Fed hits play on cuts — Fed Meeting of September 17, 2025

Fed Meeting

September 17, 2025

- Finally, Fed Funds range cut a quarter point to 4% to 4.25%.

- Dot plot suggests possibly two more cuts this year.

- Fed cut rates while raising their economic and inflation forecasts.

- Economic activity “moderated” and uncertainty “remains elevated.”

- Trump appointee Miran dissented, preferring half point cut.

Take Five

Today, the Federal Open Market Committee voted to cut their Fed Funds short-term range by a quarter of a point. The most recent change was a quarter-point cut last December. The “Fed” paused for five meetings, waiting on employment and inflation data. Both jobs and inflation data sources used by the Fed are a week to at least a month behind what is actually happening in the economy.

Tariff and trade comments were absent from the Committee’s press release for the first time in several meetings. The Committee seems to believe that tariff impacts will be “a one-time shift in the price level.” Chairman Powell has reiterated the FOMC’s dual mandate of steady employment and low inflation in recent appearances. In prior statements this year, the Committee has stressed that inflation and job risks were largely in balance.

In his Jackson Hole speech, Powell noted that unemployment and inflation were both rising. The Committee now “judges that downside risks to employment have risen.” This change of heart comes on the heels of the first round of annual revisions to the BLS job data. Each month, the BLS estimates payroll changes by polling approximately 119,000 businesses. Over the following year, the BLS compares their estimates with W-2 filings. The latest revision shows that over the past three years the monthly estimates were about two million jobs too high. In other words, the economy was weaker than the Fed thought.

The Committee now believes the job market will continue to cool, with rising layoffs leading to a higher unemployment rate. Despite persistent inflation creeping above 3% per year, the Fed judges a deteriorating labor market to be more important.

One area that did not change is the Fed’s ongoing reduction of purchases of Treasury debt. That program will continue to reduce the Fed’s bond holdings. There is some speculation that this program, called Quantitative Tightening, will be turned off in the next few months. This would allow the Fed to buy more Treasury bonds. In being a consistent buyer, the Fed pulls interest rates lower than their natural level.

What’s next?

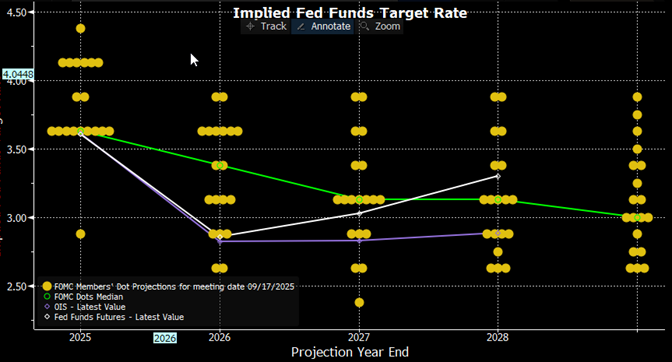

Short-term rates markets want two more quarter-point cuts this year and another three cuts next year. They imply a 2026 year-end Fed Funds rate of around 2.88%. The 19 members’ opinions of coming short-term rates, nicknamed the “dot plot,” tells a less exciting tale. At the end of 2026, the FOMC members’ median rate projection is 3.38%, and falls only to 3.125% after 2028.

Note the 2025 estimate on the far left side of the dot plot. At least six members believe no further cuts are needed this year. Nine think one more cut for sure, and possibly another in December.

So, the eternal debate starts anew: Is the wisdom of the markets or 19 people more correct on the future path of rates? We would vote on the side of markets at this point for two reasons. One, the weakening job market, especially among recent graduates and minorities, is at pre-recession levels. Second, the membership of the Fed will likely look different six months from now. Chair Powell’s term ends in May, and at least one other Board seat is up in the air. Stephen Miran is filling a vacated slot until January. We would expect the dispersion of the “dots” to change as the membership is shuffled next year.

In the haze

The economy continues to grow, likely finishing 2025 around 2% real GDP growth. There is a rolling recession in parts of the manufacturing sector. Tariffs have crimped margins and caused businesses to sit on their hands. Upper-end consumers are continuing to spend and retail sales are trending higher at a 5% yearly rate. Housing costs and job creation remain a concern, but the economy should pick up pace in early 2026.

Starting early next year, the One Big Beautiful Bill Act sections for individuals start kicking in. Tax breaks for seniors, tips and others will help consumer spending. We think those policy changes will help GDP run above the Fed’s 1.7% to 2.1% GDP growth forecast. We wonder how necessary rate cuts will be if the economy is running closer to 2.5% this time next year.

Summary

Historically, the Fed cut rates once economic signals turned down. Rising layoffs, falling earnings and new orders were the “too late” signals. None of those signals are apparent today. In fact, our recession dashboard is clear.

The Fed paused rate cuts until a sixth meeting from its last cut. We thought if the job market stayed flat this year the Fed would not cut at all, preferring to slowly fight inflation. The annual job revisions tossed that forecast in the trash. The Fed is now prioritizing job weakness over inflation.

We understand the need to get ahead of the job slowdown, but some probability must be given that the slowdown has already occurred.

We are struck by the “consistency” in the Fed’s inflation forecast. In 2022, they said they would reach the 2% target in 2024. Now they project 2028. We remain curious as to their reasoning.

The Fed is cutting rates while at the same time raising their economic growth and inflation projections from their June forecast. If the labor market stabilizes over the next month, a case could be made for the Fed to hit the “pause” button again.

To reprise our view from the June meeting, the economy will continue to grind forward in first gear, waiting on “final” tariffs.

Please let us know how we can help you.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on X here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI