Inflation — Week of June 19, 2023

Essential Economics

— Mark Frears

Perception

Last week we looked at personality types, and one thing that was not captured is attitude. Are you a glass-half-full or glass-half-empty person? If a storm is approaching, are you worried about potential damage or happy to have the rain? If your boss gives you a new task, are you complaining because you don’t want to do it, or looking at this as an opportunity? If you have adult children, when they call are you expecting a cheerful hello, or the latest crisis?

Inflation has captured the attention of the consumer, producer, media and the Fed. Are they looking at this with a positive or negative bent?

Current price picture

This past week we had several releases painting the recent state of inflation in the U.S. One thing to keep in mind is that numbers can help tell a story, in the view of the author. I will attempt to maintain full disclosure on the story these metrics are portraying.

First, Consumer Price Index (CPI) came in lower than expected, and lower than the previous reading on a monthly view. In addition, the year-over-year (YoY) overall and core (less food and energy) both came in lower. The CPI YoY trend is below, showing a continued trend of declining price pressure.

Source: Bloomberg

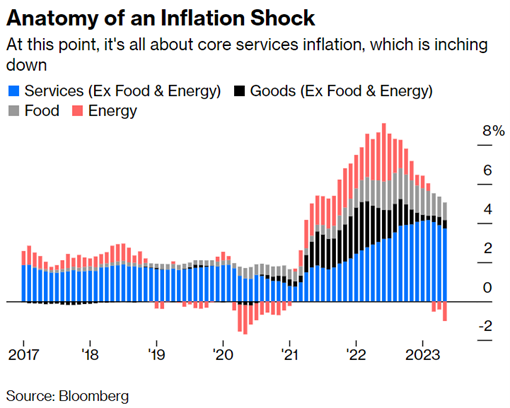

The issue here is not that we are improving, but that we are still above long-term trends. As you can see below, the primary culprit here is core services.

Source: Bloomberg

Second, Producer Price Index (PPI), came in negative on an overall monthly basis and core prices were flat compared to last month. It is interesting to note that while the YoY overall number is well below the 2% Federal Open Market Committee (FOMC) inflation target, this gets virtually no media or analyst coverage. As you can see below, this metric reached as high as 11.7% and has fallen back to 1.1%.

Source: Bloomberg

Third, the University of Michigan Consumer Sentiment one-year inflation metric dropped to 3.1% in June, down from 4.1% the previous month. This is the lowest reading since March 2021. Again, improving, but not yet back to the low levels we have come to expect.

Fourth, the FOMC’s preferred metric is the Personal Consumption Expenditures (PCE) core price index. As stated above, their target for this indicator is 2% and Chair Powell reiterated that in his most recent press conference. As you can see below, while some progress has been made in bringing this down from its peak of 5.4%, the current reading of 4.7% shows there is still work to be done. The most recent forecast from the FOMC calls for this to be at 3.9% by year-end 2023 and 2.6% by year-end 2024.

Source: Bloomberg

Overall, inflation metrics are showing progress, but there are many moving parts in bringing these back down to historical levels.

Positives

Given all the negative talk about inflation, it seemed foreign to look for positive impacts of higher rates and costs, but there are a few.

First, cash now has value. Whether you are living on a fixed income or have some money stashed away for emergencies, or mad money, you can now earn decent interest on these funds! Bank money market funds and money market mutual funds now pay rates close to five percent.

Second, from a commercial view, companies now have pricing power. While their costs may be higher, they have more flexibility to raise prices to get their margins better aligned. Also, higher costs can weed out weaker players in business. That is part of the business cycle; can you survive periods of stress? If not, then capital can be put to work where it has the best opportunity. Harsh, but that is what makes the overall economy better.

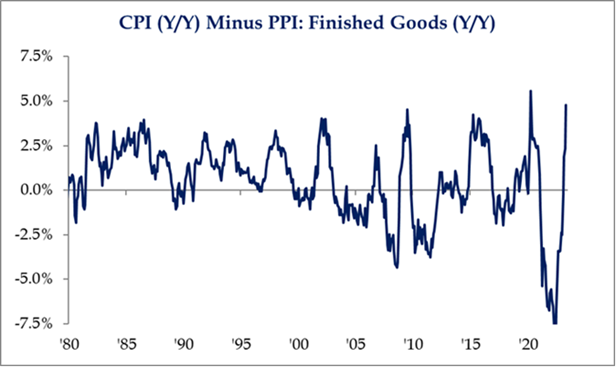

We saw above that PPI was falling faster than CPI. This bodes well for margins and earnings. As you can see below, this spread is approaching the highs.

Source: Strategas Research

A third positive effect of higher prices is that people start to look closer at their spending habits. Most of us don’t operate on a real budget unless we are forced to. This can have an eye-opening impact that causes us to re-evaluate where our hard-earned dollars are going!

Even at the lower income level, worker pay has finally caught up with inflation, as real earnings have now turned positive for the first time in over two years.

Negatives

The higher costs of goods and services has impacted just about everyone. In addition, there has been scarcity in some areas, caused by lack of supply. Let’s look at some specific instances.

First, wages have not kept up with inflation. While real earnings have now turned positive, it has been a long road to get to that point. Excess savings built up during the pandemic are very close to running out.

Since the consumer keeps spending, but income is not keeping up with inflation, credit card usage has risen. The Federal Reserve Bank of New York released a study showing that consumers now owe a record $988 billion on credit cards, up 17% from a year prior. This steadily rising debt took a break during the pandemic but is back on a scary trajectory.

Second, higher prices for living spaces have forced people to postpone home purchases and devote a higher percentage of their income to rent or a mortgage. While rents are now dropping for apartments, the lack of supply in the single-family sector will keep prices high.

Third, due to higher costs, numbers like Retail Sales are overstated compared to actual products sold. This is misleading in that it appears business may be moving right along, but consumers’ purchasing power has been dramatically lowered.

Fourth, consumer confidence continues to be weighed down by the inflationary environment. The University of Michigan Consumer Sentiment metric, while trying to make a recovery, is still at low levels, as you can see below.

Source: Bloomberg

Lower confidence in the economy will cause consumers to put off making major purchases or other expenditures that drive economic growth.

Economic releases

We had a wide range of indicators released last week with CPI and the FOMC announcement topping the list.

This week, we will see housing indicators and the leading index. In addition, Chair Powell will be on Capitol Hill Wednesday and Thursday. See below for details.

Wrap-Up

It can take some serious effort, but it is possible to migrate your attitude to a fuller glass. It is worth it, for you and others around you. Inflation is here for a while longer, and that has both positive and negative effects.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 19-Jun |

NAHB Housing Market Index |

Jun | 51 | 50 |

| 20-Jun | Building Permits | May | 1,425,000 | 1,416,000 |

| 20-Jun | Building Permits MoM | May | 0.6% | -1.5% |

| 20-Jun | Housing Starts | May | 1,400,000 | 1,401,000 |

| 20-Jun | Housing Starts MoM | May | -0.1% | 2.2% |

| 20-Jun | Philadelphia Fed Non-Manuf Activity | Jun | N/A | (16.0) |

| 21-Jun | Fed Chair Powell’s semi-annual testimony to the House Financial Services Committee | |||

| 22-Jun | Chicago Fed National Activity Index | May | (0.10) | 0.07 |

| 22-Jun | Initial Jobless Claims | 17-Jun | 255,000 | 262,000 |

| 22-Jun | Continuing Claims | 10-Jun | 1,785,000 | 1,775,000 |

| 22-Jun | Existing Home Sales | May | 4,250,000 | 4,280,000 |

| 22-Jun | Existing Home Sales MoM | May | -0.7% | -3.4% |

| 22-Jun | Leading Index | May | -0.8% | -0.6% |

| 22-Jun | KC Fed Manufacturing Activity | Jun | (4) | (1) |

| 22-Jun | Fed Chair Powell’s semi-annual testimony to the Senate Banking Committee | |||

| 23-Jun | S&P Global US Manufacturing PMI | Jun | 48.5 | 48.4 |

| 23-Jun | S&P Global US Services PMI | Jun | 54.0 | 54.9 |

| 23-Jun | S&P Global US Composite PMI | Jun | 53.5 | 54.3 |

| 23-Jun | KC Fed Services Activity | Jun | N/A | 3 |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.