Fund Details

| iNCEPTION dATE | EXCHANGE | TICKER | cUSIP | tYPE | eXPENSE RATIO | BENCHMARK |

|---|---|---|---|---|---|---|

| July 12, 2023 | NYSE Arca | TXS | 88224A102 | US EQUITY | PASSIVE ETF | 0.49% | Syntax Midcap 800 |

| INTRADAY NAV TICKER | Fund Net Assets | Shares outstanding | Distribution Yield1 | 30 Day SEC Yield2 |

|---|---|---|---|---|

| TXS.IV | <etf_txs_totalNetAssets/> | <etf_txs_sharesOutstanding/> | <etf_txs_analytic_distributionrate/> | <etf_txs_analytic_thirtydaysecyield/> |

| INTRADAY NAV TICKER | Fund Net Assets | Shares outstanding | Distribution Yield1 | 30 Day SEC Yield2 |

|---|---|---|---|---|

| TXS.IV | <etf_totalNetAssets> | <etf_sharesOutstanding> | <etf_analytic_distributionrate> | <etf_analytic_thirtydaysecyield> |

1The ratio of all the distributions a fund paid in the past 12 months divided by the current share price of the fund.

2A standard calculation of yield introduced by the SEC in order to provide fairer comparison among funds. This yield reflects the interest earned after deducting the fund's expenses during the most recent 30-day period by the average investor in the fund. Negative 30-Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days.

Fund Objective

The Texas Capital Texas Equity Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Texas Capital Texas Equity Index. The Texas Capital Texas Equity Index is comprised of publicly listed companies headquartered in the state of Texas. The index is designed to reflect the performance of a diversified group of companies having a material impact on the Texas economy. The Index is a rules-based, quantitative strategy that seeks to generate long-term total returns.

Fund Rationale

We believe companies headquartered in Texas are situated to enjoy certain economic, regulatory, taxation, workforce and other benefits relative to companies headquartered in other states. The strong business environment in the state of Texas is demonstrated by, among other things, its infrastructure spending and resources, relatively low cost of conducting business, export data, and third-party rankings and recognitions. In addition, the Texas economy is large and diverse. By seeking to replicate the Index, the fund offers a cost-effective opportunity to invest directly in companies that benefit from the superior economic environment in Texas.

Macroeconomic Trends. Captures and capitalizes on the macroeconomic trends of companies located in Texas’ favorable business climate

Industry Diversification. Investment weighting determined by GDP-based sector weights and market capitalization-based company weights

Core Holding.

Enables investors to gain exposure to one of the world’s largest economies by GDP

Fund Rationale

We believe companies headquartered in Texas are situated to enjoy certain economic, regulatory, taxation, workforce and other benefits relative to companies headquartered in other states. The strong business environment in the state of Texas is demonstrated by, among other things, its infrastructure spending and resources, relatively low cost of conducting business, export data, and third-party rankings and recognitions. In addition, the Texas economy is large and diverse. By seeking to replicate the Index, the fund offers a cost-effective opportunity to invest directly in companies that benefit from the superior economic environment in Texas.

Macroeconomic Trends. Captures and capitalizes on the macroeconomic trends of companies located in Texas’s favorable business climate

Industry Diversification. Investment weighting determined by GDP-based sector weights and market capitalization-based company weights

Core Holding. Enables investors to gain exposure to one of the world’s largest economies by GDP

Investors should carefully consider the investment objectives, risks and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 844.822.3837.

Daily Statistics

| Nav | closing price | premium/discount | 30-day median bid/ask spread |

|---|---|---|---|

| <etf_txs_naV_NoLoad/> | <etf_txs_marketPrice/> | <etf_txs_premiumDiscount/> |

Historical Premium/Discount

| Term | YTD | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

|---|---|---|---|---|---|

| Days at premium | <etf_txs_2024_daysatpremium> | <etf_txs_2023q2_daysatpremium> | <etf_txs_2023q3_daysatpremium> | <etf_txs_2023q4_daysatpremium> | <etf_txs_2024q1_daysatpremium> |

| Days at discount | <etf_txs_2024_daysatdiscount> | <etf_txs_2023q2_daysatdiscount> | <etf_txs_2023q3_daysatdiscount> | <etf_txs_2023q4_daysatdiscount> | <etf_txs_2024q1_daysatdiscount> |

1The ratio of all the distributions a fund paid in the past 12 months divided by the current share price of the fund.

2A standard calculation of yield introduced by the SEC in order to provide fairer comparison among funds. This yield reflects the interest earned after deducting the fund's expenses during the most recent 30-day period by the average investor in the fund. Negative 30-Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days.

Performance

| Performance as of <etf_txs_performDate></etf_txs_performDate> (%) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Term | 1 Day | 1 Mo. | 3 Mo | 6 Mo | 1 Yr. | QTD (Current) | YTD | Since Inception |

| NAV | <etf_txs_oneDay_NoLoad></etf_txs_oneDay_NoLoad> | <etf_txs_oneMonth_NoLoad></etf_txs_oneMonth_NoLoad> | <etf_txs_threeMonth_NoLoad></etf_txs_threeMonth_NoLoad> | <etf_txs_sixMonth_NoLoad></etf_txs_sixMonth_NoLoad> | <etf_txs_oneYear_NoLoad></etf_txs_oneYear_NoLoad> | <etf_txs_quarterEndToDate_NoLoad></etf_txs_quarterEndToDate_NoLoad> | <etf_txs_yearToDate_NoLoad></etf_txs_yearToDate_NoLoad> | <etf_txs_sinceInception_NoLoad></etf_txs_sinceInception_NoLoad> |

| Closing Market Price | <etf_txs_marketOneDay></etf_txs_marketOneDay> | <etf_txs_marketOneMonth></etf_txs_marketOneMonth> | <etf_txs_marketThreeMonth></etf_txs_marketThreeMonth> | <etf_txs_marketSixMonth></etf_txs_marketSixMonth> | <etf_txs_market_Year></etf_txs_market_Year> | <etf_txs_marketQuarterEndToDate></etf_txs_marketQuarterEndToDate> | <etf_txs_marketYearToDate></etf_txs_marketYearToDate> | <etf_txs_marketinception></etf_txs_marketinception> |

| Texas Capital Texas Equity Index (Underlying Index) | <etf_txs_oneDay_SYTXSXG></etf_txs_oneDay_SYTXSXG> | <etf_txs_oneMonth_SYTXSXG></etf_txs_oneMonth_SYTXSXG> | <etf_txs_threeMonth_SYTXSXG></etf_txs_threeMonth_SYTXSXG> | <etf_txs_sixMonth_SYTXSXG></etf_txs_sixMonth_SYTXSXG> | <etf_txs_oneYear_SYTXSXG></etf_txs_oneYear_SYTXSXG> | <etf_txs_quarterEndToDate_SYTXSXG></etf_txs_quarterEndToDate_SYTXSXG> | <etf_txs_yearToDate_SYTXSXG></etf_txs_yearToDate_SYTXSXG> | <etf_txs_sinceInception_Ann_SYTXSXG/></etf_txs_sinceInception_Ann_SYTXSXG> |

| Syntax Midcap 800 | <etf_txs_oneDay_SY800G></etf_txs_oneDay_SY800G> | <etf_txs_oneMonth_SY800G></etf_txs_oneMonth_SY800G> | <etf_txs_threeMonth_SY800G></etf_txs_threeMonth_SY800G> | <etf_txs_sixMonth_SY800G></etf_txs_sixMonth_SY800G> | <etf_txs_quarterEndToDate_SY800G></etf_txs_quarterEndToDate_SY800G> | <etf_txs_yearToDate_SY800G></etf_txs_yearToDate_SY800G> | <etf_txs_sinceInception_Ann_SY800G></etf_txs_sinceInception_Ann_SY800G> | |

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Investors may obtain performance data current to the most recent month-end by calling 844.822.3837.

The Syntax US MidCap 800 Index (SY800) measures the float-adjusted market capitalization-weighted performance of the 201st- through 1000th-largest and sufficiently liquid publicly traded entities in the United States as defined according to Syntax’s proprietary country classification methodology, which considers regulatory filings, currencies of accounting and distribution, and use of tax havens.

