Back to Reality — Week of March 14, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -2.84 | -11.53 | 8.22 | 16.58 | 14.15 | 4,204.31 |

| Dow Jones Industrial Average | -1.91 | -8.93 | 3.34 | 11.22 | 11.97 | 32,944.19 |

| Russell 2000 Small Cap | -1.03 | -11.66 | -14.50 | 9.83 | 9.07 | 1,938.21 |

| NASDAQ Composite | -3.51 | -17.79 | -3.48 | 20.23 | 18.13 | 12,843.81 |

| MSCI Europe, Australasia & Far East | 0.57 | -12.10 | -5.28 | 6.32 | 6.26 | 2,043.94 |

| MSCI Emerging Markets | -5.08 | -11.70 | -18.08 | 3.72 | 5.97 | 1,085.66 |

| Barclays U.S. Aggregate Bond Index | -1.76 | -4.79 | -3.52 | 2.52 | 2.63 | 2,242.33 |

| Merrill Lynch Intermediate Municipal | -1.06 | -4.28 | -3.15 | 2.12 | 2.74 | 306.41 |

As of market close March 11, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

- Traders turn back to Fed and inflation

- Stock market remains in correction mode, consolidating and waiting on Fed

- Inflation turning persistent, thanks to higher energy prices and labor shortage

Back

Wednesday’s impending Fed meeting pulled traders back to reality last week. Yes, higher rates are coming. Yes, inflation remains a problem and, yes, thanks to the war inflation and higher energy prices will be sticking around longer than anyone thought. The U.S. Treasury 10-year maturity is an oft-used reference for the “bond market.” There are many more maturities from one week to thirty years (100 years in some countries) that make up the Treasury yield curve, but 10s get the lion’s share of attention. This is due to many other countries issuing 10-year government bonds and its use for determining some home mortgage rates.

Interest rates fell in late February when investors sought the safety of U.S. Treasuries. Today that trade is over as 10s are back up to 2.12%. Traders are preparing for Wednesday’s Fed press release and Chairman Powell’s press conference. The correction continues for stocks, with the largest declines over the last three weeks in Large Cap stocks. Small and Mid-Cap stocks have also had their ups and downs but appear to be holding their recent lows.

Foreign stocks, as one would expect, have not been so fortunate. Emerging markets were weighed down by Chinese real estate problems earlier in the year. After the 5,000-word manifesto of “no limits” friendship with Russia and today new lockdowns from omicron, China’s stock market drop this morning of 3% added to EM woes. Europe is bearing the brunt of higher fuel prices and less trade with both China and Russia. Recent data out of the Eurozone suggests first-quarter growth will be very low and a recession later this year is not out of the question.

What Else

Mark tackles inflation in greater detail below. We thought at the beginning of the year that our economy would slow by half this year to a strong 3.5% growth rate. The lack of supply in oil and gas markets made those markets more sensitive to Russia’s invasion. That inflationary impulse flowed quickly to the gas pump, crimping consumer outlays. Supply chains were healing, but now China and other Far East countries are feeling the “omicron ouch” of higher cases. We are expecting news of more port shutdowns.

The other “tool” the Fed will use to withdraw liquidity is its balance sheet. Recall over the last two years the Fed bought Treasury and mortgage securities from Wall Street and the Treasury. This action injected reserves into the international banking system. It was not “printing money” here at home, except when Congress directed the Treasury to send tax refunds to taxpayers (CARES Act stimulus). We expect Wednesday’s press release to lay out a plan of how the Fed will gradually reduce the size of its balance sheet. Lowering the balance sheet hits Wall Street, as there is less liquidity in the banking system. Raising interest rates hits Main Street by raising expenses. Savers, however, can benefit from slightly higher rates.

We had hoped the “24ths” of February and March would mark the correction lows. Unfortunately, that has not been the case. Our checklist of market lows is not complete. Volatility is above normal, but not high enough to show traders are throwing in the towel. Investor sentiment is certainly in the Marianas Trench and not coming up for air. The percent of stocks at three-month lows and below their 50-day moving average remain above bottoming levels. On the plus side, volatility, interest rates, inflation and oil all are showing lower values six months and a year from now.

Our charts sense the major market moves have taken place, but the bottom is not yet in.

Essential Economics

— Mark Frears

How much would you pay!?!

You know when you are looking for that one Christmas present for your child, and no one has it? How much would you pay? Anything! So far in the U.S. we are noticing higher gas prices and the re-emergence of scarcity of items in the grocery store, reminiscent of Covid times. Unlike the travesty facing the Ukrainian people, we are merely being inconvenienced. This has the potential to get worse over a longer period, and that is what is worrying most people.

Food and Energy

Inflation, by definition, is a general increase in prices and fall in the purchasing value of money. Go back to your high school economics: supply, and demand. If there are too few goods/services (supply), we will have to pay more to get them (demand). We have seen gas prices at the pump go up by 57 cents a gallon in the last week, and that hits our budgets immediately. Due to the scarcity in the stores, we are paying more for the goods we can find. This is impacting consumers, and we know they are two-thirds of the economic activity in the U.S.

Many people have seen wages increase in this tighter labor market, both at higher and lower wage levels. This is a good thing, but the high cost of getting things you need for daily living has caused real pay declines of 2.6%.

While the oil exported from Russia is only about 8% of U.S. consumption, there is no quick way to replace 672,000 barrels a day! Less supply, higher cost. Oil impacts us in more ways than at the pump. It is vital to transporting goods around the country and the world. The European Union is much more impacted by loss of Russian and Ukrainian exports, but the global impact cannot be denied.

Uncle Sam

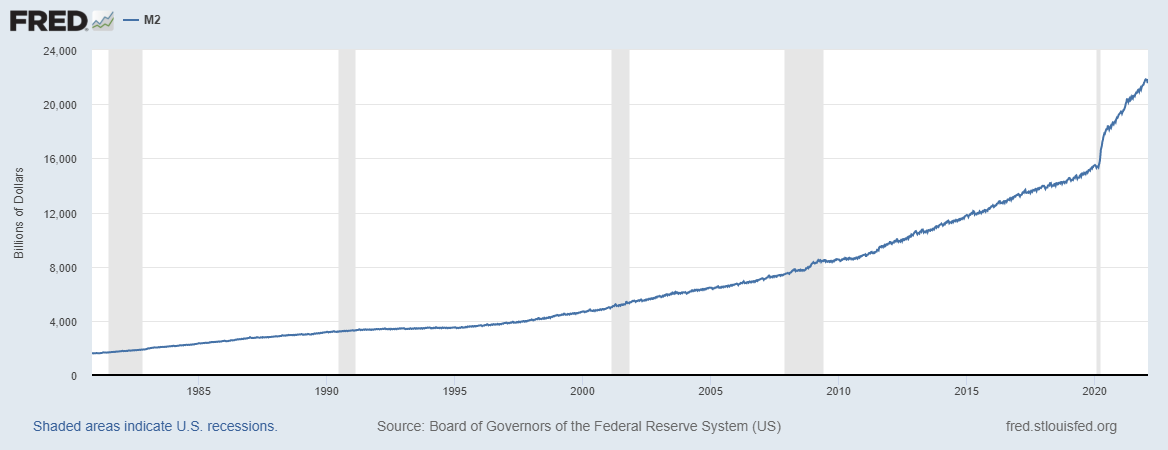

Think back on how much money paid through Covid relief directly to citizens and added to the monetary system to ensure enough liquidity to make it through stressful times. This has been unprecedented. M2 is defined as cash, checking deposits and easily convertible near money.

One of the longer-term concerns of dumping this much cash into the market was how it would impact inflation. If money supply grows faster than the economy can produce goods and services, you will have too much cash chasing too few goods and inflation will occur. This impact is adding to the restricted supply of gas and other necessities.

