Greed is rising — Week of April 8, 2024

Essential Economics

— Mark Frears

Emotional rescue

So, what keeps you up at night? For me, it used to be waiting for my kids to get home when they first started driving. Terrifying. Nowadays, it is upcoming things, like a tooth extraction, or other such fun events. Do you notice that the anticipation of things to come is usually worse than the actual occurrence?! The mind is weird. Fear is one end of the emotional spectrum, with greed on the other extreme. That desire for more and more can overcome the fear, for a time. The old Wall Street saying, “financial markets are driven by two powerful emotions — greed and fear,” is very evident!

Everything looks good right now. Strong labor market, stocks rising and prices moderating. Where are we on the emotional spectrum?

Index

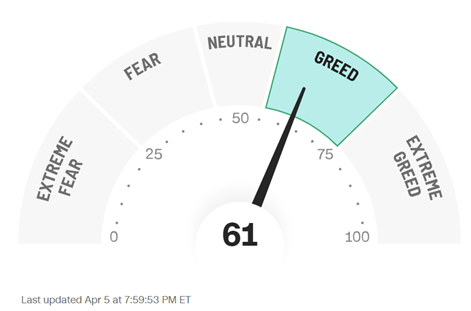

CNN has a Fear & Greed Index that many keep an eye on. It is made up of seven indicators covering stocks, bonds, momentum, options and the VIX. It is currently at a greedy reading of 61. A year ago, it was in Neutral wth a reading of 52.

Source: CNN

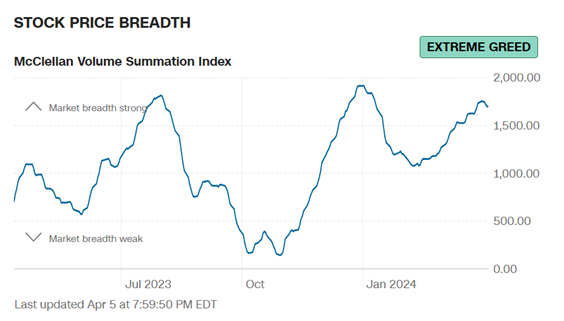

The component of this index that currently has the most extreme greed reading is stock price breadth. As you can see below, this metric looks at the amount, or volume, of shares on the NYSE that are rising compared to the number of shares that are falling. We are approaching levels of higher rising prices versus falling.

Source: CNN

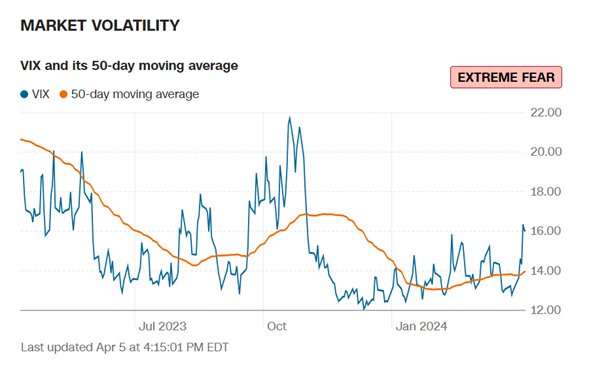

On the other end of the spectrum, we have market volatility ramping up, as an indicator of coming uncertainty. The market does not like uncertainty. As you see below, we are spiking up over the recent low levels of volatility.

Source: CNN

As the markets move to one emotional extreme or the other, we should pay attention. As you move in one direction, generally, it will not be sustained. If the greed index continues to climb, fear may come roaring back.

Other considerations

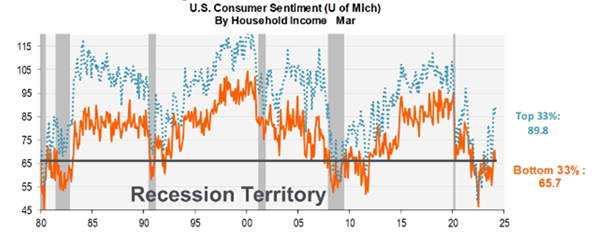

While the majority of economic growth comes from larger companies and the upper end of the income spectrum, we need to be aware of the impact of the current environment on the rest of the populous.

As you can see below, the sentiment of the lower income households is in recession territory.

Source: Piper Sandler

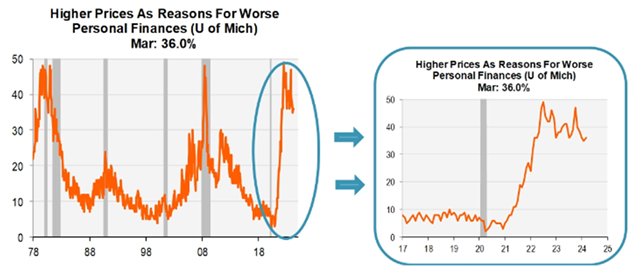

The first place you can see this is the impact of higher prices. While the economy is chugging along, this is also keeping prices at elevated levels. The chart below shows how this is impacting sentiment.

Source: Piper Sandler

Gasoline prices are rising as well, as we head into summer. As sentiment declines, consumers won’t make major purchases and will start to slow spending.

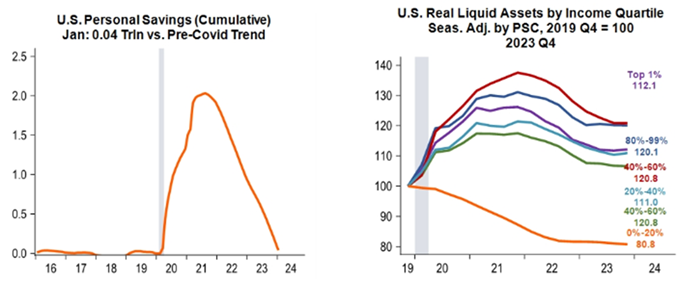

The next area of concern further impacts the budget. After the pandemic, savings balances boomed, due to lower spending and fiscal stimulus. As you see in the chart below, lower income households do not have the buffer of savings and are actually below pre-pandemic levels.

Source: Piper Sandler

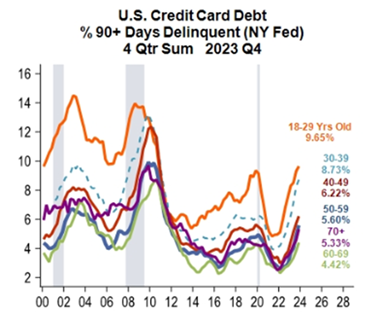

Third, the combination of high prices and no savings cushion is driving low-end consumers to use credit cards to support spending. Delinquency rates have started to rise, particularly for younger folks (chart below).

Source: Piper Sandler

While the stock market is up, and the economy is doing well with more than 2.5% growth expected for 2024, there are some places to keep an eye on. Stay tuned.

Economic releases

Last week was all about jobs, and we learned that employers continue to hire, fueling further expansion in the economy.

This week’s calendar focuses on inflation, with CPI and PPI out. In addition, we will see preliminary Consumer Sentiment data for April. See below for details.

Wrap-Up

Fear and greed are strong emotions that will drive behavior. Always remember you need to have a stronger underlying compass guiding you daily.

| Upcoming Economic Releasess: | Period | Expected | Previous | |

|---|---|---|---|---|

| 8-Apr | NY Fed 1-yr inflation expectations | Mar | N/A | 3.04% |

| 9-Apr | NFIB Small Business Optimism | Mar | 89.9 | 89.4 |

| 10-Apr | Consumer Price Index MoM | Mar | 0.3% | 0.4% |

| 10-Apr | CPI ex Food & Energy MoM | Mar | 0.3% | 0.4% |

| 10-Apr | Consumer Price Index YoY | Mar | 3.4% | 3.2% |

| 10-Apr | CPI ex Food & Energy YoY | Mar | 3.7% | 3.8% |

| 10-Apr | Real Avg Hourly Earnings YoY | Mar | N/A | 1.1% |

| 10-Apr | Real Avg Weekly Earnings YoY | Mar | N/A | 0.5% |

| 10-Apr | Wholesale Inventories MoM | Feb F | 0.5% | 0.5% |

| 10-Apr | FOMC Meeting Minutes from March 19-20 released at 1p CT | |||

| 10-Apr | Monthly Budget Statement | Mar | -$195.0B | -$296.3B |

| 11-Apr | Producer Price Index MoM | Mar | 0.3% | 0.6% |

| 11-Apr | PPI ex Food & Energy MoM | Mar | 0.2% | 0.3% |

| 11-Apr | Producer Price Index YoY | Mar | 2.2% | 1.6% |

| 11-Apr | PPI ex Food & Energy YoY | Mar | 2.3% | 2.0% |

| 11-Apr | Initial Jobless Claims | 6-Apr | 215,000 | 221,000 |

| 11-Apr | Continuing Claims | 30-Mar | 1,800,000 | 1,791,000 |

| 12-Apr | Import Price Index MoM | Mar | 0.3% | 0.3% |

| 12-Apr | Export Price Index MoM | Mar | 0.2% | 0.8% |

| 12-Apr | UM Consumer Sentiment | Apr P | 79.0 | 79.4 |

| 12-Apr | UM Current Conditions | Apr P | 81.5 | 82.5 |

| 12-Apr | UM Expectations | Apr P | 78.0 | 77.4 |

| 12-Apr | UM 1-yr inflation | Apr P | 2.9% | 2.9% |

| 12-Apr | UM 5-10-yr inflation | Apr P | 2.9% | 2.8% |

Mark Frears is a Senior Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI