I owe, I owe — Week of April 15, 2024

Essential Economics

— Mark Frears

Need improvement?

Do you know what your credit score is? You should, because it not only affects your ability to borrow, but also affects what you pay on car insurance. The report from each of the three credit bureaus should be mandatory reading, at least once a year. You will not only be able to see errors to correct, but also make sure no one else is borrowing in your name! If you pay cash for everything, you need some debt to demonstrate you can pay it back. That’s the only way to establish your credit history.

There are many forms of credit in the financial markets. We will focus on consumer and government debt this week.

Consumer

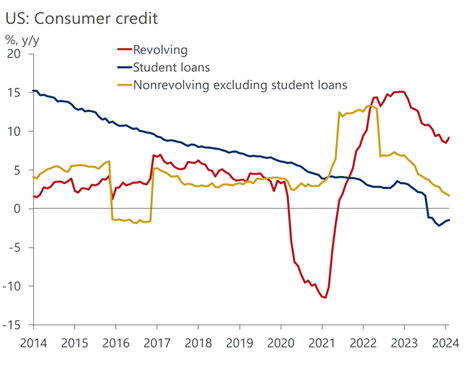

The February release of consumer debt trends (see below) is divided into revolving and non-revolving loans. Revolving is more open-ended, like credit cards, where non-revolving is closed-end, like mortgages, car loans and student loans.

Some news stories would tout the pace of growth, saying it is stabilizing/decreasing over the past 13 months, but it is still at very high levels. If you dig deeper, revolving credit (mostly credit cards) increased for the 33rd of the past 34 months.

Source: Oxford Economics / Haver Analytics

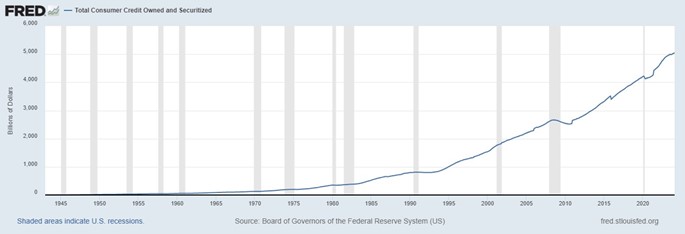

As you can see below, the amount of debt outstanding is still on an upward trajectory.

Source: Federal Reserve of St. Louis (FRED)

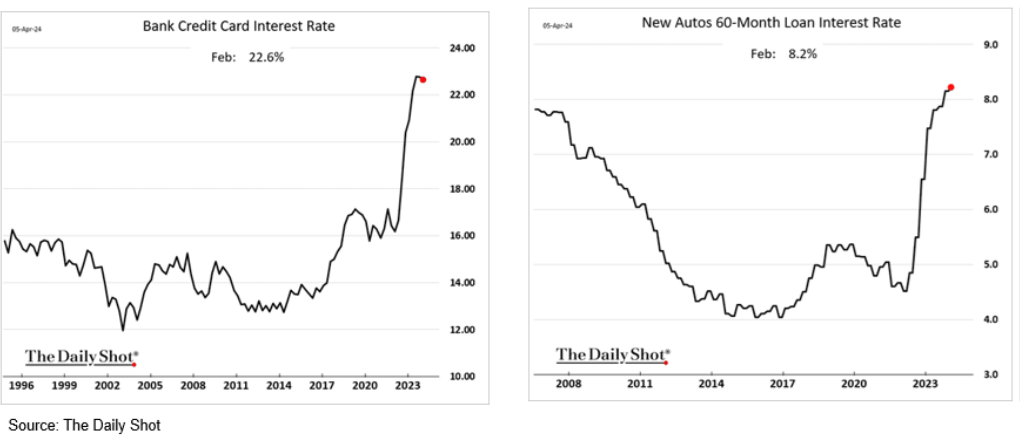

While the incremental pace of debt may be slowing, there is still a significant burden on the people holding that note. Fixed rate debt, like mortgages, has been locked in at lower rates, for a significant portion of families. The pain point is for new loans, or credit cards, that have increasing costs. The chart below shows how high credit card and car loans have gotten.

The first chart above breaks out student loans. As you can see, while they have been declining, there is a new upswing. It must be taken into consideration that the current administration has attempted to wipe out these loans for some people. As far as the overall impact, someone is owed the debt, and by cancelling it, it does not go away. Someone has to pay the debt. As this is federal debt, this would add to the deficit, and taxpayers would take this on.

Government

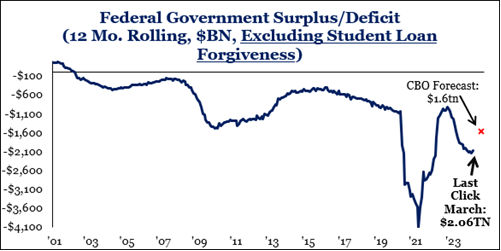

While the Fed has been focused on fulfilling one of its mandates in fighting inflation, the U.S. government has not been helpful. The FOMC is attempting to slow the economy, by raising short-term rates, causing demand to slow and prices to continue lower. At the same time they are doing this, the fiscal spending (from the administration and congress) has not slowed down. While this may be helping the economy grow, it is not helping bring prices down. As you can see below, the deficit continues to grow into negative territory.

Source: Strategas

Two things to take away from the above: First, this is worse than the CBO forecast, making their projections wrong, and subject to revision. Second, this excludes potential student loan “forgiveness,” and if this were added, it would make the deficit even larger.

You and I would not be able to run a deficit in our budget, as our creditors would come calling. The U.S. government has been able to run this position by issuing more debt. As you see below, we began our way down this slippery slope in the Great Financial Recession, where powers that be felt it would be better to bail out numerous institutions versus allowing the market to work. Secondary and tertiary fallout was cited.

Source: Federal Reserve of St. Louis (FRED)

You and I can borrow, based on our credit score. The U.S. has a credit score, per se, from the major rating agencies. Two of them have actually started to make some noise about the ability of the U.S. to repay its debt, but no one is paying much attention yet.

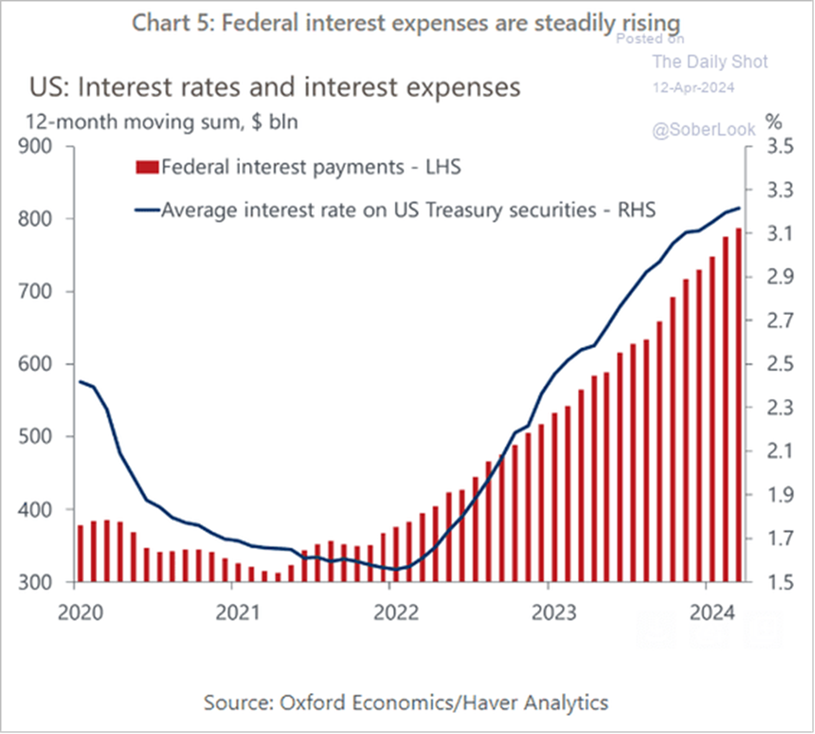

An offshoot of the Fed raising interest rates is that anyone who has outstanding variable-priced debt, or new debt issued, will pay a higher cost. As the chart below shows, the cost of servicing the U.S. debt continues to climb.

This will continue to cause the deficit to increase until rates come down or less debt is issued. No one seems to be overly concerned about this, as long as there are buyers/lenders for U.S. debt. Last week the UST auctions showed a few cracks, with less demand showing up in higher interest rates than what was expected to sell the debt.

Economic releases

Last week was CPI and PPI, showing at best a slower downward pace of price reductions. Consumer Sentiment weighed at a lower level, primarily due to fears of higher prices continuing for longer.

This week’s calendar has retail sales, as well as multiple housing releases. In addition, the Fed will release their Beige Book economic summary to be used at the April 30 to May 1 meeting. See below for details.

Wrap-Up

Paying bills on time is the best way to improve your score. Borrowing without the means to repay the debt is not sustainable. Stay tuned.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 15-Apr | Empire Manufacturing | Apr | (5.0) | (20.9) |

| 15-Apr | Retail Sales MoM | Mar | 0.4% | 0.3% |

| 15-Apr | Retail Sales ex Autos MoM | Mar | 0.5% | 0.2% |

| 15-Apr | Business Inventories | Feb | 0.4% | 0.0% |

| 15-Apr | NAHB Housing Market Index | Apr | 51 | 51 |

| 16-Apr | Building Permits | Mar | 1,510,000 | 1,518,000 |

| 16-Apr | Building Permits MoM | Mar | -0.9% | 1.9% |

| 16-Apr | Housing Starts | Mar | 1,482,000 | 1,521,000 |

| 16-Apr | Housing Starts MoM | Mar | -2.6% | 10.7% |

| 16-Apr | NY Fed Services Business Activity | Apr | N/A | 0.6 |

| 16-Apr | Industrial Production MoM | Mar | 0.4% | 0.1% |

| 16-Apr | Capacity Utilization | Mar | 78.5% | 78.3% |

| 17-Apr | Fed releases Beige Book for Apr 30-May 1 FOMC Meeting - 2p | |||

| 18-Apr | Philadelphia Fed Business Outlook | Apr | 2.3 | 3.2 |

| 18-Apr | Initial Jobless Claims | 13-Apr | 215,000 | 211,000 |

| 18-Apr | Continuing Claims | 6-Apr | 1,818,000 | 1,817,000 |

| 18-Apr | Leading Index | Mar | -0.1% | 0.1% |

| 18-Apr | Existing Home Sales | Mar | 420,000 | 4,380,000 |

| 18-Apr | Existing Home Sales MoM | Mar | -4.1% | 9.5% |

Mark Frears is a Senior Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI