Inflation wave pulls Bear back out of the cave - Week of June 13, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -5.04 | -17.60 | -6.66 | 12.41 | 11.88 | 3,900.86 |

| Dow Jones Industrial Average | -4.56 | -12.78 | -7.15 | 8.70 | 10.49 | 31,392.79 |

| Russell 2000 Small Cap | -4.37 | -19.41 | -21.26 | 7.11 | 6.15 | 1,800.28 |

| NASDAQ Composite | -5.59 | -27.25 | -18.52 | 14.17 | 13.89 | 11,340.02 |

| MSCI Europe, Australasia & Far East | -1.78 | -12.91 | -12.97 | 4.79 | 4.25 | 1,992.38 |

| MSCI Emerging Markets | 0.64 | -12.51 | -20.53 | 3.79 | 3.67 | 1,067.15 |

| Barclays U.S. Aggregate Bond Index | -0.70 | -9.91 | -9.81 | -0.41 | 0.95 | 2,121.70 |

| Merrill Lynch Intermediate Municipal | -0.30 | -6.78 | -6.84 | 0.32 | 1.52 | 298.42 |

As of market close June 10, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Too much

June is on track to be the “too much” month. Too much noise, news and negative sentiment. Markets climb walls of worry, but not before they first ram headlong into them. The bricks in the wall, in no particular order, include Ukraine, the virus strain of the moment, recession, China, and mid-term elections. Of course, the cornerstone is inflation.

Mark has the details below, but from our view the conventional wisdom on inflation is following in the Fed’s footsteps. In 2021, the Fed repeatedly pushed the narrative that inflation was “transitory.” Wall Street was not so sure. This year both the Fed and Wall Street believed, at least until last Friday, that inflation had “peaked” and was rolling over. We certainly waved the “inflation moderation” flag back in the winter.

The numbers do not lie, however, and our process is number-driven. Certainly, some goods prices have rolled over. Services, autos and housing prices continue to increase. These sectors are keeping prices higher for longer and causing traders to reassess what happens to company earnings. Supply chains have improved, but that means lots of goods in inventory. Consumer sentiment is near a 40-year low because most folks have not seen price increases of this scale in their lifetimes.

Inventories of gasoline and diesel are below five-year averages, and the summer driving season is upon us. Thanks to these supply limitations, high gas prices will continue. Fuel users have reacted to higher prices by changing behaviors. Two anecdotal points: a local drive-thru restaurant normally sees a falloff in business during May and June. Not this year, as their customers stayed home and opted for drive-thru. Spot trucking freight rates in the central U.S. are starting to moderate, suggesting that shippers are not as frantic to get goods delivered. Meanwhile, the pandemic shutdowns around the Shanghai ports continue to be on-again, off-again. The ports of Long Beach and Charleston South Carolina just set their second and third best months ever for unloading containers. Just as demand is slowing thanks to high prices, more supply hits our shores. Memorial Day sales? How about big sales for the Fourth of July?

Action

The European Central Bank finally realized, that like the Fed, it too is behind the inflation wave. Miniscule quarter-point rate increases were pushed aside last week as futures markets prepared for — wait for it — half-point increases. Remember that the ECB’s deposit rate was as low as -0.75%. Yes, Virginia, you can deposit money in European banks and get back less. Not our kind of Santa Claus. The ECB has a longer route to get to neutral, i.e., where inflation and short-term interest rates match.

The ECB also has been buying bonds to inject money into the banking system in a program similar to the Fed’s. A worrisome point is that this program has focused buying more on the southern countries’ bonds at the expense of northern members. Now that this program is coming to an end, Spain and Italy bonds are falling in price versus their Euro peers. This brings back decade-old concerns of Euro stability. Expect the dollar to resume its recent rally.

Fed speakers and the ECB seem willing to risk a recession to tame inflation, and the Street is rightfully worried. Twenty years of the Fed intervening when the Negative Noise level (stock market drops) got high enough conditioned traders to wait for the “Fed Put” in the form of lower rates or bond buying. Not this time. This morning’s 3% drop in U.S. stock indices is an unwelcome, but understandable reaction.

This week

Last week’s drop in the S&P 500 took us to the bottom of the trading range, extending back to December 2nd. A a retest of lows is always a good sign that the market correction is working its way through. Today’s action takes the index back into Bear territory and price levels of March 2021. Bespoke Research points out that last week’s up-and-down price pattern has happened 13 times since WWII. The following Monday (today) was almost always negative. In 11 of the 13 cases, the index was higher six months later. The driving season will be over in three months, mid-term elections over in five. In the meantime, this week will be bumpy because of Friday’s quarterly option expiration.

Wrap-Up

Shutdowns two years ago led to too much fear in the markets. A slower growing economy with solid earnings growth from very healthy companies should not push stock prices lower. The negative noise level is coming from outside the markets. Higher prices helped company margins during reopening and are now a headwind to earnings.

Essential Economics

— Mark Frears

I want it now!

These days, we tend to be focused on the near term. When we have a huge information source at our fingertips, drive-thru windows everywhere, and the ability to communicate with people around the world almost instantaneously, you can see how that would happen. Sometimes you need to disconnect from the noise and consider the longer term impact. Some would call this a proactive versus a reactive mindset. It is very hard not to get caught up in the here-and-now, yet there is much to be gained from a bigger picture view.

Consumer costs

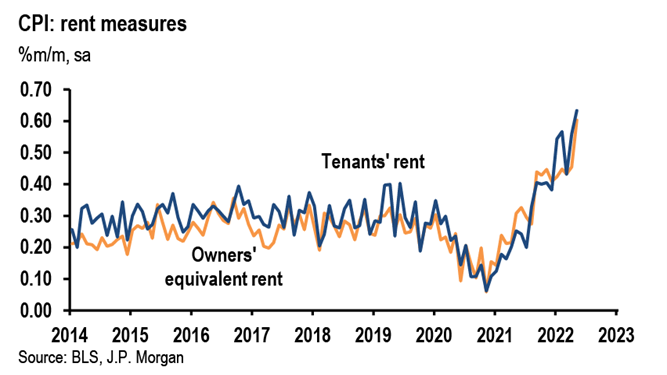

As the Federal Reserve “talking heads” were in lockdown ahead of their meeting next week, markets were focused on the Consumer Price Index (CPI) release last Friday. Expectations were for another monthly increase, and that is what happened. Energy continues to lead the way up in increasing costs for you and me. Housing, airfares and autos also cost more last month. This leads the here-and-now and gets the headlines.

From a longer-term view, economists and the Fed look at core CPI (excluding food & energy), as those two categories are volatile. Also, they look at a year-over-year view to not knee-jerk on one month’s data. The chart below shows Core CPI YoY, and you can see a slight dip last month.

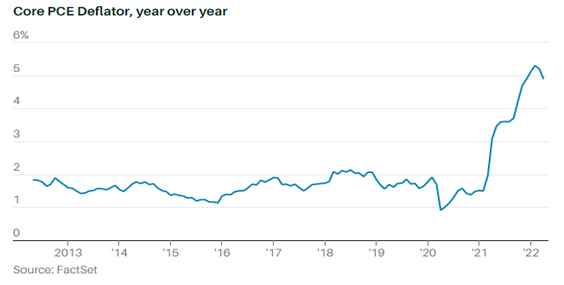

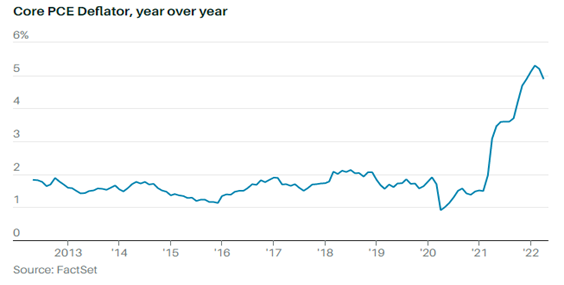

The Personal Consumption Expenditures (PCE) is another means of measuring inflation. The FOMC forecasts PCE in its quarterly Summary of Economic Projections, and not CPI.

Last month, the core year-over-year PCE deflator was 4.9%. This is a significant divergence from CPI and is attributed to differences in formulas, expenditure weights and scope effects. At the FOMC meeting next week they will publish a new forecast for PCE, and this will be closely watched.

Consumer income

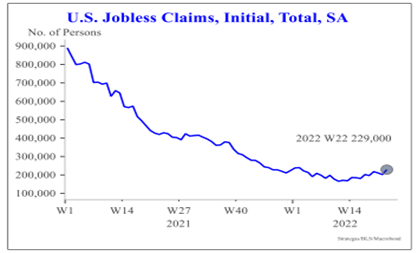

While we had a strong Payroll release last week, there are some signs that the Labor market could be slowing. As you can see below, Jobless Claims have started to increase, changing the recent trend.

