Three Months & Where Does It All Go?! — Week of March 7, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -1.24 | -8.94 | 16.47 | 17.75 | 14.72 | 4,328.87 |

| Dow Jones Industrial Average | -1.23 | -7.15 | 10.73 | 11.59 | 12.31 | 33,614.80 |

| Russell 2000 Small Cap | -1.92 | -10.74 | -5.88 | 9.79 | 8.84 | 2,000.90 |

| NASDAQ Composite | -2.76 | -14.79 | 5.36 | 21.77 | 18.94 | 13,313.44 |

| MSCI Europe, Australasia & Far East | -3.17 | -9.49 | -0.87 | 7.16 | 6.98 | 2,107.87 |

| MSCI Emerging Markets | 0.07 | -4.73 | -10.82 | 6.27 | 7.48 | 1,172.56 |

| Barclays U.S. Aggregate Bond Index | 0.47 | -3.55 | -2.26 | 3.19 | 2.78 | 2,271.56 |

| Merrill Lynch Intermediate Municipal | 0.06 | -3.19 | -1.56 | 2.63 | 2.93 | 309.91 |

As of market close March 4, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

- War events do not determine stock market trends

- Wars do contribute to inflation

- Powell says he will recommend quarter-point rate increase on March 16th

- Jobs report and surveys show economy picked up in February

Three Months

We are moving through 2022 at a fast clip. It seems like we just started the year and here we are in the third month. Twice this year stocks have tested multi-month lows and are solidly in correction territory. Bonds yields have started to rise thanks to Central Banks moving to raise rates. Putin’s buildup at the Ukraine border began late last year but started getting attention in early January. At that time oil started moving higher.

Reviewing past wars and inflation cycles shows just how different markets are today. They act and react in the same manner, but the time cycles are much shorter. Consider that past pandemic market cycles took one to one and a half years. Contrast those cycles to the first three months of 2020: start of the pandemic in January, spread in February, shutdowns send economies toward depression levels in March. Recessions and depressions always lead to supply chain inflation during the ensuing recovery. Demand before and after this pandemic was strong. Adding stimulus money exacerbated demand and sparked inflation.

Sadly, the situation in Ukraine will not end well. It is already a humanitarian crisis with estimates of at least one million refugees crossing borders. Wars spark uncertainty in all markets. Stocks head lower temporarily and goods spike in price. Commodities are entering a new Bull cycle, led by oil and grains. Wheat and soybeans started rallying last fall due to droughts in Brazil and low yields in North America. Ukraine is a top three exporter of wheat and some farmers are likely not planting there this year.

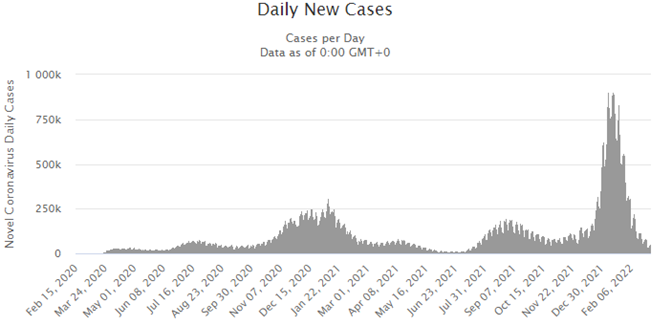

Omicron Out

One bit of good news is that omicron case counts have fallen steeply. We are aware that cases are still out there. The BA.2 strain is reported to be more virulent and faster moving than omicron. Fortunately, the symptoms are said to be very mild. Case counts through Friday:

source: Worldometers.info/coronavirus

Earnings End

The fourth quarter earnings season is largely complete. 95% of the S&P 500 companies have reported. Energy companies led the parade, beating analyst estimates by 14,395%. Yes, that’s an oddball number because in the fourth quarter of 2020 many energy names still had negative earnings. Materials companies came in second, with the improving economy raising earnings 64% over 2020’s fourth quarter. In the aggregate, 2021 fourth quarter earnings were 32% higher than a year earlier. Wall Street is looking for 8% to 11% growth in earnings this year.

Market Positioning

Wars and events always jolt markets temporarily. In almost every case since the Cuban Missile Crisis, stocks were higher six months later. Stocks were also higher a year later. Going back to the start of World War I, Ned Davis Research tallied 33 cases of wars causing a short-term downturn in markets. Only five times were stocks lower six months later and four of those were in World Wars. We mentioned last week that stocks may have found a bottom in late January and tested that level again in late February. Through Friday, many stock indices were either flat or slightly positive since the beginning of the invasion.

There is plenty of good news that markets are ignoring for the moment. Mark addresses the fine February jobs report below. We are cognizant of market fears, and inflation is taking center stage.

We believe markets are beginning to recognize that the Ukraine war could impact inflation on several fronts. First, crude oil prices have jumped nearly $40 since the fall. Higher pump prices limit spending in other areas. Since higher interest rates also take more income, think of higher gas prices as doing part of the Fed’s work. That is part of the reason why odds of half of a percent rate increase vanished over the last two weeks. Second, wheat and other grains also have moved higher since the fall harvest. Higher food and energy costs are going to hit Europe harder than the U.S. in the coming months.