| Quarter-End Performance as of <etf_txs_quarterly_performDate></etf_txs_quarterly_performDate> (%) | |||

|---|---|---|---|

| Term | QTR | 1 Yr. | Since Inception |

| NAV | <etf_txs_quarterly_quarterEndToDate_NoLoad></etf_txs_quarterly_quarterEndToDate_NoLoad> | <etf_txs_quarterly_oneYear_NoLoad></etf_txs_quarterly_oneYear_NoLoad> | <etf_txs_quarterly_sinceInception_NoLoad></etf_txs_quarterly_sinceInception_NoLoad> |

| Closing Market Price | <etf_txs_quarterly_marketQuarterEndToDate></etf_txs_quarterly_marketQuarterEndToDate> | <etf_txs_quarterly_market_Year></etf_txs_quarterly_market_Year> | <etf_txs_quarterly_marketinception></etf_txs_quarterly_marketinception> |

| Texas Capital Texas Equity Index (Underlying Index) | <etf_txs_quarterly_quarterEndToDate_SYTXSXG></etf_txs_quarterly_quarterEndToDate_SYTXSXG> | <etf_txs_quarterly_oneYear_SYTXSXG></etf_txs_quarterly_oneYear_SYTXSXG> | <etf_txs_quarterly_sinceInception_Ann_SYTXSXG></etf_txs_quarterly_sinceInception_Ann_SYTXSXG> |

| syntax midcap 800 | <etf_txs_quarterly_quarterEndToDate_SY800G></etf_txs_quarterly_quarterEndToDate_SY800G> | <etf_txs_quarterly_sinceInception_Ann_SY800G></etf_txs_quarterly_sinceInception_Ann_SY800G> | |

Fund Management

Investment Adviser: Texas Capital Bank Private Wealth Advisors

Administrator and Fund Accountant: Ultimus Fund Solutions, LLC.

Distributor: Northern Lights Distributors, LLC

Portfolio Manager: J. Steven Orr, Chief Investment Officer

Mr. Orr is responsible for the strategy, construction, and performance of client portfolios and trusts. With over 30 years of portfolio management experience, Steven joined Texas Capital Bank in 2013 from Communities Foundation of Texas, where he had managed investments and helped raise the Foundation’s performance to among the highest in their peer groups of universities and foundations. Prior to his work at Communities Foundation, he successfully ran insurance and arbitrage portfolios for Associates First Capital totaling $4 billion, as well as mutual fund bond and insurance and portfolios at Caterpillar, Inc. Steven earned his Bachelor of Arts in Economics and a minor and Math from the University of Texas at Austin, a Master in Business from Texas State, and a Juris Doctorate from St. Mary’s School of Law. He is an attorney and a CFA® and CMT® Charter holder.

Top 10 Holdings

| Portfolio Holdings as of <etf_txs_performDate/> | |||

|---|---|---|---|

| description | Industry | Shares | Portfolio Weight (%) |

| <etf_txs_securityDescription_1/> | <ETF_TXS_industry_1/> | <ETF_TXS_sharesHeldOfSecurity_1/> | <ETF_TXS_netAssetsPercentage_1/> |

| <ETF_TXS_SECURITYDESCRIPTION_2/> | <ETF_TXS_industry_2/> | <ETF_TXS_sharesHeldOfSecurity_2/> | <ETF_TXS_netAssetsPercentage_2/> |

| <ETF_TXS_SECURITYDESCRIPTION_3/> | <ETF_TXS_industry_3/> | <ETF_TXS_sharesHeldOfSecurity_3/> | <ETF_TXS_netAssetsPercentage_3/> |

| <ETF_TXS_SECURITYDESCRIPTION_4/> | <ETF_TXS_industry_4/> | <ETF_TXS_sharesHeldOfSecurity_4/> | <ETF_TXS_netAssetsPercentage_4/> |

| <ETF_TXS_SECURITYDESCRIPTION_5/> | <ETF_TXS_industry_5/> | <ETF_TXS_sharesHeldOfSecurity_5/> | <ETF_TXS_netAssetsPercentage_5/> |

| <ETF_TXS_SECURITYDESCRIPTION_6/> | <ETF_TXS_industry_6/> | <ETF_TXS_sharesHeldOfSecurity_6/> | <ETF_TXS_netAssetsPercentage_6/> |

| <ETF_TXS_SECURITYDESCRIPTION_7/> | <ETF_TXS_industry_7/> | <ETF_TXS_sharesHeldOfSecurity_7/> | <ETF_TXS_netAssetsPercentage_7/> |

| <ETF_TXS_SECURITYDESCRIPTION_8/> | <ETF_TXS_industry_8/> | <ETF_TXS_sharesHeldOfSecurity_8/> | <ETF_TXS_netAssetsPercentage_8/> |

| <ETF_TXS_SECURITYDESCRIPTION_9/> | <ETF_TXS_industry_9/> | <ETF_TXS_sharesHeldOfSecurity_9/> | <ETF_TXS_netAssetsPercentage_9/> |

| <ETF_TXS_SECURITYDESCRIPTION_10/> | <ETF_TXS_industry_10/> | <ETF_TXS_sharesHeldOfSecurity_10/> | <ETF_TXS_netAssetsPercentage_10/> |