Source: Strategas/ BLS/ Macrobond

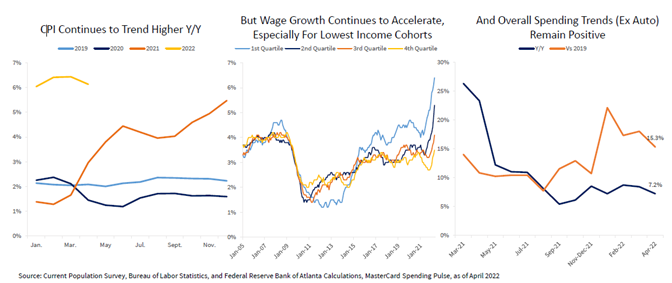

Despite higher inflation, the demand side of the equation is still strong. As you can see below, the lowest income cohort is seeing the fastest wage growth, and overall spending is doing very well.

The Job Openings and Labor Turnover Survey (JOLTS) still shows over eleven million job openings. The FOMC will attempt to reduce this number instead of job hiring. That is their short- and long-term goal!

Busy or not

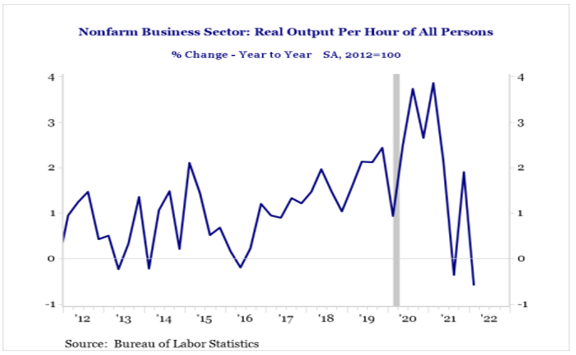

One of the concerns in the job market, post-COVID, is productivity. We are not seeing this in the manufacturing sector, but the larger services sector has seen a significant fall-off.

The rationale for this trend ranges from skill-matching to human resource constraints to work-from-home activity to childcare/schooling inconsistency to still having excess cash. All of these may point to why workers may not be in the workforce, but once they are there, it is very hard to pin down the reason for not producing as much output. Some might say this is a technology plateau, but in the services sector, that is less likely. In the short-term, this will hurt corporate profits as they pay more for workers, but get less out of them. If this continues longer-term, it could materially impact the overall strength of the United States.

Jerome Powell

The FOMC must be very nimble in balancing short-term and long-term, because their actions today will have consequences for many years.

Their primary focus right now is inflation, so they are raising rates and pulling cash from the market via Quantitative Tightening. They cannot influence supply, so they focus on raising rates enough to slow down the economy and reduce demand. The multi-billion-dollar question is whether they will stop raising rates before the economy goes into recession. They are searching for the mythical “soft landing.”

Wrap-Up

It is a constant struggle to not be distracted by the here-and-now, but take a moment to look at the bigger picture and see where your near-term actions will take you. The FOMC and markets must also take this into consideration and avoid getting caught up in the NOW.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 14-Jun | NFIB Small Business Optimism | May | 93.0 | 93.2 |

| 14-Jun | Producer Price Index MoM | May | 0.8% | 0.5% |

| 14-Jun | PPI ex Food & Energy MoM | May | 0.6% | 0.4% |

| 14-Jun | Producer Price Index YoY | May | 10.8% | 11.0% |

| 14-Jun | PPI ex Food & Energy YoY | May | 8.6% | 8.8% |

| 15-Jun | Empire Manufacturing | Jun | 4.5 | (11.6) |

| 15-Jun | Retail Sales MoM | May | 0.2% | 0.9% |

| 15-Jun | Retail Sales ex Autos MoM | May | 0.7% | 0.6% |

| 15-Jun | Import Price Index MoM | May | 1.2% | 0.0% |

| 15-Jun | Export Price Index MoM | May | 1.3% | 0.6% |

| 15-Jun | Business Inventories | Apr | 1.2% | 2.0% |

| 15-Jun | NAHB Housing Market Index | Jun | 68 | 69 |

| 15-Jun | FOMC Rate Decision (lower bound) | 1.25% | 0.75% | |

| 15-Jun | FOMC Rate Decision (upper bound) | 1.50% | 1.00% | |

| 16-Jun | Building Permits | May | 1,789,000 | 1,819,000 |

| 16-Jun | Building Permits MoM | May | -1.9% | -3.2% |

| 16-Jun | Housing Starts | May | 1,709,000 | 1,724,000 |

| 16-Jun | Housing Starts MoM | May | -0.9% | -0.2% |

| 16-Jun | Initial Jobless Claims | 11-Jun | 215,000 | 229,000 |

| 16-Jun | Continuing Claims | 4-Jun | 1,300,000 | 1,306,000 |

| 17-Jun | Industrial Production MoM | May | 0.4% | 1.1% |

| 17-Jun | Capacity Utilization | May | 79.2% | 79.0% |

| 17-Jun | Leading Index | May | -0.4% | 0.3% |

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.