Lower commodities, trucking and interest rates suggest producer prices peaking — Week of June 27, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 6.46 | -17.32 | -6.99 | 12.11 | 11.88 | 3,911.74 |

| Dow Jones Industrial Average | 5.39 | -12.43 | -6.09 | 8.14 | 10.44 | 31,500.68 |

| Russell 2000 Small Cap | 6.02 | -20.90 | -23.49 | 6.38 | 5.84 | 1,765.74 |

| NASDAQ Composite | 7.51 | -25.51 | -18.62 | 14.76 | 14.21 | 11,607.62 |

| MSCI Europe, Australasia & Far East | 0.81 | -19.66 | -18.57 | 1.57 | 2.62 | 1,837.39 |

| MSCI Emerging Markets | -0.80 | -18.21 | -25.19 | 0.94 | 2.38 | 995.34 |

| Barclays U.S. Aggregate Bond Index | 0.85 | -10.73 | -10.47 | -1.05 | 0.67 | 2,102.45 |

| Merrill Lynch Intermediate Municipal | 0.47 | -8.06 | -7.76 | -0.23 | 1.24 | 294.30 |

As of market close June 24, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Less is more

Commodity prices have finally decided to take a break. The old saw, “the cure for high prices is high prices,” rings in our minds. Commodity prices peaked in early March. Since then, the Fed has increased short rates by 1.5%. Are high prices and higher rates having an effect on demand? Yes, in housing, less so in gasoline sales. Since the Fed meeting in early March, oil is down 12%, copper futures -24% and lumber -50%.

Interest rates have dropped over a quarter of a percent during the last week. But the Fed is on its way to a 3.5% overnight rate over the next 12 months, correct? Well, perhaps not. We were writing early in the year that the Fed likely would not raise rates as far as their projections suggested. We are sticking with that call. Declines in commodity, interest rates and trucking rates suggest the economy is already slowing enough to affect inflation levels. Fed Chairman Powell acknowledged last week in Congressional testimony that a recession was not out of the question. He also caused a bit of a stir by suggesting that the Fed will focus on headline (gas and food) inflation going forward.

Whipsaw

Last week’s 6%-plus run for stocks was just the second positive week in the last 12. The S&P 500 has had only seven positive weeks out of the 25 to start the year. Hopes that the Fed will not raise rates as high as feared sparked Friday’s big run. The 116-point move closed a brutal -3.8% chart gap created on June 13. The next big chart gap is 3% higher at 4,017, created on June 10. That 4,017 level is close to dealer option hedging turning positive. Any rise above that level would see a positive push higher from option hedging instead of the current downward influence.

Hedging, lower rates and possibly peaking inflation are all fundamental drivers that could support a short-term rally higher. The second quarter ends this week, so portfolio managers will be dressing up reports with winners and tossing losers. Pension plans and risk parity managers will be rebalancing from better-performing bonds into poorer-performing stocks. Also, July 1 is traditionally a big deposit day for retirement plans. All the above should make for an interesting, possibly positive week. Are two weeks in a row a new uptrend? We think not. Mid-term election years take the summer to work through volatility. Earnings season will get busy in mid-July, and only then will we get a read on revisions to still-optimistic estimates.

Wrap-up

A countertrend rally in a Bear cycle is not out of the question. Fund flows and rebalancing this week could create positive noise in the markets but does not change the intermediate trend. Our indicators are keeping us on the sidelines and may give us an opportunity to lower risk in the coming weeks.

Essential Economics

— Mark Frears

Perspective

Each of us has our own view of life, based on what we experience day-to-day. On my first visit to Seattle, I had been on the train since Chicago and had never set foot in the city before. My view was kind of intimidating, all the unknowns. When I arrive in Seattle now, it is with familiarity and excitement. I know where I am going and how to get there. The markets experienced a change in perspective last week, without any forewarning!

Housing

We all must live somewhere, whether we own a home, rent an apartment, or live in our parent’s basement. If you own a home, you most likely have a nice low interest rate on your mortgage. If you rent, you have experienced rising costs, even before the impact of supply chain disruption. There are too much demand and too few living spaces available. This will take some time to balance out, so these living costs will stay higher.

Last week we had two opposing housing releases. Existing home sales came in lower than expected. With rising rates, mortgages are not as attractive, but we are coming into the time of the year when many relocate. Later in the week, new home sales reversed April’s 12% decline with a 10.7% increase. This was only a bounce-back, not a new increasing trend.

Confidence

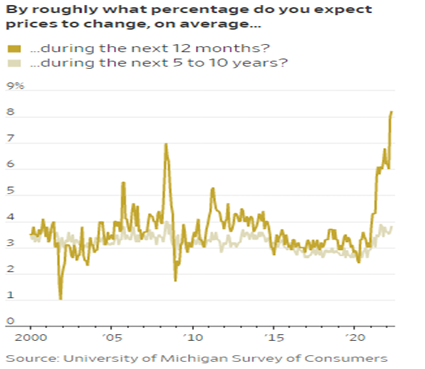

On Friday, we had the latest University of Michigan (better school up in East Lansing) Consumer Sentiment release. This survey of consumer attitudes/views dates to 1946 and has become a benchmark for inflation expectations. The overall metric dropped to a 40-year low; let us dig into some of the details.

There are two specific questions on future expectations. One, how much do you expect prices to go up in the next five to 10 years? This month they see a 3.1% increase, down from an earlier reading of 3.3%. Two, how much will prices increase over the next 12 months? That expectation dropped from 5.4% to 5.3%.

As you can see, these are both at sustained elevated levels. Given the continued attention on prices at the pump and in the grocery store, demand has not slowed enough for us to see a lower price trend.

Popular inflation measure

Last week the Consumer Price Index (CPI) was released with much fanfare just down slightly from recent highs. The three biggest components are food, energy and shelter, making up 54% of the index. The category of “services less energy services” makes up 57% of CPI and has risen 5.2% over the past 12 months. The next largest group is “commodities less food and energy commodities,” which makes up 21.4% and is up 8.5% over the past 12 months. Put this in perspective since the two smallest categories involve energy. These two categories make up 3.4% of CPI, yet they are up 50.3% and 16.2% this year! So, your pain at the pump really does not flow through to what we see in CPI, making it worse than it appears.

What do you want?

As you recall, the Federal Open Market Committee’s actions (FOMC) regarding short-term interest rates are very closely watched by Wall Street. Right now, their focus is on quelching inflation and their tool to do that is by increasing rates enough to slow down the economy and reduce demand. How far and how much are very much in people’s minds.

The “r-word” has been bantered about in the media and in questions to the FOMC members. Will they be able to slow the economy enough to have a “soft landing” and keep prices from soaring? Or will they push rates so high that we plunge into recession?

Last week, sometime between Wednesday and Thursday, market sentiment changed. Huge. The three-year U.S. Treasury note dropped 35 basis points (bp). The focus moved past the inflation concerns and assuming the FOMC would have to start cutting rates before mid-year 2023.

This market sentiment shift primarily impacts interest rates, and by association USD levels. What this does not affect is the current impact of inflationary prices. It still costs more to live right now and that will not change quickly. While the economy is slowing, some due to expected rate increases, and some due to consumers starting to pull back on purchases, it will take time for the slower demand to flow through to prices.

Wrap-up

The economic picture shows a slowing economy. How far is still the question. The consumer can shift perspective as fast as the bond market did last week, and we never know what the trigger will be. Stay tuned.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 27-Jun | Durable Goods Orders | May | 0.1% | 0.5% |

| 27-Jun | Durable Goods Orders ex Transport | May | 0.4% | 0.4% |

| 27-Jun | Cap Gds Orders Nondef ex Aircraft | May | 0.2% | 0.4% |

| 27-Jun | Pending Home Sales MoM | May | -4.0% | -3.9% |

| 27-Jun | Dallas Fed Manuf Activity | Jun | (6.5) | (7.3) |

| 28-Jun | Wholesale Inventories MoM | May | 2.2% | 2.2% |

| 28-Jun | FHFA House Price Index MoM | Apr | 1.6% | 1.5% |

| 28-Jun | S&P 20-City Home Price MoM | Apr | 1.85% | 2.42% |

| 28-Jun | Conf Board Consumer Confidence | Jun | 100.0 | 106.4 |

| 28-Jun | Conf Board Present Situation | Jun | N/A | 149.6 |

| 28-Jun | Conf Board Expectations | Jun | N/A | 77.5 |

| 29-Jun | GDP Annualized QoQ | Q1 | -1.5% | -1.5% |

| 29-Jun | Personal Consumption | Q1 | 3.1% | 3.1% |

| 29-Jun | GDP Price Index | Q1 | 8.1% | 8.1% |

| 30-Jun | Personal Income | May | 0.5% | 0.4% |

| 30-Jun | Personal Spending | May | 0.4% | 0.9% |

| 30-Jun | Real Personal Spending | May | -0.2% | 0.7% |

| 30-Jun | Initial Jobless Claims | 25-Jun | 230,000 | 229,000 |

| 30-Jun | Continuing Claims | 18-Jun | 1,310,000 | 1,315,000 |

| 30-Jun | PCE Deflator YoY | May | 6.4% | 6.3% |

| 30-Jun | PCE Core Deflator YoY | May | 4.8% | 4.9% |

| 1-Jul | Construction Spending MoM | May | 0.4% | 0.2% |

| 1-Jul | ISM Manufacturing | Jun | 54.9 | 56.1 |

| 1-Jul | ISM Prices Paid | Jun | 80.0 | 82.2 |

| 1-Jul | ISM New Orders | Jun | N/A | 55.1 |

| 1-Jul | ISM Employment | June | N/A | 49.6 |

| 1-Jul | Ward's Total Vehicle Sales | Jun | 13,400,000 | 12,680,000 |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.