Look through the noise — Week of January 15, 2024

Essential Economics

— Mark Frears

Squirrel!

It’s a new year — time for new beginnings, resolutions, renewed focus. Does that hold for you, or are you still distracted by minor things flying by? If you are a proponent of calendars and scheduling, it can make a difference to block out time for specific tasks. Forget the multi-tasking myth; focus on one thing at a time. Small pieces building toward your goals. You can do this!

There is no end to the things we can focus on when looking at the economy. The Fed is one of these inputs, but what are you focused on? Greenspan’s briefcase, Fed Funds target rate or something else? Let’s take a look at an important item that deserves your attention.

History

It may not seem like that long ago to many, but it was a different means of managing the FOMC’s easing or tightening direction in the 2010 to 2015 time frame. As you can see below, going back to 1960, at every other time, rates were far enough above zero so that moving the rate and the communication that went along with that would provide the desired actions.

Source: Bloomberg

In the zero interest rate period, there was felt a need to further stimulate the economy, and other countries were going to negative rates. The U.S. chose to use their balance sheet to provide further stimulus to a slower economy. This was done through Quantitative Easing (QE) that utilized purchasing of U.S. Treasuries (UST) and mortgage-backed securities (MBS) from the market, providing cash as a means of stimulus.

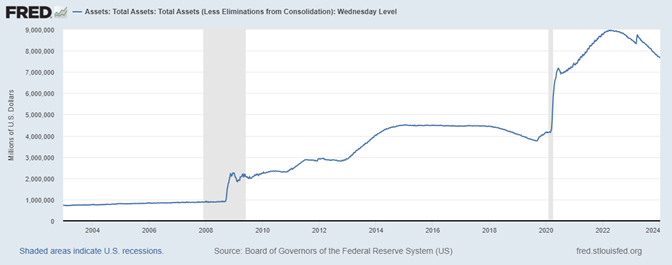

Assets

As a consequence of these actions, the Fed’s balance sheet grew at an unprecedented rate. This was now established as an accepted means of providing stimulus and was also utilized during the pandemic, as you can see below.

Source: St. Louis Fed

At the beginning of the current tightening cycle, there has been an associated sale of securities, Quantitative Tightening (QT), although a $400 billion increase came with the Silicon Valley Bank failure. Current QT plan is for $95 billion of securities to be sold to the market each month. With the current asset balance at just under $8 trillion, that will take a while to run off.

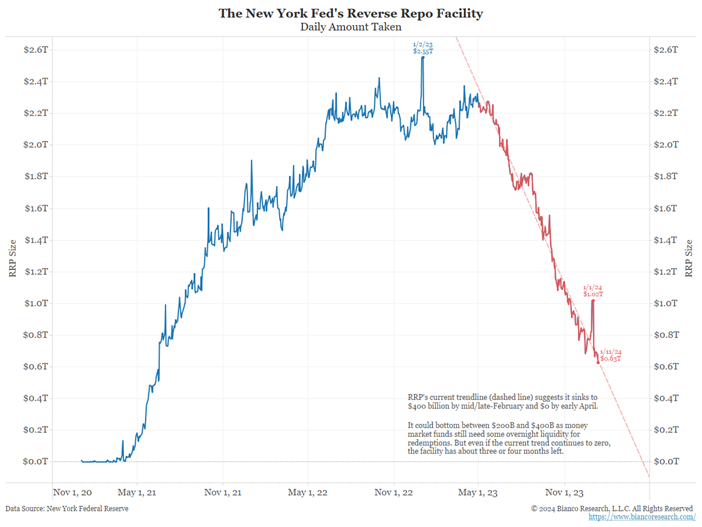

Liabilities

The Fed funds these assets primarily through three liabilities. First, bank reserves that are left at the Fed. Prior to the Great Financial Recession (GFR) in 2008, there was no interest paid to banks on these reserves. Ever since then, banks receive interest for their balances left at the Fed. A risk-free way to make money. Second, currency issued provides funding for their assets. Third, the reverse repo facility (RRP) utilized by non-banks to park cash. As these entities are not members of the Federal Reserve, they were looking for a way to park cash and earn interest. This was used by the Fed to help manage cash in the system and their target interest rate. As you can see below, with the tightening monetary environment, balances in the RRP have fallen dramatically and are expected to go to zero by early April.

