Are you supporting small businesses? — Week of April 22, 2024

Essential Economics

— Mark Frears

Lansing State Journal

In junior high (what we called it before middle school), I “threw papers” to make spending money. It was an afternoon delivery, and I loaded up the bags, slung them across my shoulders, and walked the neighborhood. This helped me learn about business, as I had to pay for the papers up front, and then collect payment from my customers. Fewer collections, and my margin shrank!

Small businesses employ more than 90% of the workers in the U.S. and contribute more than 40% to Gross Domestic Product (GDP). Let’s take a deeper look at this sector.

Potential longer-term impact

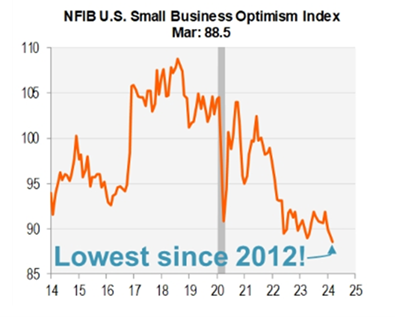

The National Federation of Independent Business (NFIB) is an association of small businesses, and their monthly release is watched carefully for clues. In the March report, as you can see below, their sentiment index was very dismal.

Source: Piper Sandler

This is down to recessionary levels, and the primary reasons are inflation and employment. The chart below gives an update on their labor market. Currently, fewer firms are struggling to fill open job positions. Also, the quits rate has trended to below average levels as fewer people feel comfortable about easily getting another job.

Source: Oxford Economics / Haver Analytics

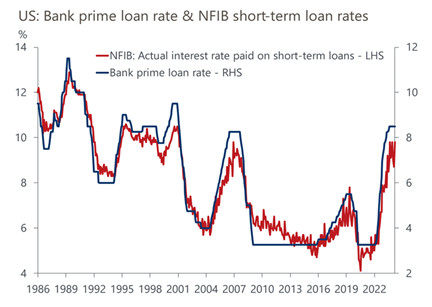

The potential slowdown in small business hiring will ripple through the economy, but so far, large firms are offsetting this. On the inflation front, small businesses are more dependent on floating rate loans, and the longer the Fed leaves short-term rates unchanged, the longer Prime rate stays higher. As the chart below shows:

Source: Oxford Economics / Haver Analytics

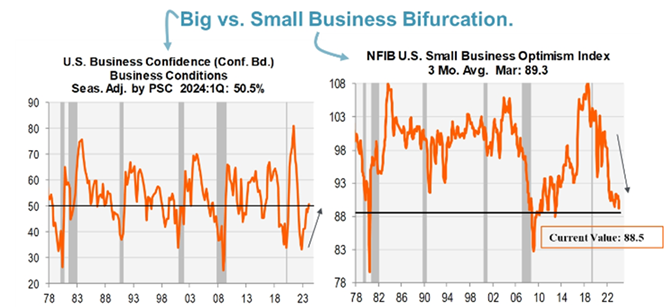

You can see the contrast between large and small businesses below. That call for recession may not be fully off the table yet.

Source: Piper Sandler

Economic releases

Last week was Retail Sales and Housing. The economy continues to do well and move the markets into a Fed-on-hold mentality. In addition, Middle East tension is escalating and uncertain. Markets don’t like uncertainty.

This week’s calendar has Personal Income and Spending, Durable Goods and first guess at Q1 GDP, as well as the Fed’s favorite inflation metric, PCE. In addition, the Fed “talking heads” will be in blackout ahead of the April 30 to May 1 meeting. See below for details.

Wrap-Up

Small businesses are so important to the health of the economy. Where can you contribute? The profits from my paper route allowed me to buy an aluminum canoe, which is still at our cottage today.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 22-Apr | Chicago Fed Natl Activity Index | Mar | 0.09 | 0.05 |

| 23-Apr | Philadelphia Fed Non-Manuf Activity | Apr | N/A | (18.3) |

| 23-Apr | S&P Global US Manufacturing PMI | Apr P | 52.0 | 51.9 |

| 23-Apr | S&P Global US Services PMI | Apr P | 52.0 | 51.7 |

| 23-Apr | S&P Global US Composite PMI | Apr P | 52.0 | 52.1 |

| 23-Apr | New Home Sales | Mar | 670,000 | 662,000 |

| 23-Apr | New Home Sales MoM | Mar | 1.2% | -0.3% |

| 23-Apr | Richmond Fed Manufacturing Index | Apr | (8) | (11) |

| 23-Apr | Richmond Fed Business Conditions | Apr | N/A | (8) |

| 24-Apr | Durable Goods Orders | Mar P | 2.5% | 1.3% |

| 24-Apr | Durable Goods ex Transportation | Mar P | 0.2% | 0.3% |

| 24-Apr | Cap Goods Orders Nondef ex Aircraft | Mar P | 0.2% | 0.7% |

| 25-Apr | GDP Annualized QoQ | Q1 | 2.5% | 3.4% |

| 25-Apr | Personal Consumption | Q1 | 2.8% | 3.3% |

| 25-Apr | GDP Price Index | Q1 | 3.0% | 1.6% |

| 25-Apr | Retail Inventories MoM | Mar | N/A | 0.5% |

| 25-Apr | Wholesale Inventories MoM | Mar P | 0.3% | 0.5% |

| 25-Apr | Initial Jobless Claims | 20-Apr | 215,000 | 212,000 |

| 25-Apr | Continuing Claims | 13-Apr | 1,810,000 | 1,812,000 |

| 25-Apr | Pending Home Sales MoM | Mar | -0.3% | 1.6% |

| 25-Apr | KC Fed Manufacturing Activity | Apr | N/A | (7) |

| 26-Apr | Personal Income | Mar | 0.5% | 0.3% |

| 26-Apr | Personal Spending | Mar | 0.6% | 0.8% |

| 26-Apr | Real Personal Spending | Mar | 0.3% | 0.4% |

| 26-Apr | PCE Deflator YoY | Mar | 2.6% | 2.5% |

| 26-Apr | PCE Core Deflator YoY | Mar | 2.7% | 2.8% |

| 26-Apr | UM Consumer Sentiment | Apr F | 77.9 | 77.9 |

| 26-Apr | UM Current Conditions | Apr F | N/A | 79.3 |

| 26-Apr | UM Expectations | Apr F | N/A | 77.0 |

| 26-Apr | UM 1-yr inflation | Apr F | N/A | 3.1% |

| 26-Apr | UM 5-10-yr inflation | Apr F | N/A | 3.0% |

| 26-Apr | KC Fed Services Activity | Apr | N/A | 7 |

Mark Frears is a Senior Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI