The Consumer is Confident — Week of July 3, 2023

Essential Economics

— Mark Frears

Over or Not So Much?

So, if asked to speak in front of a large audience, do you freeze up or rise to the occasion? One of the best things I ever did was to take speech classes in high school and college. I was petrified to speak in front of a small group, much less a large auditorium! For me, it was all about preparation and repetition. My confidence grew and the butterflies usually stay to a minimum.

The economy is driven by consumers, as they fuel two-thirds of Gross Domestic Product (GDP). Are they outspending and consuming, or hunkered down waiting for the Godot recession?

Multiple measures

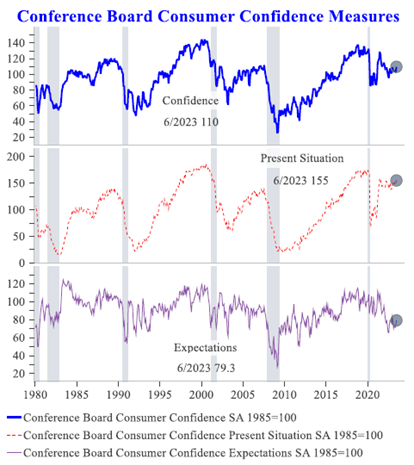

One of the two main confidence measures comes from the Conference Board. As you can see below, all facets of this benchmark rose in June. The increase in the overall confidence was well above expectations, driven by improvements in both the present situation and consumer expectations. This metric is weighted more toward the labor market and reinforces the prevailing knowledge that the labor market is strong.

Source: Strategas Research

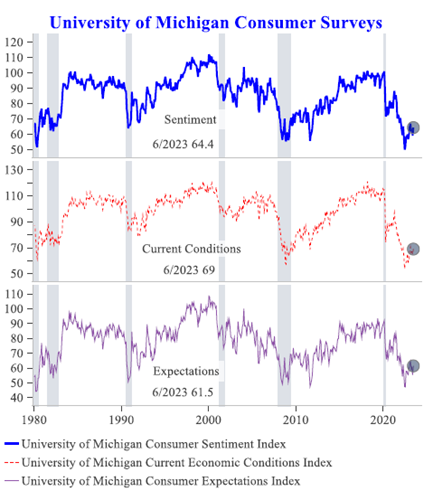

The second measure comes from the University of Michigan (Go State) and is weighted more toward price or inflation view. As you can see below, all three parts of this measurement showed continued improvement in June.

Source: Strategas Research

While not back at levels associated with boom times, we are seeing a positive upward trend.

Jobs

One of the primary reasons consumers feel confident is if they have a job, and even if they lose the current job, they know they can get another.

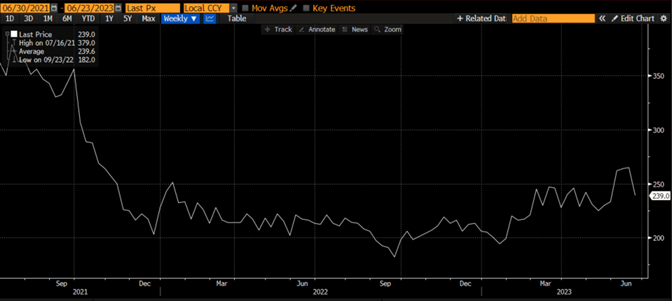

The weekly Jobless Claims for unemployment benefits came back down to recent trend levels (see below), indicating fewer people filing for claims. While claims are not a forward-looking indicator, there should be some signs of stress if a recession is approaching.

Source: Bloomberg

This week we will get a full slate of updates on the labor market. We will primarily focus on the number of jobs added last month, and the unemployment rate. The doomsayers are looking for any sign of weakness in lower number of jobs added, or spike in unemployment. This would build the case for the Fed to not need to hike rates many more times.

In addition, we will get the Job Openings and Labor Turnover Survey (JOLTS). Will this caffeine-infused indicator continue to show elevated opportunities?!

Inflation

Yes, prices are still too high, eating into the purchasing power of consumers. Maybe we are getting used to it and adapting? Substitution of goods and services happens when prices rise. Choices.

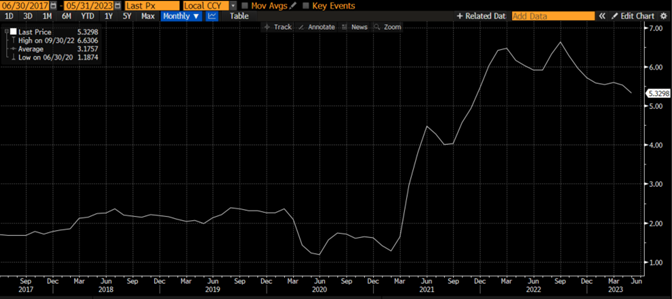

In addition, the trend is your friend. As you can see below, the Personal Consumption Expenditures (PCE) year-over-year measure has dropped significantly from the peak. The current 3.8% measurement is still a ways off from the Fed’s expectation of 3.2% by the fourth quarter of this year, so the Fed will stay vigilant with higher short-term rates.

Source: Bloomberg

Consumer Price Index (CPI) excluding food and energy (see below) is also trending down, yet these stickier categories are not falling as fast.

