Anticipation — Week of April 3, 2023

Essential Economics

— Mark Frears

Ketchup

Remember that ketchup commercial where the child enjoys the anticipation as the ketchup slowly, enticingly rolls out of the bottle? Do you have something that you are really looking forward to? A trip, event or maybe the weekend. It can help you get through the day-to-day grind if you have something to anticipate. We have an expectation that this thing/event to come will make it all good. Sometimes that works, but not always. Although having something to look forward to can be the real panacea. What are consumers and markets looking forward to?

Overall

The Conference Board’s Consumer Confidence release was last week, providing the latest insight into the consumer’s expectations. This measurement is tilted towards a labor market focus, so the current low unemployment and supposedly plentiful jobs available are influencing these opinions more than the current bank failures. This survey was done on March 20, after the news of Silicon Valley and Signature Bank.

The average, going back to 2000, has been 93.91, and the metric is currently at 104.2, as you can see below.

Sources: Bloomberg

After the pandemic decline, we have settled into a range due to the confidence in the employment situation.

If we look at the breakdown of this release, as seen below, the Present Situation dropped a bit due to a slightly less favorable job market. Based on conversations I have had with people seeking employment, many of the jobs posted are not “real,” or an employer is really warehousing resumes for future use. Maybe the job market is softening more than previously thought.

Sources: The Conference Board; NBER

The Expectations Index is a short-term view and has been below 80 for 12 of the last 13 releases. This often signals a recession within the next year.

Inflation

Another much-watched consumer confidence metric is the University of Michigan sentiment release. It has two inflation components, a one-year view and a longer five to 10-year view. The one-year view below shows expectations are headed back toward long-term trends of 3.1%. Consumers feel that inflation is decreasing.

Sources: Bloomberg

The longer, five- to 10-year view, below, is also back to longer-term averages, up from historical lows.

Sources: Bloomberg

The Federal Open Market Committee (FOMC) uses the Personal Consumption Expenditures (PCE) metric in their quarterly Summary of Expectations (SEP) to forecast their inflation expectations. They increased their 2023 estimate from 3.1% to 3.3% but are sticking to their longer-term target of 2.0%. The February release of 5.0% is down from the previous month’s 5.4%, but still a ways from 2.0% or even 3.3%!

Sources: Bloomberg

So, inflation is down from the peak, but people are still not sure how fast we will get back to historical lows. The sticky labor-related sector is staying stubbornly high.

Equities

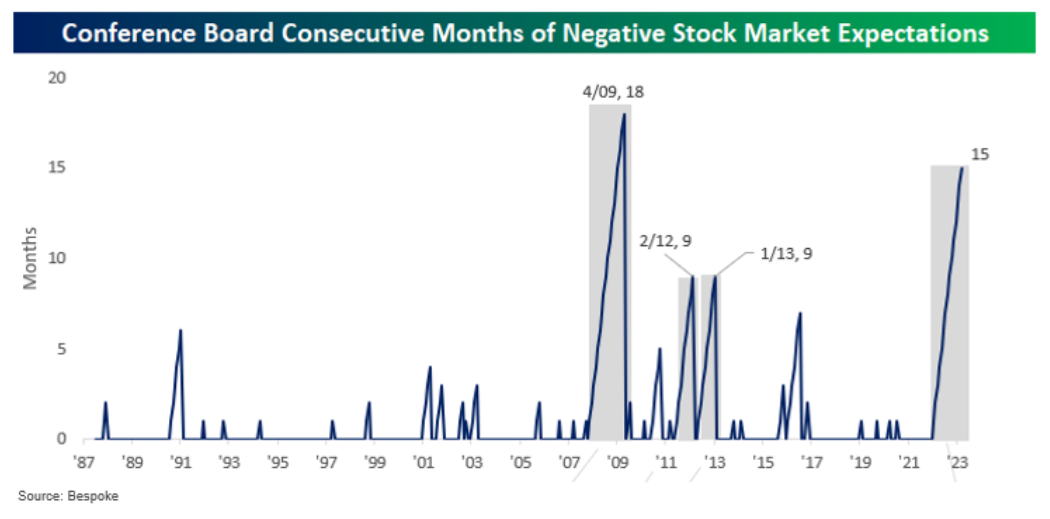

Another metric that comes from the Conference Board is the Stock Market Expectations. As you can see below, for the 15th consecutive month, the percentage of consumers expecting lower stock prices in the next year exceeded the percentage of those who expect stock prices to move higher. The only longer stretch was during the 2008 recession. As we talked about extremes last week, when we hit this very pessimistic level, the bounce back could be significant. Stay tuned.

Sources: Bespoke

Fed

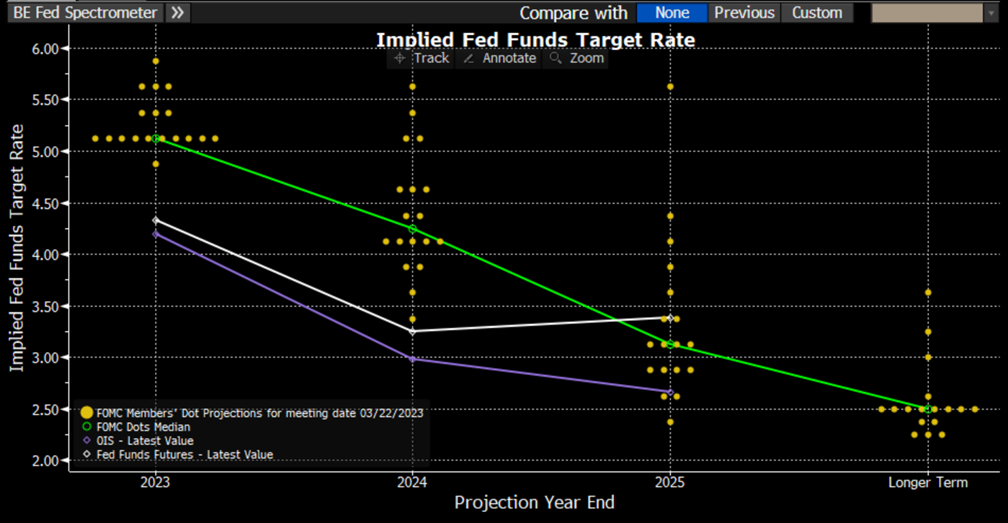

Much is riding on the expectations of what the Fed will do. We know they have to fight inflation, and they will raise short-term rates until they feel like they have reached their goal. Current expectations, from the futures markets as well as the Dot Plots that the FOMC releases, are for one more hike in May. That is where the consensus changes. If you listen to Fed Talking Heads, they say there is no hurry to lower rates as inflation is still elevated, but their Dot Plot of what they projected at the March meeting shows a rate lower by 0.75% to 1.00% by year end 2023. Hmm. See the green line below. Fed funds futures are the white line and they expect the rate to be close to a full percentage point below that by year end!

Sources: Bloomberg

What’s the big deal here? If rates are lower, that would imply inflation has been conquered and the economy should be in better shape. Lower rates also make equities more attractive. The expression is “don’t fight the Fed,” so we will see who is right!

Credit

One of the fallouts of the failed banks, while these were isolated cases of mismanagement, is how the rest of the banking sector will react. Expectations are for banks to become a bit more cautious in their lending and to focus on their balance sheets to ensure they are in the best shape they can be. This is viewed as a tightening credit environment and could contribute to an economic slowdown. Goldman Sachs Group Inc. concluded the recent turmoil may lead to a 2% to 5% reduction in lending in the U.S.

This lower expectation for economic growth could flow from banks to businesses to consumers.

Big picture

The all-powerful consumer does not seem to be changing their habits, even with the stresses in the markets. Personal income and spending were both up last month, and given the strong job market, they are feeling pretty good.

Economic releases

Next week we have the all-important job market numbers. The primary focus will be on the Nonfarm Payroll and Unemployment rate on Friday. Additional attention will be given to the Job Openings and Labor Turnover Survey (JOLTS), the ADP Payroll release and the Labor Force Participation Rate. Please see below for more information.

Wrap-up

Expectations can turn into actual events, but not all expectations will be fulfilled. The markets are in a bit of a holding pattern, waiting for any more fallout in the financial sector, the Fed and the upcoming earnings season. What are you waiting for?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 3-Apr | Construction Spending MoM | Feb | 0.0% | -0.1% |

| 3-Apr | ISM Manufacturing | Mar | 47.5 | 47.7 |

| 3-Apr | ISM Prices Paid | Mar | 51.2 | 51.3 |

| 3-Apr | ISM Employment | Mar | N/A | 49.1 |

| 3-Apr | ISM New Orders | Mar | 47.5 | 47.0 |

| 3-Apr | Ward's Total US Vehicle Sales | Mar | 14,600,000 | 14,890,000 |

| 4-Apr | Factory Orders | Feb | -0.5% | -1.6% |

| 4-Apr | JOLTS Job Openings | Feb | 10,500,000 | 10,824,000 |

| 5-Apr | ADP Employment Change | Mar | 210,000 | 242,000 |

| 5-Apr | ISM Services Index | Mar | 54.3 | 55.1 |

| 5-Apr | ISM Services Prices Paid | Mar | N/A | 65.6 |

| 5-Apr | ISM Services Employment | Mar | N/A | 54.0 |

| 5-Apr | ISM Services New Orders | Mar | N/A | 62.6 |

| 6-Apr | Challenger Job Cuts YoY | Mar | N/A | 410.1% |

| 6-Apr | Initial Jobless Claims | 1-Apr | 200,000 | 198,000 |

| 6-Apr | Continuing Claims | 25-Mar | 1,698,000 | 1,689,000 |

| 7-Apr | Change in Nonfarm Payrolls | Mar | 200,000 | 311,000 |

| 7-Apr | Change in Private Payrolls | Mar | 240,000 | 265,000 |

| 7-Apr | Unemployment Rate | Mar | 3.6% | 3.6% |

| 7-Apr | Avg Hourly Earnings YoY | Mar | 4.3% | 4.6% |

| 7-Apr | Labor Force Participation Rate | Mar | 62.5% | 62.5% |

| 7-Apr | Underemployment Rate | Mar | N/A | 6.8% |

| 7-Apr | Consumer Credit | Feb | $19.000B | $14.799B |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.