Anticipation — Week of January 22, 2024

Essential Economics

— Mark Frears

Can’t wait

What is something you could not wait for? Your wedding day, birth of a child, graduation, first driver’s license? Time seems to drag when you are in that waiting mode. No matter what you do, the calendar will not speed up.

Since early 2023, the markets have been waiting on a recession. It has been more like waiting on Godot. Let’s see what the economic landscape looks like now.

Outlook

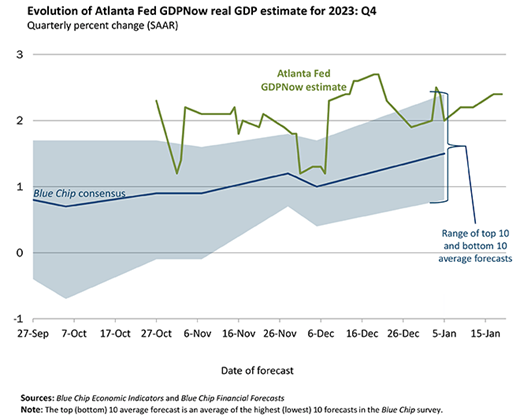

The definition of a recession is two or more consecutive quarters of negative economic growth, with Gross Domestic Product (GDP) the usual metric. This week will get the first estimate of fourth-quarter GDP. As you can see below, the Atlanta Fed GDPNow estimates this will come in at around 2.4%.

Source: Atlanta Fed

If you look at the shaded area of top and bottom 10 forecasts, there were negative GDP expectations up until early November. So, while most everyone now expects GDP for Q4 to come in above 1%, this wasn’t always the case.

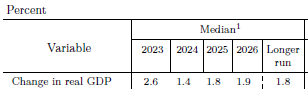

The Federal Open Market Committee (FOMC) publishes estimates for GDP and other metrics four times each year. Most recently, in December, they posted their expectations through 2026, as you can see below.

Source: Federal Reserve Summary of Economic Projections (Dec. 2023)

While these are period end estimates, we don’t see any negatives in there.

History

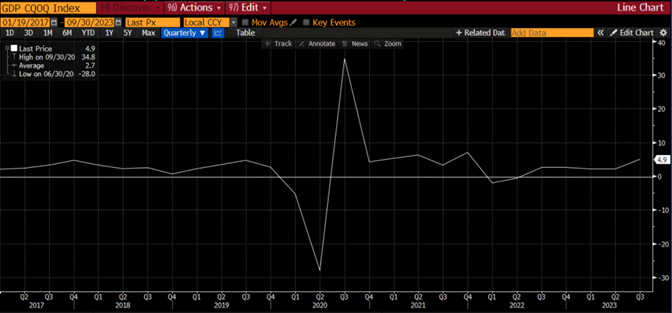

Well, maybe we missed it. As the chart below shows, we had the significant economic slowdown during the pandemic.

Source: Bloomberg

There were two quarters of negative GDP in the first and second quarters of 2022, but most people looked at that as an anomaly, as the labor market was ticking along and consumers continued to spend. Changes in government spending and inventories drove much of the volatility.

So, if that wasn’t the most-anticipated-recession-ever, I guess we are still waiting on it.

Possible detours

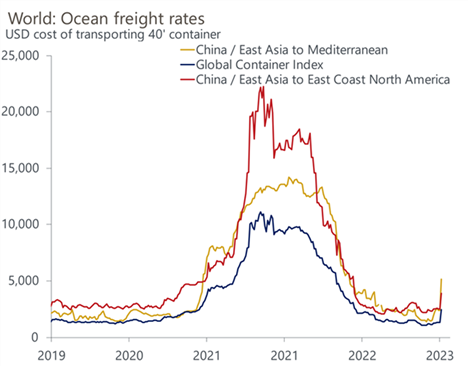

There are three areas of risk to the current “no recession” scenario. First, inflation is not vanquished. In spite of the most aggressive tightening of short-term rates, consumer behaviors have not changed. They continue to spend, leaving the realistic option of increasing prices. On top of this, Middle East wars have ramped up, causing potential disruption of goods delivery. Yes, you heard correctly, supply chain issues again. The Red Sea and Suez Canal avoidances are causing slowing of and increased costs of shipping.

Source: Oxford Economics/Refinitiv

Second, lower-income consumers are having to rely on credit cards to continue spending. Housing and food continue to take up a larger portion of the budget. Credit card delinquencies are above pre-pandemic levels and consumers making only minimum payment is above 10% for the first time since 2019, per the Philadelphia Fed report.

Third, consider this totally out-of-the-box possibility: What if the Fed has to raise rates to combat inflation? What?! Everyone is piling on the rate cut bandwagon, and you know what happens when people all move to one side of the boat. Instability could occur. A rate hike, or even a strong mention of this in FOMC communications, could derail consumer and commercial confidence in the soft-landing scenario.

Possible express lanes

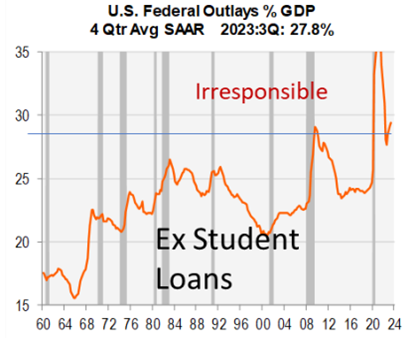

There are also three areas that could keep the economy chugging along just fine. First, your tax dollars at work. Yes, Virginia, the money spent by the government comes from you and me. Programs left over from the pandemic are concluding, but your favorite senator or congressman, determined to be reelected, wants to continue to favor you. So, possible tax cuts are on the table now, as they try to reach a budget agreement. As you can see below, federal outlays are in the irresponsible area as a percentage of GDP.

Source: Piper Sandler

Second, the labor market continues to hum along. We will get the next nonfarm payroll release the first week of February, but last week’s jobless claims dropped by almost 20,000. This is not indicative of a labor market that will see rising unemployment. Therefore, employers will have to pay good wages to retain and attract laborers.

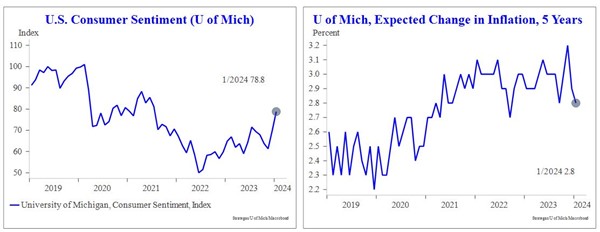

Third, the consumer continues to have a rosy outlook on the future. As shown below, sentiment jumped in the January preliminary numbers. In addition, their expectations of inflation being an issue down the road continue to drop.

Source: Strategas

As the consumer is the driver of two-thirds of GDP, sentiment will be a crucial factor for the economy this year. People don’t like uncertainty, and with the U.S. election already gathering significant headlines, things could get bumpy.

Economic releases

Last week’s highlight was Retail Sales, coming in hotter than expected, showing the consumer continues to spend. Consumer Sentiment came in higher than expected as well.

This week’s calendar has the Leading Index, Q4 GDP, Durable Goods Orders and PCE Deflator inflation indicator. Fed officials will be in their blackout period ahead of the FOMC meeting on January 30-31. See below for details.

Wrap-Up

The thinking used to be that we wanted the recession here, so it would be over with. Now, it’s more a question of if, not when, the U.S. will experience a significant slowdown. I am going to focus my expectations on something I can count on, like spring.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 22-Jan | Leading Index | Dec | -0.3% | -0.5% |

|

|

| ||

| 23-Jan | Philadelphia Fed Non-Manuf Activity | Jan | N/A | 6.3 |

| 23-Jan | Richmond Fed Manufacturing Index | Jan | (6) | (11) |

| 23-Jan | Richmond Fed Business Conditions | Jan | N/A | 0 |

|

|

| ||

| 24-Jan | S&P Global US Manufacturing PMI | Jan | 47.5 | 47.9 |

| 24-Jan | S&P Global US Services PMI | Jan | 51.0 | 51.4 |

| 24-Jan | S&P Global US Composite PMI | Jan | 51.0 | 50.9 |

|

|

| ||

| 25-Jan | Chicago Fed Natl Activity Index | Dec | N/A | 0.03 |

| 25-Jan | GDP Annualized QoQ | Q4 | 2.0% | 4.9% |

| 25-Jan | Personal Consumption | Q4 | 2.5% | 3.1% |

| 25-Jan | GDP Price Index | Q4 | 2.3% | 3.3% |

| 25-Jan | Retail Inventories MoM | Dec | 0.3% | -0.1% |

| 25-Jan | Wholesale Inventories MoM | Dec P | -0.2% | -0.2% |

| 25-Jan | Durable Goods Orders | Dec P | 1.1% | 5.4% |

| 25-Jan | Durable Goods ex Transportation | Dec P | 0.2% | 0.4% |

| 25-Jan | Cap Goods Orders Nondef ex Aircraft | Dec P | 0.2% | 0.8% |

| 25-Jan | Initial Jobless Claims | 20-Jan | 200,000 | 187,000 |

| 25-Jan | Continuing Claims | 13-Jan | 1,840,000 | 1,806,000 |

| 25-Jan | New Home Sales | Dec | 649,000 | 590,000 |

| 25-Jan | New Home Sales MoM | Dec | 10.0% | -12.2% |

| 25-Jan | KC Fed Manufacturing Activity | Jan | N/A | (1) |

|

|

| ||

| 26-Jan | Personal Income | Dec | 0.3% | 0.4% |

| 26-Jan | Personal Spending | Dec | 0.4% | 0.2% |

| 26-Jan | Real Personal Spending | Dec | 0.3% | 0.3% |

| 26-Jan | PCE Deflator YoY | Dec | 2.6% | 2.6% |

| 26-Jan | PCE Core Deflator YoY | Dec | 3.0% | 3.2% |

| 26-Jan | Pending Home Sales MoM | Dec | 2.0% | 0.0% |

| 26-Jan | KC Fed Services Activity | Jan | N/A | (10) |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.