Source: Bianco Research

What to watch

At the January FOMC meeting, pay attention to what they say about balance sheet reduction to see how the tightening is progressing. One interesting fact is that while rates have been rising and value of the securities they hold (like most financial institutions) has decreased, they don’t have to recognize a negative mark-to-market like what materially impacted Silicon Valley Bank! Nice perk.

There are a few ways this larger balance sheet can impact markets. First, they can’t just sell all these securities at once, or even quickly, as it would suck significant liquidity from the market causing disruption in the short-term funding market. Second, as long as they hold higher balances, they must be funded, and this comes at a cost to the government, and taxpayers. Third, keeping these securities out of circulation could disrupt the supply of available bonds. Although, with the $900 billion more in issuance this year, I think we’ll be OK on that front. The finding of buyers for all those securities is another.

Economic releases

Last week was focused inflation numbers with CPI coming out higher than expected and PPI balancing it out by coming out lower than expected. Consumer credit was much higher than expected, but people are still managing their debt payments without too much stress.

This week’s calendar has retail sales, housing releases and consumer sentiment. Next FOMC meeting is January 30-31. See below for details.

Wrap-Up

While others are focused on the target rate for the Fed, you should also pay attention to the asset size of their balance sheet for clues as to tightness in the monetary system. Hope you are having good progress on your New Year’s goals!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 16-Jan | Empire Manufacturing | Jan | (5.0) | (14.5) |

| 17-Jan | NY Fed Services Business Activity | Jan | N/A | (14.6) |

| 17-Jan | Retail Sales MoM | Dec | 0.4% | 0.3% |

| 17-Jan | Retail Sales ex Autos MoM | Dec | 0.2% | 0.2% |

| 17-Jan | Import Price Index MoM | Dec | -0.5% | -0.4% |

| 17-Jan | Export Price Index MoM | Dec | -0.7% | -0.9% |

| 17-Jan | Industrial Production MoM | Dec | 0.0% | 0.2% |

| 17-Jan | Capacity Utilization | Dec | 78.7% | 78.8% |

| 17-Jan | Business Inventories | Nov | -0.1% | -0.1% |

| 17-Jan | NAHB Housing Market Index | Jan | 39 | 37 |

| 17-Jan | Fed releases Beige Book for Jan 30-31 FOMC Meeting | |||

| 18-Jan | Building Permits | Dec | 1,475,000 | 1,460,000 |

| 18-Jan | Building Permits MoM | Dec | 0.6% | -2.5% |

| 18-Jan | Housing Starts | Dec | 1,425,000 | 1,560,000 |

| 18-Jan | Housing Starts MoM | Dec | -8.7% | 14.8% |

| 18-Jan | Philadelphia Fed Business Outlook | Jan | (7.0) | (10.5) |

| 18-Jan | Initial Jobless Claims | 13-Jan | 206,000 | 202,000 |

| 18-Jan | Continuing Claims | 6-Jan | 1,845,000 | 1,834,000 |

| 19-Jan | UM (Go UW) Consumer Sentiment | Jan P | 70.0 | 69.7 |

| 19-Jan | UM (Go UW) Current Conditions | Jan P | 73.0 | 73.3 |

| 19-Jan | UM (Go UW) Expectations | Jan P | 66.6 | 67.4 |

| 19-Jan | UM (Go UW) 1-yr inflation | Jan P | 3.1 | 3.1% |

| 19-Jan | UM (Go UW) 5-10-yr inflation | Jan P | 3.0 | 2.9% |

| 19-Jan | Existing Home Sales | Dec | 3,830,000 | 3,820,000 |

| 19-Jan | Existing Home Sales MoM | Dec | 0.3% | 0.8% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.