Source: Bloomberg

Economic activity

Last week we received the latest guesstimate for first quarter GDP, and while this period is in the past, it was revised up significantly from 1.3% to 2.0%. Stronger consumer spending and exports drove most of the upward revision.

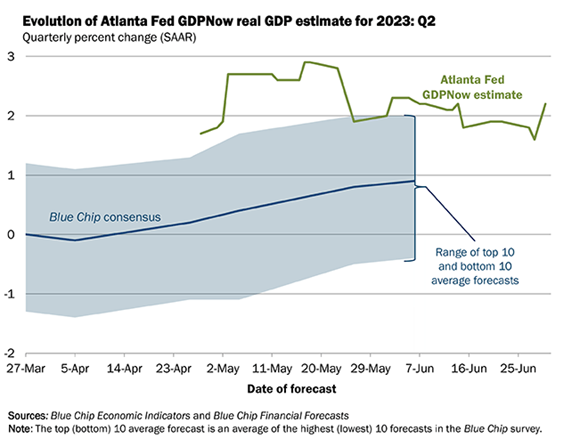

The forward-looking Atlanta Fed GDPNow is forecasting above 2% growth for Q2. As you can see below, this is well above consensus, but recent strong economic data gives credence to the projection.

Source: Blue Chip Economic Indicators and Blue Chip Financial Forecasts

Other anecdotal evidence of continued solid growth can be found in the 2.5 million travelers flowing through TSA gates at airports daily.

The metric below, from the Durable Goods survey, is considered a great indicator of future business spending. The May reading shows that business is putting money to work.

Source: Oxford Economics/Haver Analytics

So, growth is a good thing, right? Well, not in the eyes of the Fed if inflation is still above their 2% target. The uncertainty that is hanging over the markets is how far and for how long will the Fed keep short-term rates high? The conundrum the Fed faces is that their actions are not materially impacting the confidence of the consumer to keep spending. Will higher short-term rates finally cause the consumer to lose confidence and stop spending, so growth can slow, and inflation can subside?

The long end of the curve, with rates lower than the short-term, would indicate we are headed into a recession. That would be caused by the Fed further influencing consumers to pull back. The scary thing is that the Fed may have to take more drastic measures and that would push the economy into a more severe recession. Next Fed meeting is July 26, and there will be plenty of Fed officials speaking before then. Pay attention.

Economic releases

Last week saw strong U.S. growth numbers, with some moderating of inflation. The equity market reacted positively, and bond rates moved higher in anticipation of further Fed rate hikes and inflation staying sticky.

This week, we have the Institute of Supply Management (ISM) most recent update on services and manufacturing. In addition, we will have the latest glimpse into the labor market with ADP, JOLTS and Non-farm payroll. See below for details.

Wrap-Up

Confidence can be a fragile thing, and too much will cause you to lose sight of some important factors. Build your own self-confidence while still staying in tune with the world around you. This will result in a lasting positive effect for you. Can the consumer’s confidence continue at this pace, or will the Fed quash it?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 3-Jul | Construction Spending MoM | May | 0.5% | 1.2% |

| 3-Jul | ISM Manufacturing | Jun | 47.2 | 46.9 |

| 3-Jul | ISM Prices Paid | Jun | 44.0 | 44.2 |

| 3-Jul | ISM Employment | Jun | N/A | 51.4 |

| 3-Jul | ISM New Orders | Jun | N/A | 42.6 |

| 3-Jul | Wards Total U.S. Vehicle Sales | Jun | 15,300,000 | 15,050,000 |

| 5-Jul | Factory Orders | May | 0.8% | 0.4% |

| 5-Jul | FOMC Minutes from June 14 released | |||

| 6-Jul | Challenger Job Cuts YoY | Jun | N/A | 286.7% |

| 6-Jul | ADP Employment Change | Jun | 240,000 | 278,000 |

| 6-Jul | Initial Jobless Claims | 1-Jul | 245,000 | 239,000 |

| 6-Jul | Continuing Claims | 24-Jun | 1,740,000 | 1,742,000 |

| 6-Jul | JOLTS Job Openings | May | 9,968,000 | 10,103,000 |

| 6-Jul | ISM Services Index | Jun | 51.3 | 50.3 |

| 6-Jul | ISM Services Prices Paid | Jun | N/A | 56.2 |

| 6-Jul | ISM Services Employment | Jun | N/A | 49.2 |

| 6-Jul | ISM Services New Orders | Jun | N/A | 52.9 |

| 7-Jul | Change in Nonfarm Payrolls | Jun | 225,000 | 339,000 |

| 7-Jul | Change in Private Payrolls | Jun | 200,000 | 283,000 |

| 7-Jul | Unemployment Rate | Jun | 3.6% | 3.7% |

| 7-Jul | Avg Hourly Earnings MoM | Jun | 0.3% | 0.3% |

| 7-Jul | Avg Hourly Earnings YoY | Jun | 4.2% | 4.3% |

| 7-Jul | Labor Force Participation Rate | Jun | 62.6% | 62.6% |

| 7-Jul | Underemployment Rate | Jun | N/A | 6.7% |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.