Will the Big Dog continue to hunt? — Week of February 12, 2024

Essential Economics

— Mark Frears

Big dog

Have you ever been in a place where you felt you were the one in charge? All decisions came through you, and you were the one all looked up to. Your plan was the map to the future. Even the best laid plans of mice and men often go awry.

While we are watching the Fed so closely, and the elections as well, there is a bigger dog in the fight. You and me! The consumer is two-thirds of Gross Domestic Product (GDP) — that is the strength of the economy. What is the current status of the consumer?

Income

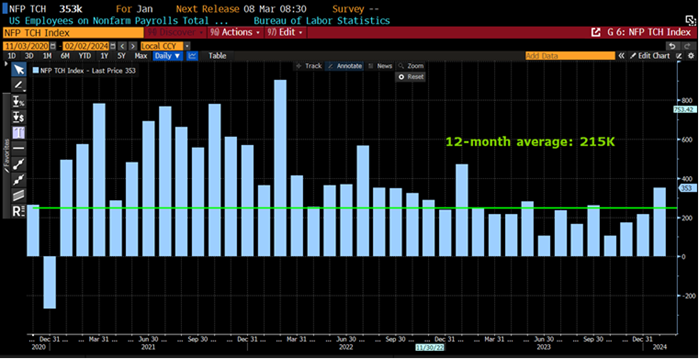

The consumer’s first concern is probably their job. How will they pay the bills and put food on the table and a roof over their heads? Basic needs. The nonfarm payroll release measures how many new people were hired in the previous month. For January, there were 353,000 new jobs, and this was way above the expectation of 180,000. As you can see below, this was above the average of the past 12 months.

Source: Bloomberg

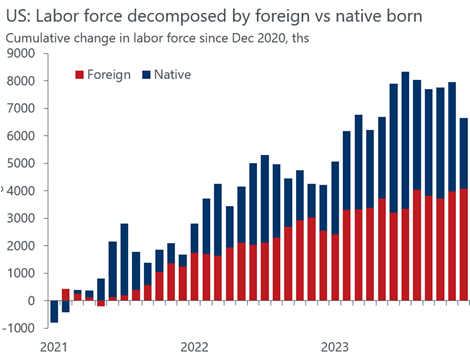

An interesting component of the labor force, as seen below, is the significant impact of immigration.

Source: Oxford Economics / Haver Analytics

As the U.S. population is aging, and early retirements were helped along by the pandemic, there is concern as to the ability of the labor force to keep up with demand. The foreign workers have helped to fill that gap. If productivity continues to improve and immigration continues to add to supply, the longer-term impact of the aging population may have less of a negative effect.

Spending

So, the consumer has a job; that don’t impress me much. How about their wages? Are they keeping up with costs? As you can see in the chart below, the Employment Cost Index (ECI) has come off the peak but is still above the average going back to 2008.

Source: Bloomberg

This is a broad metric measuring both direct costs like salary and also indirect costs like benefits. Based on this metric, things are heading in the right direction for the employer, but not necessarily for the employee.

We will get an updated view on Consumer Price Index (CPI) this week, with expectations for year-over-year at 2.9% and core at 3.7%. While this is showing good progress, wages are barely staying above this level, and costs remain high.

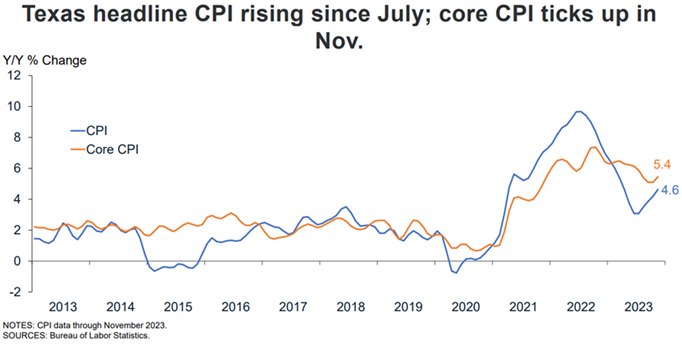

While there is no doubt, Texas is the place to be, from a business perspective, there are a few negatives. The chart below shows prices in Texas are higher and the overall metric is trending higher.

