Sep | 0.2% | 0.1% |

| 13-Oct | CPI ex Food & Energy MoM | Sep | 0.4% | 0.6% |

| 13-Oct | Consumer Price Index YoY | Sep | 8.1% | 8.3% |

| 13-Oct | CPI ex Food & Energy YoY | Sep | 6.5% | 6.3% |

| 13-Oct | Real Avg Hourly Earnings YoY | Sep | N/A | -2.8% |

| 13-Oct | Initial Jobless Claims | 8-Oct | 225,000 | 219,000 |

| 13-Oct | Continuing Claims | 1-Oct | 1,365,000 | 1,361,000 |

| 14-Oct | Retail Sales MoM | Sep | 0.2% | 0.3% |

| 14-Oct | Retail Sales ex Autos MoM | Sep | -0.1% | -0.3% |

| 14-Oct | Import Price Index MoM | Sep | -1.1% | -1.0% |

| 14-Oct | Export Price Index MoM | Sep | -1.0% | -1.6% |

| 14-Oct | Business Inventories | Aug | 0.9% | 0.6% |

| 14-Oct | UM (Go MSU) Consumer Sentiment | Oct | 59.0 | 58.6 |

| 14-Oct | UM (Go MSU) Current Conditions | Oct | N/A | 59.7 |

| 14-Oct | UM (Go MSU) Expectations | Oct | N/A | 58.0 |

| 14-Oct | UM (Go MSU) 1-yr inflation | Oct | N/A | 4.7% |

| 14-Oct | UM (Go MSU) 5- to 10-yr inflation | Oct | N/A | 2.7% |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.