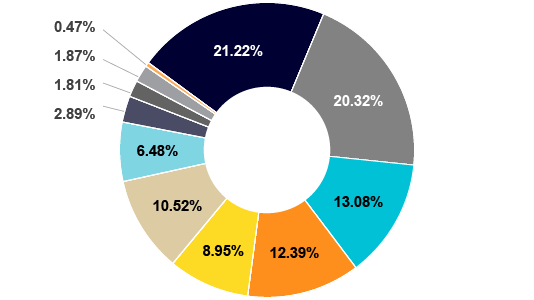

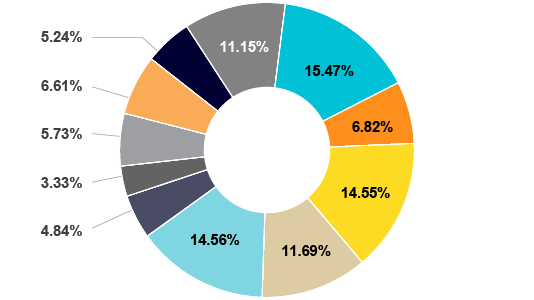

Sector Weights

as of March 28, 2024

Source: Syntax and Refinitiv as of March 28, 2024. Index powered using Refinitiv data.

The Syntax US MidCap 800 Index is the property of Syntax LLC, which calculates and maintains the Index. Syntax® is a registered trademark of Syntax LLC and/or its affiliate. The Texas Capital Texas Equity Index is the property of Texas Capital Bank, which has contracted with Syntax LLC to calculate and maintain the Index. Syntax, Refinitiv, and their affiliates and data providers did not participate in the creation, marketing or distribution of the ETF and have no liability in connection with the ETF nor the information provided herein.

Investors should carefully consider the investment objectives, risks, and charges of the fund before investing. The prospectus contains this information and other information about the fund, and it should be read carefully before investing. Investors can obtain a copy of the prospectus by calling 844.TCB.ETFS (844.822.3837).

This website should not be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. Nothing on this website is intended to be investment, tax, financial or legal advice.

Not a Deposit. Not FDIC Insured. Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Investors may obtain performance data current to the most recent month-end by calling 844.TCB.ETFS (844.822.3837).

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Texas Capital Bank Wealth Management Services, Inc. d/b/a Texas Capital Bank Private Wealth Advisors (“PWA”), a wholly owned subsidiary of Texas Capital Bank and an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”), serves as investment adviser to the Texas Equity Index ETF and is paid a fee for its services. Shares of the Texas Equity Index ETF are not deposits or obligations of, or guaranteed or endorsed by, Texas Capital Bank or its affiliates. The Texas Equity Index ETF is not insured by the FDIC or any other government agency.

The Syntax US MidCap 800 Index is the property of Syntax LLC, which calculates and maintains the Index. Syntax® is a registered trademark of Syntax, LLC and/or its affiliate.

Index performance does not represent actual fund or portfolio performance and such performance does not reflect the actual investment experience of any investor. An investor cannot invest directly in an index. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in a portfolio invested in accordance with an index. None of the Syntax Indices or the benchmark indices portrayed herein charge management fees or incur brokerage expenses, and no such fees or expenses were deducted from the performance shown; provided, however, that the returns of any investment portfolio invested in accordance with such indices would be net of such fees and expenses. Additionally, none of these indices lend securities, and no revenues from securities lending were added to the performance shown. Performance shown is unaudited and subject to revision. This site may include materials and documents containing forward-looking statements which are based on our expectations and projections as of the date made. Past returns are not necessarily predictive of future returns.

The Texas Equity Index ETF is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC, which is not affiliated with Texas Capital Bank Private Wealth Advisors.