By legislation, the Federal Open Market Committee (FOMC) has two goals, full employment, and price stability. Their focus now is on price stability, or rather, fighting inflation, and they are expected to raise rates by 0.25% at their meeting next week. This, along with their verbiage and published Summary of Economic Projections will set the tone as to how serious they are about continuing to raise rates and combat inflation. At the same time, they must keep in mind the global risk premium impact on the economy. Walking the proverbial tight rope.

Expectations

Prior to the Russia-Ukraine war the consumer was already facing rising prices. Home prices are high and now mortgage rates are rising. Cars were already expensive due to supply constraints. Savings from Covid government payments are depleting.

The University of Michigan Consumer Sentiment index has fallen to the lowest level since September 2011. People are very pessimistic about the current picture, and this can impact their spending behavior. This index is inflation focused, and this is the number one concern for consumers. While they can readily find jobs, they are concerned their wages will not cover their costs.

Another part of this survey covers specific inflation expectations over the next year and from a longer-term perspective. The near-term reading has climbed to the highest level since 1981, but the five-to-ten-year view still shows moderate expectations.

Expectations were for this inflationary time to be shorter, and that has been extended. There is still optimism that this will not be a long-term phenomenon.

Wrap-Up

The FOMC is center stage this week, managing expectations for their fight against inflation. I wonder how much gas they would give me for a Tickle Me Elmo?!

The bottom evidence is not complete for stocks. The war and once again, omicron will keep us on the edge of our seats. Inflation still looks to moderate later in the year and any slowdowns will just add to an eventual rebound in demand. Patience remains key.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 15-Mar | Producer Price Index MoM | Feb | 0.9% | 1.0% |

| 15-Mar | PPI ex Food & Energy MoM | Feb | 0.6% | 0.8% |

| 15-Mar | PPI YoY | Feb | 10.0% | 9.7% |

| 15-Mar | PPI ex Food & Energy YoY | Feb | 8.7% | 8.3% |

| 15-Mar | PPI ex Food, Energy & Trade YoY | Feb | 7.2% | 6.9% |

| 15-Mar | Empire Manufacturing | Mar | 7.8 | 3.1 |

| 16-Mar | MBA Mortgage Applications | 11-Mar | N/A | 8.5% |

| 16-Mar | Retail Sales MoM | Feb | 0.4% | 3.8% |

| 16-Mar | Retail Sales ex Autos MoM | Feb | 0.8% | 3.3% |

| 16-Mar | Import Price Index MoM | Feb | 1.5% | 2.0% |

| 16-Mar | Import Price Index YoY | Feb | N/A | 10.8% |

| 16-Mar | Export Price Index MoM | Feb | 1.6% | 2.9% |

| 16-Mar | Export Price Index YoY | Feb | N/A | 15.1% |

| 16-Mar | Business Inventories | Jan | 1.1% | 2.1% |

| 16-Mar | NAHB Housing Market Index | Mar | 81 | 82 |

| 16-Mar | FOMC Rate Decision at 1p CDT | 0.25-0.50% | 0-0.25% | |

| 17-Mar | Building Permits | Feb | 1,868,000 | 1,899,000 |

| 17-Mar | Building Permits MoM | Feb | -1.5% | 0.7% |

| 17-Mar | Housing Starts | Feb | 1,700,000 | 1,638,000 |

| 17-Mar | Housing Starts MoM | Feb | 3.8% | -4.1% |

| 17-Mar | Initial Jobless Claims | 12-Mar | N/A | 227,000 |

| 17-Mar | Continuing Unemployment Claims | 5-Mar | N/A | 1,494,000 |

| 17-Mar | Industrial Production MoM | Feb | 0.5% | 1.4% |

| 17-Mar | Capacity Utilization | Feb | 77.9% | 77.6% |

| 18-Mar | Existing Home Sales | Feb | 6,150,000 | 6,500,000 |

| 18-Mar | Existing Home Sales MoM | Feb | -5.4% | 6.7% |

| 18-Mar | Leading Index | Feb | 0.3% | -0.3% |

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.