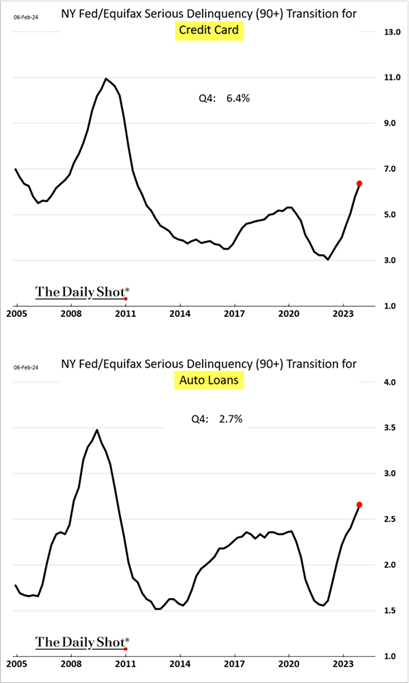

We will also get an update on Retail Sales this week, expecting a minor slowdown in January. The question on many people’s minds is whether the consumer can continue to spend. The December Consumer Credit dropped significantly, but there are two perspectives there. One, the consumer borrowed less, or two, lenders were less inclined to extend credit. As you can see below, delinquencies are picking up, and this could slow consumer spending considerably.

Source: NY Fed and Equifax

There remains an untold story of the consumer. Spending continues unabated in higher-income brackets, while lower- and middle-income families are being squeezed by shelter and food costs. Single-digit percentage increases in prices may not sound bad, but it adds up.

Economic releases

Last week was pretty quiet with ISM Services and Consumer Credit flying below the radar. Annual revisions to CPI were not significant either.

This week’s calendar is jam-packed. We have inflation numbers in CPI and PPI, as well as Retail Sales and Housing Starts. Consumer Sentiment will round out the week. See below for details.

Wrap-Up

As a consumer, do you have a plan for 2024? Are you planning on spending more or less than last year? The uncertainty of an election year, in the U.S. and around the world, along with Middle East conflicts, may cause the consumer to hunker down. So far we are not seeing that, but keep watching!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 12-Feb | NY Fed 1-yr inflation expectations | Jan | N/A | 3.01% |

| 12-Feb | Monthly Budget Statement | Jan | -$21.0B | -$129.4B |

| 13-Feb | NFIB Small Business Optimism | Jan | 92.1 | 91.9 |

| 13-Feb | Consumer Price Index MoM | Jan | 0.2% | 0.3% |

| 13-Feb | CPI ex Food & Energy MoM | Jan | 0.3% | 0.3% |

| 13-Feb | Consumer Price Index YoY | Jan | 2.9% | 3.4% |

| 13-Feb | CPI ex Food & Energy YoY | Jan | 3.7% | 3.9% |

| 13-Feb | Real Avg Hourly Earnings YoY | Jan | N/A | 0.5% |

| 13-Feb | Real Avg Weekly Earnings YoY | Jan | N/A | 0.8% |

| 15-Feb | Empire Manufacturing | Feb | (11.8) | (43.7) |

| 15-Feb | Retail Sales MoM | Jan | -0.1% | 0.6% |

| 15-Feb | Retail Sales ex Autos MoM | Jan | 0.2% | 0.4% |

| 15-Feb | Philadelphia Fed Business Outlook | Feb | (8.6) | (10.6) |

| 15-Feb | Import Price Index MoM | Jan | -0.1% | 0.0% |

| 15-Feb | Export Price Index MoM | Jan | -0.1% | -0.9% |

| 15-Feb | Initial Jobless Claims | 10-Feb | 220,000 | 218,000 |

| 15-Feb | Continuing Claims | 3-Feb | 1,880,000 | 1,871,000 |

| 15-Feb | Industrial Production MoM | Jan | 0.3% | 0.1% |

| 15-Feb | Capacity Utilization | Jan | 78.8% | 78.6% |

| 15-Feb | Business Inventories | Dec | 0.4% | -0.1% |

| 15-Feb | NAHB Housing Market Index | Feb | 46 | 44 |

| 16-Feb | Building Permits | Jan | 1,515,000 | 1,495,000 |

| 16-Feb | Building Permits MoM | Jan | 1.5% | 1.9% |

| 16-Feb | Housing Starts | Jan | 1,460,000 | 1,460,000 |

| 16-Feb | Housing Starts MoM | Jan | 0.0% | -4.3% |

| 16-Feb | NY Fed Services Business Activity | Feb | N/A | (9.7) |

| 16-Feb | Producer Price Index MoM | Jan | 0.1% | -0.1% |

| 16-Feb | PPI ex Food & Energy MoM | Jan | 0.1% | 0.0% |

| 16-Feb | Producer Price Index YoY | Jan | 0.7% | 1.0% |

| 16-Feb | PPI ex Food & Energy YoY | Jan | 1.7% | 1.8% |

| 16-Feb | UM Consumer Sentiment | Feb P | 80.0 | 79.0 |

| 16-Feb | UM Current Conditions | Feb P | N/A | 81.9 |

| 16-Feb | UM Expectations | Feb P | N/A | 77.1 |

| 16-Feb | UM 1-yr inflation | Feb P | 2.9% | 2.9% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.