Our indicators for Europe are moving toward neutral and are not as bright green for the U.S. Nothing will stop the Fed from raising rates a quarter point in two weeks. The European Central Bank, however, may hold off until much later in the year.

Essential Economics

— Mark Frears

Where Does It All Go?!

We are consumers; therefore, we consume! Our spending can be ingrained habits developed over time or influenced by current events. Have you heard of “Prime-nesia”? It's when you open your front door to a porch filled with Amazon boxes and can’t remember what you ordered! The need versus want decision can be a slippery slope.

You and I

We are a very important part of the overall economy. Gross Domestic Product (GDP) is the primary measure of the health of the economy. Two-thirds of that is driven by the consumer. That’s a big chunk.

Our normal spending has mostly resumed, as COVID impact fades. What we are buying is costing us more. Last month, we saw the Consumer Price Index (CPI) increase 7.5% on a year-over-year basis. We will get an update on this for February next week and expectations are for 7.9%. This can have a twofold impact. What we buy costs more, and it can make us hesitant to buy.

Consumer Sentiment, as measured by University of Michigan, is more focused on financial conditions, like inflation, and sentiment is at an 11-year low. Consumer Confidence, as measured by the Conference Board, focuses more on the labor market and is only at a three-year low. This is normal for the current situation, as wages are increasing, and jobs are plentiful. The question is, will this be enough for consumer to continue to spend?

In addition, recent geopolitical events will impact consumer behavior, but we have not seen any sales releases yet that encompass that time frame.

Businesses

Companies are seeing strong demand, as evidence by consumer spending. Due to supply chain issues, they were often unable to provide goods, and COVID restrictions kept workers at home, making service-oriented businesses unable to operate at full capacity. These restrictions are fading.

The February Payroll release showed a higher than expected 678,000 new workers added to the workforce, and the unemployment rate dropping to 3.8%. 76.6% of private industries showed growth, emphasizing the breadth of the increase. Average Hourly Earnings were unchanged month-over-month, due to the increased hiring in lower wage-earning workers.

On a negative note, Institute of Supply Management (ISM) Services PMI shows weakening momentum. Contrary to this, the Markit U.S. Services Index jumped 5.3 points in February, the most in ten months. Both indexes are off their peaks from mid-2021, as Services were hit hard by delta and omicron.

U.S. Construction spending was stronger than expected in January, increasing 1.3%. Another good sign here is that both residential and nonresidential spending rose by 1.3%. Residential spending was focused on single-family homes over multi-family. As more buyers can find homes, this will multiply spending.

U.S. Government

As we all know, the primary reason the COVID recession has been so shallow is the mountains of cash Fiscal and Monetary policy have dumped into the system. Fiscal stimulus has essentially stopped, even though the Monetary stance is still accommodative. Even though the direct payments to the consumer have stopped, our finances are in better shape overall. As of November 2021, the savings levels of high earners are 35% above pre-pandemic levels and low earners are 65% above.

In addition, IRS refund checks are being distributed currently and they are running higher than last year. These will be used to pay off debt, add to savings or current expenses, or plan a vacation. Impacts of government spending are still in play but will fade as the year goes along.

Wrap-Up

Your spending may seem like small packages, but you do have a material impact on the economy. Are your habits changing with inflation and Ukraine on your mind, or are your expenditures more in the needs category? We have started to book some vacations for later this year, that is, if we can get out the front door!

Most measures of monthly activity in the U.S. and Europe picked up last month as the omicron wave faded. The Russian invasion pushed the virus and to an extent, inflation, off the headlines. Markets always look ahead, and solid earnings and full employment should help the economy fight inflation.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 7-Mar | Consumer Credit | Jan | $24.000B | $18.898B |

| 8-Mar | NFIB Small Business Optimism | Feb | 97.4 | 97.1 |

| 8-Mar | Trade Balance | Jan | -$87.4B | -$80.7B |

| 8-Mar | Wholesale Inventories MoM | Jan f | 0.8% | 0.8% |

| 9-Mar | MBA Mortgage Applications | 4-Mar | N/A | 0.7% |

| 9-Mar | JOLTS Job Openings | Jan | 10,968,000 | 10,925,000 |

| 10-Mar | Consumer Price Index MoM | Feb | 0.8% | 0.6% |

| 10-Mar | CPI ex Food & Energy MoM | Feb | 0.5% | 0.6% |

| 10-Mar | CPI YoY | Feb | 7.9% | 7.5% |

| 10-Mar | CPI ex Food & Energy YoY | Feb | 6.4% | 6.0% |

| 10-Mar | Initial Jobless Claims | 5-Mar | 218,000 | 215,000 |

| 10-Mar | Continuing Unemployment Claims | 26-Feb | N/A | 1,476,000 |

| 10-Mar | Real Average Weekly Earnings YoY | Feb | N/A | -3.1% |

| 11-Mar | UM (Go State) Consumer Sentiment | Mar p | 62.5 | 62.8 |

| 11-Mar | UM Current Conditions | Mar p | N/A | 68.2 |

| 11-Mar | UM Expectations | Mar p | N/A | 59.4 |

| 11-Mar | UM 1-year inflation expectations | Mar p | N/A | 4.9% |

| 11-Mar | UM 5-10 year inflation expectations | Mar p | N/A | 3.0% |

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.